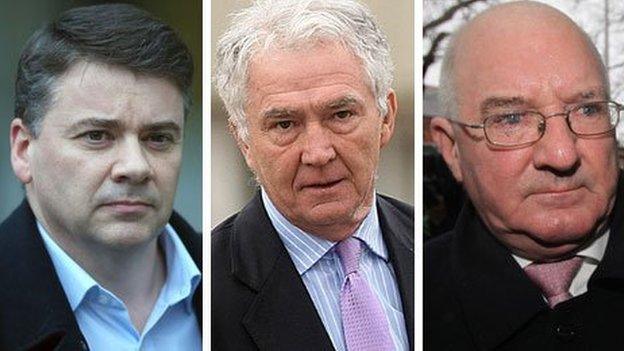

David Drumm: Ex-Anglo Irish Bank CEO fails in bankruptcy bid

- Published

Former Anglo Irish Bank chief executive David Drumm can be held liable for debts of 10.5m euros (£8.34m) after he failed in his bid to be declared bankrupt, a court in the US has ruled.

A judge found Mr Drumm was "not remotely credible" and his conduct "both knowing and fraudulent".

The judge's comments were made in a 122-page judgment, external issued on Tuesday.

Mr Drumm had sought the court's protection after he moved to the US following the bank's collapse.

The judgment, which followed seven months of deliberations at a court in Boston, also accused the 48-year-old of telling "outright lies".

'Witch-hunt'

"Such conduct disqualifies a debtor from the privilege of a discharge in our system of bankruptcy," said the judge in the ruling.

The court heard that both a court-appointed trustee and the Irish Bank Resolution Corporation (IBRC) had established reason to deny Mr Drumm bankruptcy "many times over".

The judge said there were 30 objections on which the bank and trustee had established cause to deny Mr Drumm a discharge from his debts.

In response, Mr Drumm's lawyer told the court that he had made an honest mistake and had been subjected to a "witch-hunt".

'Privilege'

However, the judge said the former banker's conduct disqualified him from the "privilege" of discharge in the US system of bankruptcy.

Mr Drumm moved to Boston in June 2009, six months after his resignation from the bank.

He filed for bankruptcy in October 2010, after he failed to reach a settlement with the bank over outstanding debts.

- Published14 April 2014

- Published7 July 2013

- Published30 June 2013

- Published28 June 2013

- Published27 June 2013