Chinese investors target Australian wines

- Published

Both Chinese and Australian wine producers are keen to cash in on the growing wine-drinking habit in China

Chinese nationals are expected to invest a staggering amount of money in Australian real estate, with Credit Suisse predicting they will spend A$44bn ($39bn; £24bn) over the next seven years.

But it is not just the booming housing market that is feeling the effect. China's appetite for assets is also being felt in rural Australia, where Chinese investors are buying everything from cattle properties and feed lots to dairy farms and wineries.

It is that last category that appears to have taken a more personal turn, says the owner of Jurds Real Estate agency in New South Wales' Hunter Valley, Alan Jurd.

Wealthy Chinese buyers consider wineries trophy purchases, says Mr Jurd, who has watched the trend gather pace in recent years.

"China-based wine importers are looking for a beautiful and prestigious winery in Australia as a showcase for their business and to impress their Chinese customers."

The Yaldara winery in South Australia's Barossa Valley was bought recently for A$15.5m by Chinese businessmen Zhitai Wang, a resident of NSW, and Kuifen Wang from Qingdao in Shandong province.

The two men already own the 1847 Winery in the same region.

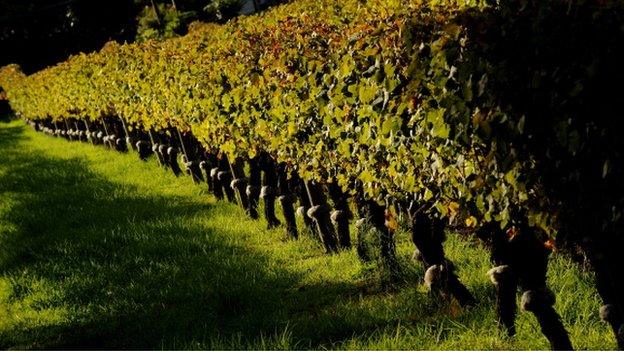

Many buyers are looking for vertical integration, says Mr Jurd. "They want the vineyards, the winery, the branding and distribution, and while they continue to supply the domestic Australian market, they are primarily interested in a market that locals here don't have - China."

Owning for life

Two years ago, winemaker Xin Jin, who goes by the name of Jim Jin in Australia, bought his own Barossa vineyard in South Australia to make wines under the Reis Creek Wines label.

Winemaker Xin Jin says Australian vineyards are cheaper than those in China

With 70 hectares under planting, half of his grapes are sold to Australian producer Orlando Wines, which makes Australia's largest wine brand, Jacob's Creek Reserve. He uses the rest of the grapes to produce his own labels for export to China.

"It's easy to get cheap wines in China but the market has become more mature and people want premium brands now," says Mr Jin.

"To produce those, I decided I must have my own vineyard. Secondly, I have the confidence now [to know what I'm doing] and I work with experts."

Mr Jin says Chinese visitors believe Australian vineyards are well managed and good value. "[The land is] cheaper than in China and they can own it for life."

As many as half of recent Australian winery purchases have been made by Chinese residents and non-domicile Chinese, estimates Stephen Strachan, director at Adelaide wine consultants Gaetjen Langley.

"The Barossa Valley is number one but purchases are also happening in the Hunter [Valley], Margaret River [in Western Australia], Yarra Valley [in Victoria] and McLaren Vale [South Australia]," he says.

Working together

Mr Jin is unusual among Chinese investors. He studied winemaking in Beijing before completing a masters at the University of Adelaide and then working at Australian wineries.

But most Chinese investors retain local viticulturalists.

By some estimates half of recent Australian winery purchases have been made by Chinese buyers

Hong Kong-based Yingda Investment Company bought a majority stake in South Australian Coonawarra winery Hollick wines in April this year. Founders Ian and Wendy Hollick remain at the helm and are pleased with the outcome.

"It's a cross-fertilisation between the two companies," says Mr Hollick. "We don't feel a loss of control because we are guiding them in many respects with advice on technical and operational matters," he says.

The winery has been trying for 10 years to make it big in China. The new investor provides the Hollicks with access to an established wine distribution business and a chain of hotels and tourism resorts.

"It's a fantastic opportunity for us to get access to a very broad part of the Chinese market," says Mr Hollick.

Ferngrove Frankland River Wines in Western Australia has also benefitted from Chinese investment. Since 2010, one of China's wealthiest men, Xingfa Ma, has spent nearly A$30m on the Margaret River estate, opened 12 wine retail stores in China, and plans more.

Any sale of Australian assets to offshore ownership arouses some local unease, says Mr Strachan.

"But, by and large, the industry view is that these buyers are a positive thing, particularly when the linkage to Chinese distribution is understood."

Since the global financial crisis, banks have been reluctant to lend to agricultural businesses. In the 12 months that the Hollick vineyard was on the market, the only serious interest came from Asia.

The bottom line, says Mr Strachan, is that the Chinese value Australian land and wineries more than Australians do.

- Published11 August 2014

- Published8 August 2013

- Published27 October 2011

- Published6 September 2013