'Robin Hood' tax battles in EU

- Published

- comments

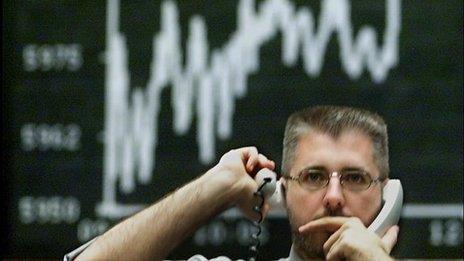

City of London: How would global finance react to a tax on trades?

In the heat of the eurozone crisis, when the European project was in danger and weak countries were being bailed out with billions, there was gritted-teeth determination to make the bankers pay in the future.

For many the root of the crisis lay with the greed of the bankers, rather than the design of the euro or the speculative bubbles built up in countries like Spain and Ireland.

After all, the Celtic Tiger had been brought to its knees when the government took onto its books the debts of the banks and nearly bankrupted itself. It was often repeated at the time that in future crises the banks would take the strain and not the taxpayers.

In this atmosphere an idea was revived. It was the Tobin tax, first proposed by the American economist James Tobin 40 years ago. He suggested taxing all payments from one currency to another, to curb massive destabilising movements of funds.

In the eurozone an idea gained traction of levying a small charge on trades in equities and bonds across the EU's markets.

Tax on 'speculation'

Initially the German Chancellor, Angela Merkel, was not persuaded. It made little sense to her. The French - and particularly President Francois Hollande - were enthusiastic. After all, he had declared in 2012 that "my real adversary is the world of finance". But in Paris, at the highest level, there were doubters. The Governor of the Bank of France, Christian Noyer, warned the tax posed a very real risk to the economy and could destroy businesses and jobs.

Last year Angela Merkel's enthusiasm was rekindled. Her coalition partners, the Social Democrats, made a financial tax a priority - it was some red meat that could be offered to their supporters. So Mrs Merkel and Mr Hollande teamed up and a total of 11 countries backed imposing the tax.

There was pressure, too, from elements within the European Parliament. Some Socialist supporters said the "Robin Hood" tax - the Financial Transaction Tax (FTT) - was necessary "to make speculation and casino capitalism less lucrative".

The UK was against the tax. They thought it would never work unless it was imposed by the G20 and levied globally. Otherwise financial centres like London would lose out to New York or Singapore.

London was most concerned that this tax could be imposed on UK firms trading in those EU member states that had agreed to it. So a precautionary legal challenge was mounted.

The expectation was that it would take the European Court of Justice a year to give an initial judgement. That ruling has been brought forward, unexpectedly, to Wednesday this week.

A London stockbroker: The City dominates financial services in the EU

Defending the City

There is widespread speculation that the court will find against the UK. This should be seen as part of a process, and other legal challenges may follow.

The court's decision, however, will matter - firstly on the political level. Some will see the ruling as a test of the UK's influence over matters deemed important to its key interests. Some politicians may seize on the ruling in the run-up to next month's European elections.

Secondly, a rejection of the UK's case will give weight to those voices arguing that the FTT would be disastrous for the City, damaging the money markets and increasing the cost of finance.

Chancellor George Osborne has described it as "not a tax on banks and bonuses, but a tax on pensioners and people with savings and investments".

So disputes about the FTT could be folded into the wider argument over Britain's relationship with the EU.

On the one side would be the French and Germans and others wanting to rein in the speculative appetites of the bankers, and divert funds to ease future crises. And on the other the British, determined to defend the City of London.

- Published10 September 2013

- Published29 April 2014

- Published22 January 2014