EU leaders clinch pact to defend euro

- Published

David Cameron: ''We protected the UK taxpayer from having to bail out EU countries that get themselves into trouble''

EU leaders say tough new budget rules agreed at their summit in Brussels will protect the euro from a future Greek-style debt crisis.

The EU "sealed a solid pact to strengthen the euro," said European Council President Herman Van Rompuy.

A permanent fund will be set up to bolster the euro in times of crisis, and the EU will have extra powers of scrutiny over national budgets.

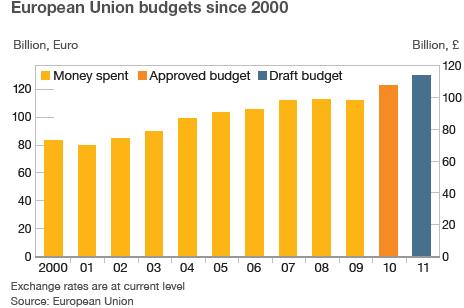

A 2.9% limit on the EU budget increase was also agreed, under UK pressure.

But tough negotiations are expected with the European Parliament, which voted for a 5.9% rise. If no deal is reached by mid-November the 2011 budget will be frozen at the 2010 level.

Enforcing rules

EU officials said the eurozone had almost collapsed during the Greek debt crisis in May because it lacked a rescue mechanism.

Germany wants limited changes to the EU's Lisbon Treaty to reinforce the changes, but is facing resistance from other countries.

The leaders will return to Brussels in December, hoping to agree upon any revision, which it is hoped will be ratified in all EU countries by mid-2013.

Meanwhile, UK Prime Minister David Cameron won backing for his battle against a 5.9% rise in the EU budget.

Germany and France were among 10 nations supporting Mr Cameron's attempt to limit the budget increase to 2.9% - a rise that would still cost UK taxpayers roughly £435m (500m euros).

"Now we have agreed that the EU budget must reflect what we're doing in our own countries," Mr Cameron said, describing the deal as "incredibly important".

He will have further talks with German Chancellor Angela Merkel at his Chequers residence on Saturday.

The bigger prize for Mr Cameron would be a deal to keep the UK's hard-won budget rebate, as difficult talks loom on the EU budget period beyond 2013.

Treaty question

The BBC's Jonty Bloom, in Brussels, says the new crisis mechanism, external is designed to force a country to put its house in order long before its economic problems threaten the eurozone.

Under the rules, EU officials will warn governments about property and speculative bubbles, and will be able to impose stringent fines on countries that borrow and spend too much.

The permanent crisis fund will replace a temporary one, worth 440bn euros, which expires in 2013. It was created earlier this year to bail out Greece and support the euro.

But Germany has argued that the Lisbon Treaty will have to be amended to make the emergency fund permanent and legally watertight.

The current treaty contains a clause banning members from bailing each other out.

Chancellor Merkel said all the leaders agreed that creating a permanent crisis mechanism "will require a limited treaty change".

It took almost a decade of hard negotiations and two referendums in the Republic of Ireland to ratify the Lisbon Treaty, and many states are reluctant to make a move which could trigger a similar process.

The EU Constitution - the treaty's ill-fated forerunner - was rejected by voters in France and the Netherlands.

Mr Van Rompuy has been tasked with finding out whether the fund can be set up without each of the 27 member states having to ratify the treaty all over again.

The UK says a mechanism to ensure stability in the eurozone is desirable - and that the planned sanctions would not apply to the UK.

But all 27 member states' budgets will come under close scrutiny in a "peer review" process.

There would be escalating sanctions on countries which overshot the maximum debt level allowed under the EU's Stability and Growth Pact (SGP), which is 60% of GDP.

Sanctions would kick in earlier than is the case under the current SGP, enabling the EU to take preventive action, for example against a country with an unsustainable housing bubble, or with mounting debt that undermines its competitiveness.