Australian government faces budget dilemma

- Published

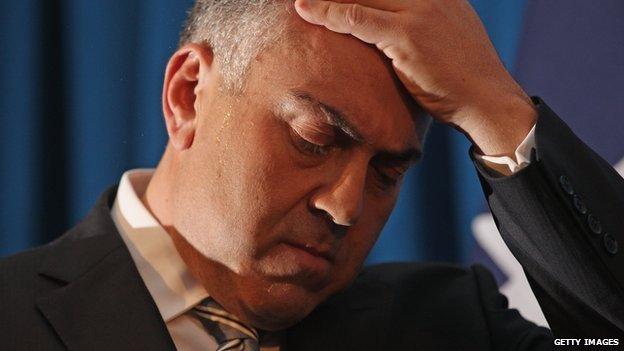

Will Mr Hockey's budget really be the horror story that Deloitte has warned?

As Australian Treasurer Joe Hockey prepares his second budget, the Australian government faces some hard choices.

Last year's budget - which aimed to slash education funding, increase health care costs and strip benefits from young, unemployed Australians - was rejected by the public. A year later, voters remain sceptical of the need to cut government expenditure.

What dilemmas does the treasurer face?

Growth in traditional sources of revenue, such as personal and corporate income tax, has slowed because of a weakening economy.

Generous tax concessions for property investors are costing the government dearly

But far bigger is the hole ripped out of budget finances by a slump in mining royalties.

Last month, Mr Hockey warned he was preparing to write off up to A$25bn ($20bn, £13bn) in budget revenue over the next four years thanks to the slump in the price of iron ore.

The other problem is that the government has promised it would not increase taxes. That leaves it few options if it wants to rein in its ballooning deficit.

That has left the budget looking like a horror story "written by Stephen King and painted by Edvard Munch", says respected Deloitte Access economist Chris Richardson.

So, what can be done?

There have been a variety of suggestions from experts, including:

Having fewer and lower direct taxes, such as lower personal income and corporate taxes but a higher Goods and Services (GST) tax

Winding back property tax concessions. Australia's 1.3 million landlords claim about A$14 billion in tax losses a year

Applying the current 10% GST to goods worth less than A$1,000 bought online from overseas. (This could cost more than it raises)

Reducing generous superannuation (retirement pension) tax concessions

Australians don't want to pay more to visit the doctor

What won't be in the budget?

An increase in fees to visit the doctor. The government was forced to dump its proposal for a A$7 payment to visit a GP because of fierce public opposition

A tax on mining profits. Imposed by the previous Labor government when a mining boom underpinned the economy, it was quickly dumped by the Coalition after it won office in 2013

A tax on carbon emissions. Imposed by the previous Labor government, it was but dumped by the Coalition because of the costs to industry

A levy on big business to fund a generous paid parental leave scheme. Mr Abbott was forced to dump his signature policy because it could have cost as much as A$5.5bn a year

What can we expect?

The budget's centrepiece will likely be a package that leaves subsidies for wealthy families intact and offers more to poorer families.

The "losers" could be lower income families who don't work, who will be entitled to fewer hours of subsidised childcare, and single-income families who will lose family tax benefits.

Meanwhile, small business will likely benefit from a 1.5% tax cut.

Pensioners are a powerful voting block in Australia

Other savings could come from:

Overhauling the aged pension system, with more money for pensioners living on modest incomes but less for wealthier retirees. The government says it expects to save about A$2.4bn over four years from those changes

Slashing the foreign aid budget by as much as A$1 billion

Imposing the GST on imports of so-called "intangibles" such as downloaded books, music, videos and software. This has been dubbed the "Netflix tax"

What are the experts worried about?

"At the moment, the Treasurer is ruling a lot of things out," says Access Economics' Mr Richardson. "But that creates spending problems down the track. At budget time there are many sacred cows. But over the next decade, many cows may end up slaughtered to raise revenue."

At least Mr Hockey didn't receive the kind of advice his opposite number in the UK did in 2010, when the former Treasury Secretary Liam Byrne left a note for his Conservative successor saying: "I'm afraid to tell you there's no money left."

- Published3 March 2015