Anglo Irish Bank trial: Sean FitzPatrick 'brought in to mend fences'

- Published

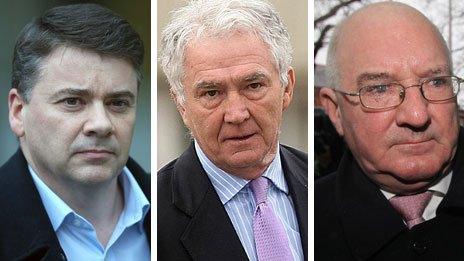

Pat Whelan, Sean FitzPatrick, and Willie McAteer deny providing illegal loans to prop up the share price of the former Anglo Irish bank

A former bank chairman told police he was brought in to "mend fences" with now bankrupt former billionaire Sean Quinn, a court has heard.

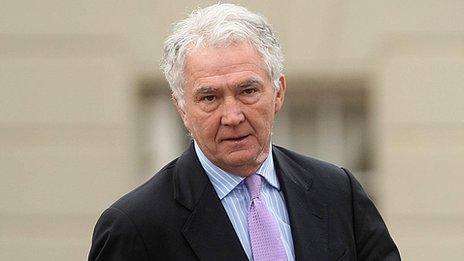

Sean FitzPatrick, former Anglo Irish chairman, is on trial in Dublin.

He is accused, with former executives William McAteer and Pat Whelan, of providing funds to buy Anglo shares, in contravention of the Companies Act.

They face 16 counts of providing unlawful financial assistance to 16 individuals to buy shares in the bank.

The 16 individuals are six members of the Quinn family and a group of investors known as the Maple Ten.

Mr Whelan has also pleaded not guilty to further charges of being privy to the fraudulent alteration of loan facility letters to seven individuals.

Lawyers for Mr FitzPatrick and Mr Whelan have said they accept the loans were made but they deny any illegality.

Mr FitzPatrick, 65, of Greystones, County Wicklow, Mr McAteer, 63, of Rathgar, Dublin, and Mr Whelan, 51, of Malahide in Dublin have pleaded not guilty to all charges.

Fallen out

The court has been hearing details of four interviews carried out by police with Mr FitzPatrick four years ago.

Mr FitzPatrick stepped down as chief executive of Anglo Irish Bank in late 2004 and became non-executive chairman of the bank in January 2005.

David Drumm took over as chief executive.

Sean Quinn was once Ireland's richest man

Mr FitzPatrick told police that after the funding deal with the Maple Ten went through relationships between the bank and Mr Quinn were "at an absolute bottom line" as he had fallen out with Mr Drumm.

"The only other person that David saw as being able to speak to Quinn was me. My instructions were clear: mend fences, not negotiation," he said.

When asked if he was stepping outside a non-executive director role he told police: "I have to be quite tough with you, this was the single biggest transaction of the bank..he was threatening legal action and they needed someone to talk to him and I was the obvious person in the bank, I didn't negotiate, I wasn't asked to negotiate".

Solution

The deal, which went through on 14 July 2008, involved the Maple Ten buying a total of 9.4% of Anglo shares.

This was intended to unwind businessman Mr Quinn's 29.4% stake in Anglo. The trial has previously heard that Mr Quinn was unhappy about the transaction after it had taken place.

Mr FitzPatrick did not agree with police that it was strange that he had not been told the identities of the Maple Ten and was left out of the equation, yet was brought in at other times to speak to Mr Quinn.

When asked if he was "a bit put out" that he had not been told the names of the Maple Ten, Mr FitzPatrick said: "Well he (David Drumm) was the chief executive and he had to come through with a solution and he now had a solution.

"The problem had come up at every board meeting and we had been worrying about it for months. What are we going to do with it? How is it going to be solved?

"Suddenly he came out and said it was solved and I'm keeping the list tight. Why would I come out and say how dare you? Why would I do that?"

During cross examination by counsel for Mr FitzPatrick, the police agreed that at all times Mr FitzPatrick had co-operated fully and had answered every question.

- Published7 February 2014

- Published6 February 2014

- Published5 February 2014

- Published9 December 2011