'Tampon tax': Australia decides not remove controversial levy

- Published

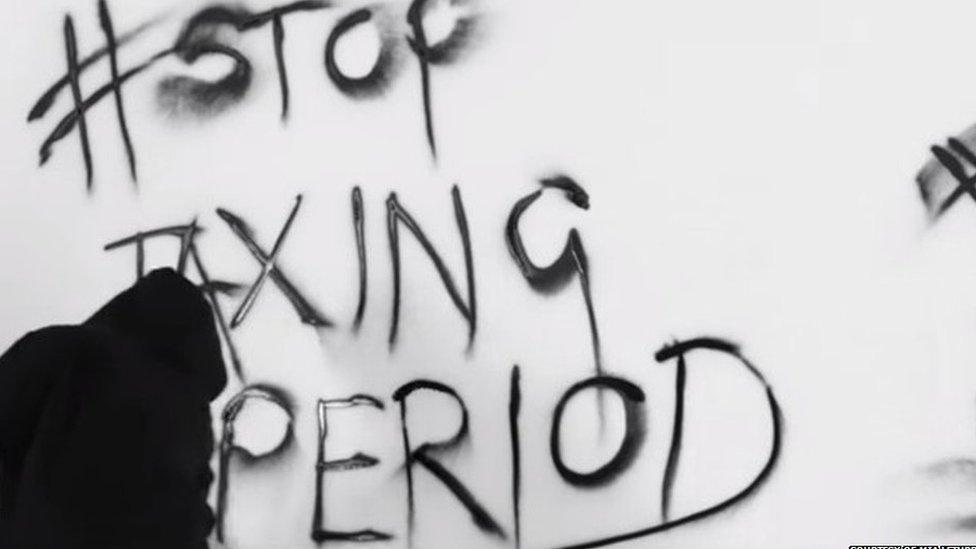

There was popular support for the removal of the so-called tampon tax

Australia's states and territories have decided not to remove an unpopular tax on female sanitary products.

Unlike products such as condoms and sunscreen, sanitary products attract the 10% goods and services tax (GST) because they are deemed non-essentials.

A recent petition against so-called tampon tax attracted 90,000 signatures, and a rap was created and rallies held to campaign against it.

But the treasurers' meeting on Friday failed to agree on removing it.

All state and territory governments have to agree for changes to be made to the GST.

Drop It Coz It's Rot makes fun of a tax the producer calls "ridiculous"

Treasurer Joe Hockey had promised to raise this tax issue with state treasurers, saying he believed tampons and sanitary pads were essential items.

But removing it would have left an estimated tax shortfall of at least $30m Australian (£14m; $22m) annually.

Online shopping

The treasurers did agree, however, to expand the GST to include all online purchases of goods and services sold into Australia from offshore from 1 July, 2017.

Currently, the tax only applies to foreign products and services bought online that are valued over A$1,000 ($731; £466).

Australian "bricks and mortar" retailers have long argued that offshore vendors enjoyed an unfair advantage because of the way the tax was applied, particularly in light of the growing popularity of online shopping.

Mr Hockey told reporters at a press conference that local retailers were suffering a competitive disadvantage because they were paying more tax than their foreign online competitors.

"This has put our businesses, our workers at a competitive disadvantage," Mr Hockey said.

- Published26 May 2015

- Published21 August 2015

- Published12 August 2015