China and Australian housing: Splurge at an end?

- Published

Chinese buyers spent big in Sydney's property market in 2015, with harbour-side luxury apartments in high demand

Chinese buyers have helped drive huge price rises in Australia's property market, but Beijing is now trying to prevent its citizens from taking cash out of the country. Julian Lorkin investigates whether the boom is over.

Shanghai-based Australian real estate agent Scott Kirchner helped moneyed Chinese buyers snap up new Australian apartments and homes at a record rate last year.

Mr Kirchner, who speaks fluent Mandarin, is one of many Australian agents who run offices in Beijing and Shanghai hoping to reap profits from Chinese investors spending big offshore.

But increasing pressure on China's currency, the yuan, means Beijing is taking steps to stop money flowing out of the country. For agents like Mr Kirchner, the market may have passed its peak.

"Until now the rules were loose. You could liquidate investments on the Shanghai stock market and turn it into cash in Australia. The Chinese government wants to stop that," Mr Kirchner told the BBC.

According to Chinese law, individuals can take a maximum of $50,000 (A$69,800; £35,000) out of the country. Chinese banks that once looked away when investors transferred money to outside China are now scrupulously applying rules about the transfer of capital overseas.

This means fewer Chinese buyers can get enough money out of the country to buy expensive Australian real estate.

"Many of my customers are saying that they went to transfer funds overseas, and the bank refused," Mr Kirchner says. "Now I tell Chinese buyers not to sign Australian contracts unless they already have their money in their hand - outside China."

Economic woes

China's share market has plunged since its peak in mid-2015

China's economy, the world's second-largest, appears to be slowing, with the benchmark Shanghai Composite Index dropping more than 40% since its peak in June.

Investors who sold at the share market's peak became yuan millionaires, but those who held on have lost much of their wealth.

"Many left it too late, and quite simply they don't have the cash any longer," says Mr Kirchner. "In Sydney, every real estate agent was looking at China. Now, they are more cautious, which will cause problems for Australian developers."

Last year Chinese buyers spent a record A$12bn on Australian property, boosting house prices at a time when locals were already feeling anxious about the rocketing cost of property.

But growth in house prices has now slowed in Australia. Between October and December 2015, Sydney house prices dropped by 3%, the biggest fall on record.

Investment banks like Macquarie are forecasting a 7% decline in 2016, and say a housing collapse could push Australia into recession.

Andrew Wilson, Domain's senior economist, said: "The heady days of the boom are well over, and Australia is playing catch up with rest of the world in terms of low interest rates, and low growth."

"China has been a very significant part of the market for the past few years, particularly for high rise apartments in Sydney," he said, adding that with growth forecasts of only 3% to 5% in 2016, there were questions over whether housing would remain attractive to investors.

Cause for optimism

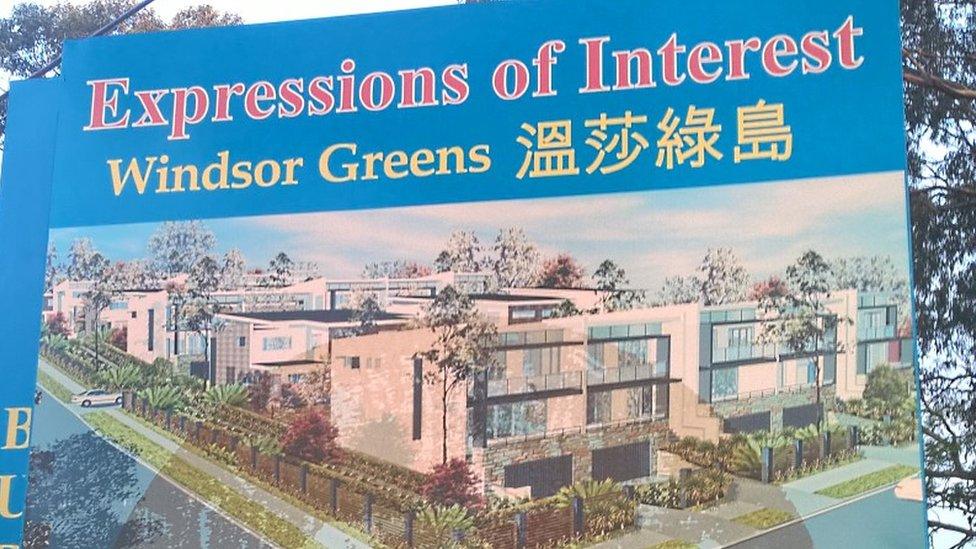

A Sydney real estate sign designed to attract Chinese buyers

Some analysts and agents are less pessimistic, arguing that Chinese investors are looking for safer havens than shares, and their investment in housing will prop up Australian house prices.

Only a small proportion of Chinese investors managed to liquidate their assets before the crash and clampdown. But a small percentage of China's share market is still a vast number of investors.

Tim Lawless, from real estate analysts Corelogic, said many Chinese investors had brought money to Australia already, as they had planned to buy property there for several years. Families could also team up to circumvent the US$50,000 foreign investment limit.

"That will sustain the property market," Mr Lawless said. "Chinese who have cash here are still interested in Australian property.

"However, they are looking for areas that might still have growth, like Melbourne or the Gold Coast. Sydney is past its peak, but prices haven't fallen off a cliff. "

Mr Wilson agreed, saying Chinese buyers were still active in Melbourne.

"Those who managed get out of China before the rout are looking for a safe haven which is resilient to any downturn. Chinese students are also buying, with the expectation that they and their parents will emigrate permanently in the next few years," he said.

LuLu Pallier, from Sotheby's Realty, markets luxurious mansions to wealthy buyers from mainland China.

She said the market for properties above A$5m remained strong.

"Buyers at this level already have their money in Australia, and want to put it somewhere safe," Ms Pallier said.

"Australia is very attractive. Compared with Chinese shares it is very stable. Confidence in Shanghai shares and property has evaporated."