The Australian bank customers who lost everything

- Published

Australia bank inquiry: 'They didn't care who they hurt'

Australia is holding a 12-month national inquiry into misconduct in its banking and financial institutions.

Five months in, some allegations aired in public hearings have shocked even industry watchers.

They include evidence of predatory loans, widespread reckless practices and even one bank charging fees to dead customers.

Amid the scrutiny, thousands of Australians have come forward with stories of losing homes, businesses and their life savings. The BBC spoke to some of them.

'You just feel so hopeless and overwhelmed' - Craig Caulfield

Craig Caulfield says he has been emotionally and financially crippled

Craig Caulfield's battle with the nation's largest lender, Commonwealth Bank of Australia, is in its ninth year.

In 2010, he asked the bank for assistance after struggling with loan repayments for his sugar cane farm in Queensland. The bank rejected his request.

The parties then disagreed over the original loan type, and whether Mr Caulfield was legally entitled to mediation.

When he asked to review those documents, he found they contained errors for which he was not responsible.

According to Mr Caulfield, the application listed his driving licence number as "123456". Other details about his income and assets were also wrong, he said.

When various resolution attempts failed, he fell into despair.

"The people who were supposed to help me were so neutered and the banks and lawyers [were] so strong," he said. "Given their financial might, what justice is there?"

At one point the bank offered to restructure the loan, but Mr Caulfield declined, saying the deal remained "unaffordable".

"You just feel so hopeless and overwhelmed," he said.

The bank told the BBC it would not comment specifically on Mr Caulfield's case, but said it was an "unfortunate reality" that some clients experienced financial stress.

"When this happens, we try to work with customers to find a financial solution to their problem, based on their unique circumstances," a spokesman said.

But Mr Caulfield says he has experienced years of unfair treatment: "I thought I would just talk to the bank and it would be sorted."

'I'd have signed anything' - Carolyn Flanagan

Carolyn Flanagan testified at the royal commission inquiry in May

Carolyn Flanagan, 67, signed a contract in 2010 with bank Westpac. But she could not read the form herself, and has difficulty recalling the day it happened.

Ms Flanagan is legally blind and suffers from several medical conditions. She was recovering from cancer surgery and a stroke when she went to the bank.

Despite her vulnerability, the bank accepted Ms Flanagan's offer to use her Sydney home - her only asset - to guarantee a business loan held by her daughter.

When that business failed, Westpac seized Ms Flanagan's home and began steps to evict her.

She told the royal commission inquiry in May: "I'd have signed anything for her [my daughter]... if you can't help your children, who can you help?"

Her lawyer, Dana Beiglari, said the bank should not have permitted the contract.

"She had no capacity to pay without losing the roof over her head, and her medical condition severely limited any ability to understand the contract," she told the BBC.

Ms Beiglari ultimately negotiated a deal to allow Ms Flanagan to live in the house for the rest of her life. However, the home is now owned by the bank.

A Westpac representative told the inquiry that "technically" there was no problem with how the deal was signed.

However, he said that bank staff should have realised "warning signs" at the time.

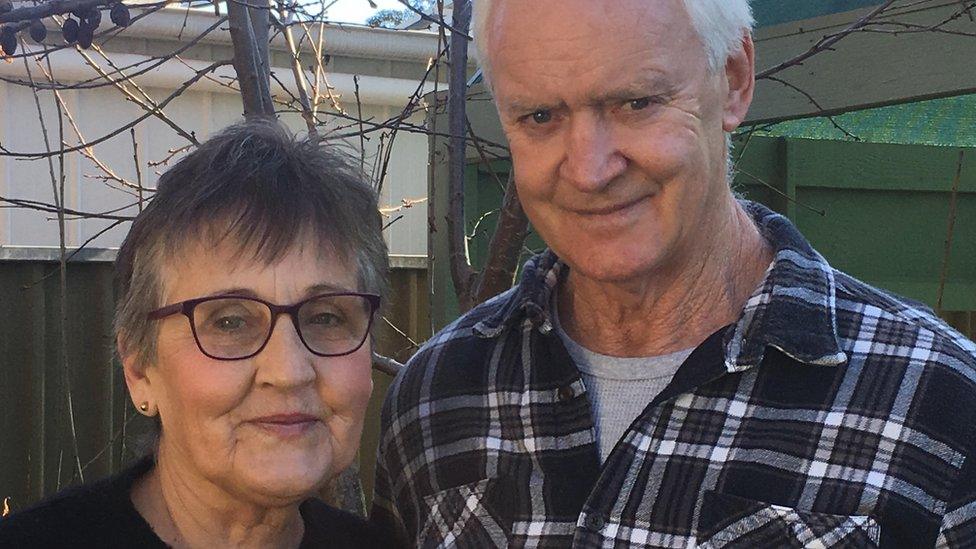

'They will bleed us dry until we die' - Deborah and Jim Barker

Deborah and Jim Barker say their loan documents were falsified

Deborah and Jim Barker, from Victoria, say they were caught up in a scam after applying for a loan at Commonwealth Bank.

They say they had taken out a A$1m (£560,000; $740,000) loan, but later learned they were making repayments on a A$1.5m loan.

They allege their loan documents were falsified with copied signatures, fake assets, and the listing of Mr Barker's salary as A$343,000 - when in fact he earned about A$80,000.

"Even the telephone numbers were wrong so they couldn't ring us," Ms Barker says.

The couple say they are victims of a wider scam that led to the convictions of a mortgage broker and an accountant, neither of whom were bank employees., external

The Barkers were the first to raise the alarm with the bank, after discovering two unauthorised withdrawals amounting to A$26,000.

Commonwealth Bank has denied allegations that bank staff were involved in the scam.

It has also denied that the Barkers' A$1.5m loan size was invalidly set, although it refunded them the A$26,000.

The Barkers say they have been financially ruined by the bank's position, which they still dispute.

After losing their four investment properties and eventually their home, they now live with their son and survive on a pension.

In 2016, the pair made an unsuccessful court bid to overturn a default judgement from 2014 that sided with Commonwealth Bank.

"The banks won't admit to anything unless you take them to court," Ms Barker says.

"Even then they've got this bottomless pit of shareholders' funds to fight you. They will deny and deny and bleed us dry until we die."

The bank would not comment directly on the Barkers' case, but a spokesman told the BBC: "In the event mistakes are made by the bank, we look to put these right."

These stories are among more than 7,000 submitted to the royal commission inquiry so far. At this point, only a few dozen cases have been publicly examined.

All entries are reviewed but the inquiry does not have time to examine every case in hearings, a spokesman said.

- Published19 April 2018

- Published3 May 2018

- Published23 January 2018