GST: India's online game tax could kill a booming industry

- Published

The tax is a "step in the right direction", says Siddhartha Iyer, a Supreme Court lawyer who has been fighting to ban online gaming

The Indian government's decision to impose a 28% tax on online gaming poses an "existential threat" to the booming industry and could spell its death knell, say experts.

Shares of Indian online gaming platforms and casinos have crashed following the GST (Goods and Services Tax) Council's decision.

The country's 900+ gaming start-ups had been paying a small tax on the fee they charged for offering games. But the imposition of a 28% GST on the full face value of a gaming transaction will mean the entire amount collected from players will now come under the ambit of taxation.

According to industry estimates, total tax collection on player winnings will go beyond 50%, including GST, platform commissions and income taxeswhen the new law is implemented.

In effect, for every $100 (£76.8) spent by a player, there will be a "sunk cost" of $28 towards GST, in addition to a $5-15 charge by the gaming platform and a 30% tax deducted at source (TDS) on any winnings drawn.

This will "disincentivise players and is totally inconsistent with global standards" where VAT or GST is levied at a median rate, and that too only on platform fees or commissions, said Sudipta Bhattacharjee, partner at corporate law firm Khaitan & Co.

"The move has completely blindsided the industry. It will shake investor confidence and lead to a funding winter," Mr Bhattacharjee added.

India's gaming boom

The online gaming industry has seen a massive boom in India over the last five years, with an annual compounded growth rate of 28-30%. Driven by easy access to affordable smart phones and cheap mobile data, the sector attracted $2.5bn in foreign direct investment, including from the likes of Tiger Global.

But these growth rates will now be called into question as the GST council's decision will impact startups at "multiple levels", including their user base, revenues as well as investor sentiment, according to Soham Thacker, Founder & of CEO of GamerJi - an eSports tournament company.

"Many gaming companies, in order to limit the impact on the investors side, may choose to relocate their business outside India," Mr Thacker added.

"They have killed the multibillion-dollar industry with a single stroke. And at the same time the decision could give a massive boost to illegal and illegitimate operators in the country," Gaurav Gaggar, Promoter of Poker High, a poker site, said.

Terming the decision "unconstitutional, irrational, and egregious", the All India Gaming Federation said the government had ignored over 60 years of "settled legal jurisprudence" by lumping online skill gaming with gambling activities.

The number of paid gamers in the country has also increased significantly in recent years

Gambling, which is seen as a chance-based game, is illegal in many India states and is frowned upon. But most states have allowed online games which are seen as skill-based.

The industry body expects hundreds of thousands of job losses in the online gaming sector because of the latest move.

Gaming startups in India currently employ 50,000 people and were expecting to create another 350,000 direct and 1,000,000 indirect jobs by 2028.

A 'catastrophic' move

Many gaming companies the BBC spoke to said there was a lack of consistency behind the ruling.

"It is very unfortunate that when the government has been supporting the industry… such a legally untenable decision has been taken," Roland Landers, CEO of the All India Gaming Federation said in a statement. "It will be catastrophic for the $1tn digital economy dream of the prime minister."

Indian PM Narendra Modi has on more than one occasion praised the gaming industry as a sunrise sector that had the potential to create jobs and cater to the global market.

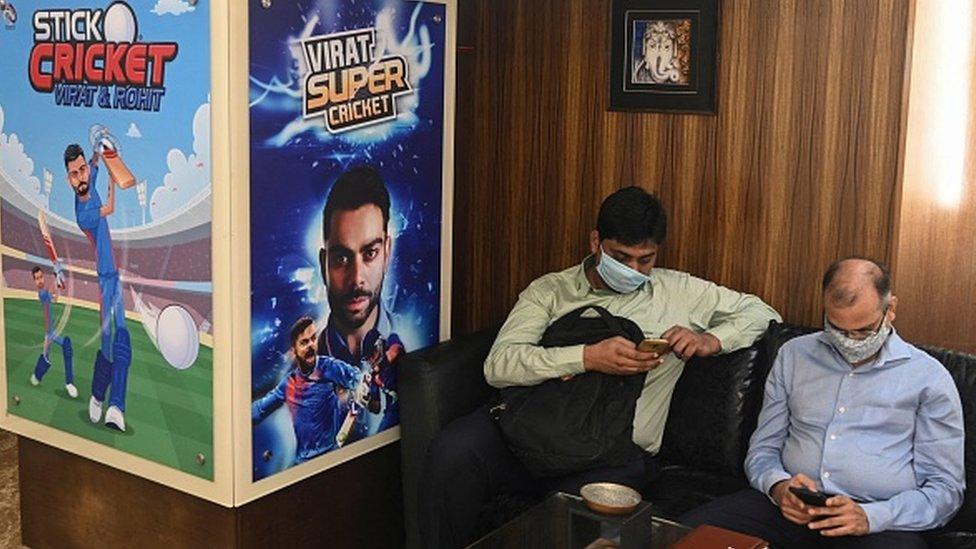

The tax is a "step in the right direction", says Siddhartha Iyer, a Supreme Court lawyer who has been fighting to ban online gaming

"This kind of extortionist tax regime flies in the face of these steps and advocacy needs to happen at multiple levels to retract this proposal," said Mr Bhattacharjee.

He expects the gaming industry to unite and mount a strong legal challenge if the federal and state governments go ahead and enact the amendments into their tax laws.

But India's revenue secretary called, external the move a "unanimous" decision that would not be reviewed or rolled back.

The moral question

Announcing the decision late on Tuesday, Finance Minister Nirmala Sitharaman said that the GST council, which comprises of federal and state finance ministers, said "no one wanted to kill an industry".

"But they can't be encouraged to such an extent over essential goods and services," she said.

The 28% tax is a "step in the right direction", Siddhartha Iyer, a Supreme Court lawyer who has been fighting to ban online gaming told the BBC.

Mr Iyer called gaming a "speculative activity".

"Every week there is a story of someone killing themselves because of this [debts incurred due to online gaming]," he said.

"Here, under the GST regime, the government has taken the view that [these games] are gambling and that is correct in my opinion because you are putting a wager on the performance of something not in your control," Mr Iyer added. "We tax alcohol and cigarettes because we want to discourage people from these activities, it should be the same for this [online gaming] as well."

Others like Faisal Maqbool, a former gaming addict who lost close to 400,000 rupees ($5,000, £3,750) while playing an online card game in 2022, say even stricter measures are needed.

"This is an addiction. And it has afflicted children and teenagers. Along with higher taxes, the government needed to put in restrictions on the basis of age, income etc. I vouch for a total ban on these activities," Mr Maqbool told the BBC.

Read more India stories from the BBC: