Chinese buyers looking for Australian property 'bling'

- Published

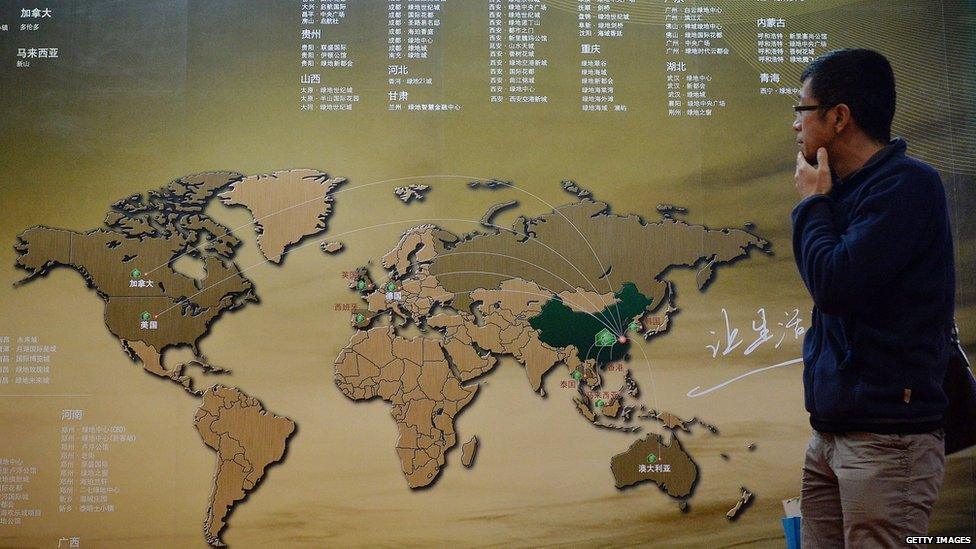

Australia is one of the top markets for Chinese investors looking for residential property

With house prices soaring out of the reach of many young Australians, Chinese investors have been singled out for criticism. But experts say foreign investment has a silver lining.

Facing a dwindling number of investment opportunities in their own country, Chinese buyers are snapping up new Australian apartments and homes at a record rate, says real estate experts.

They have their eye on homes with a quality finish and a splash of grandeur.

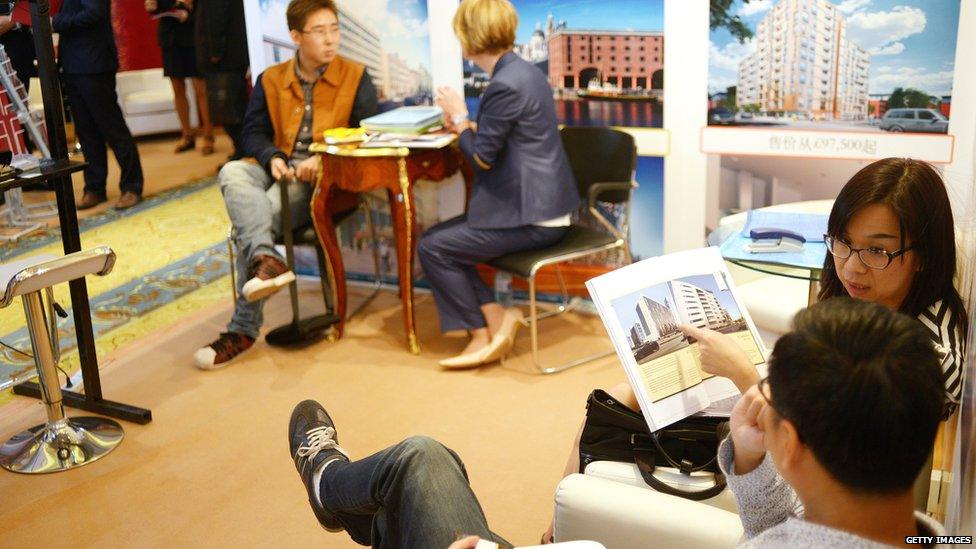

The interest is so strong - with predictions of billions of dollars more to come thanks to changes in Chinese offshore investment rules - that Australian real estate agents are setting up offices in Beijing and Shanghai to take advantage of the demand.

Chief Executive of property website Juwai, Simon Henry, describes it as an "incoming wall of Chinese investment" that Australia isn't ready for.

Mr Henry expects it to continue for some time, in part because Beijing has relaxed currency rules making it easier for wealthy Chinese to invest in overseas property.

A looming change in currency rules is expected to spur Chinese investment offshore

"Keen, moneyed-up investors want high quality properties in Sydney, which will generate both a good return and gain in value," Mr Henry told the BBC.

Nest eggs

"The current level of Chinese investment in Australia may seem quaintly small in a few years," he says.

Primarily, Chinese investors are looking at property as a nest egg because of the lack of similar investments in China, he says.

"Plus, their children are highly educated. Parents buy to ensure their kids have somewhere to stay when studying for an Australian degree."

Hans Hendrischke, Professor of Chinese Business at the University of Sydney, agrees.

"There are now 150,000 Chinese students in Australia, with parents often purchasing apartments for their children," says Prof Hendrischke.

"A decade ago, this large Chinese community didn't exist. Parents who have bought a unit for their offspring follow it up with a house for themselves to retire to," he adds.

Chinese investors are keen on:

• Modern properties, preferably brand new

• Apartments close to cities, universities and public transport

• Houses open to the street, with good views

• A little bit of glamour and "bling"

The kinds of properties being bought are often dictated by the children's taste, says Dan White, director of Australian property agent Ray White, which has opened branches in Beijing and Hong Kong.

"Kitchens have to be right up-to-date with marble bench tops and all the latest devices," says Mr White.

Chinese investors want "bling" and Australian developers are happy to deliver it, he says.

Ten years ago, Chinese investment flowed into Hong Kong property, says Mr Henry.

Opposition

"Now Australia and the US are top for Chinese investment properties. Australia's best asset is [being in] a similar time zone, within a few hours' flying time of China," he says.

However, Chinese investment here is a sensitive issue for many Australians.

The Australian government has repeatedly warned overseas owners not to breach foreign investment laws, amid claims Chinese money is artificially boosting housing prices, especially in Sydney.

Not everyone in Sydney is happy about Chinese investment in the property market

Property values in Sydney are rising 13% a year, according to the Australian Bureau of Statistics.

They are the best gains of any capital city in Australia, says property research firm RP Data.

The government has imposed fees on non-residents buying property and anyone found breaking the rules - such as buying an existing house instead of investing in a new property - may be forced to sell.

But experts don't think that will have much impact on the flow of money.

Australians should welcome the investment because longer term, it will make homes more, not less, affordable by funding the construction of new apartments, claims Mr White.

"This is great for renters who have traditionally found it very tough, particularly in the tight Sydney market," he says.

It is not just the luxury, inner city suburbs that are doing well.

The supply of new homes is increasing in outer suburbs, too. For example, approvals have quadrupled in the past 12 months around Sydney's north-western suburbs of Castle Hill, Rouse Hill and Kellyville, where property advertisements often appear in English and Mandarin, according to property consultants MacroPlan Dimasi.

Under government rules, foreign investors are only allowed to buy new housing

Asian brokerage and investment group CLSA forecasts a surge in Chinese immigration to Australia over the next few years, which property analysts say will translate into another surge in foreign investment in Australian residential property.

Australian prices may seem high but a city like Sydney is still relatively cheap compared with other worldwide cities, says Mr Henry.

"What we are seeing now may just be an early start before Chinese investors arrive in force," he says.

"Their children like Australian universities and our beaches. With our climate, and our lifestyle no wonder their parents are following."

Julian Lorkin is a Sydney business writer.

- Published29 March 2015

- Published25 February 2015