ESM in the dock: Germany's fears

- Published

- comments

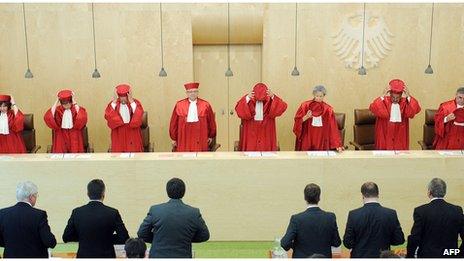

Germany's Federal Constitutional Court is set to deliver key verdicts on the ESM

Never more so than now, Germany remains the key to what will happen in Europe. Anxiety about the direction that Europe is travelling has become widespread inside the country.

Those arguments will be on full display this week.

On Wednesday the eight judges of the Germany's Federal Constitutional Court will put on their red robes and deliver key verdicts on two of the eurozone's new structures. Some say it will be the most important decision in the court's history.

The judges must decide whether the eurozone's new permanent bailout fund, the European Stability Mechanism (ESM), breaches the German constitution.

The ESM was due to have come into operation in July but is on hold awaiting the court's decision.

Merkel's project

The ESM will have deep pockets; 500bn euros (£400bn) to help eurozone countries in trouble.

Its German critics claim that it hands more power to Brussels and therefore should be subject to a referendum.

The court will also pass verdict on the eurozone's fiscal pact, which would give Brussels much greater powers to oversee and control national budgets with the threat of sanctions against those who break the rules.

This pact was very much Angela Merkel's project. She sees it as essential to ensuring countries do not over-spend again.

The critics say that it, too, should trigger a referendum.

If the court were to agree with the critics it would, without doubt, deepen the crisis in the eurozone. Uncertainty would flood back and there would be panic.

Such an outcome worries the German government enough for it to have applied subtle pressure on the legal professors who serve as judges.

The German Finance Minister Wolfgang Schaeuble said: "We have examined this very carefully and I can't see any problem with our German Constitution. They will not block, I am sure, the treaties of the fiscal pact and ESM."

Democratic rights

The comment reflects a nervousness. The expectation is that the court will approve the measures going ahead - but, with conditions. And they will be examined carefully.

The head of the court, Andreas Vosskuhle, last year said that the scope for Germany passing more power to Brussels had "probably been largely exhausted".

Interestingly, polls suggest that the public wants the court to reject these measures.

The German people are increasingly rattled. Too much has been given away. At stake here is the principle that parliament has supreme authority. That underpins the constitution which guarantees democratic rights.

The critics argue that preserving the eurozone is being placed above democracy.

The unease afflicting Germans is reflected in the reaction to last week's European Central Bank (ECB) decision to start bond-buying.

Newspapers were scathing. The Suddeutsche Zeitung said that "a euro community that is based on constantly breaching treaties is built on a shaky foundation".

The ESM has divided German public opinion

The paper regarded the ECB decision as the bank rewarding economic mismanagement.

Die Welt concluded that it was "the ultimate politicisation of a young central bank, which, according to its statutes and the EU's treaties, should be one of the world's most independent".

The President of the Bundesbank has become the standard bearer for critics by saying that the ECB had come "too close to state financing of governments via the printing presses".

'Sinking or swimming'

Chancellor Angela Merkel, in this dispute, backed the ECB.

Increasingly she is seen as making too many concessions. Elections in Germany are a year away, and the suspicion is that she would like to see the eurozone crisis off the agenda before then.

Another test may come this week. Sooner or later Spain is likely to apply for a general bailout.

Last week the President of the ECB, Mario Draghi, said such a rescue should come with "strict conditionality".

But will it? Or, here too, will there be a fudge which will only reinforce the widespread belief in Germany that the printing presses have been switched on to help weak governments?

The financier, George Soros, has thrown down this challenge to Germany "either throw in your fate with the rest of Europe, take the risk of sinking or swimming, or leave the euro, because if you have left, the problems of the eurozone would get better".

A fierce debate in Germany is under way.