Greece debt: EU says reform proposals 'valid'

- Published

Syriza is trying to balance efforts to ease austerity while appeasing its creditors

Greece is a step further on its way to receiving a bailout extension after its list of proposed reforms was backed by one of its key creditors.

Top European Commission officials called the proposals, external "sufficiently comprehensive to be a valid starting point".

European finance ministers are set to discuss the list shortly.

Greece needs approval from international creditors to secure a four-month loan extension.

Newly elected Greek Prime Minister Alexis Tsipras is trying to balance satisfying the demands of creditors with meeting his pre-election pledges.

His government wants to clamp down on tax evasion, corruption and inefficiency in order to fund social spending and alleviate what it calls Greece's "humanitarian crisis".

'No roll back'

The statement from Commission Vice-President Valdis Dombrovskis and Economic Affairs Commissioner Pierre Moscovici signals the support of one member of the so-called troika that has supervised Greece's financial rescue. The other members are the European Central Bank and the International Monetary Fund.

The statement urges Greece to "refrain from any roll back of measures and unilateral changes to the policies and structural reforms that would negatively impact fiscal targets, economic recovery or financial stability, as assessed by the institutions" of the troika.

The Eurogroup of eurozone finance ministers were to discuss the list in a conference call on Tuesday at about 13:00 GMT.

Greek proposals

Combat tax evasion

Tackle corruption

Commit not to roll back already introduced privatisations, but review privatisations not yet implemented

Introduce collective bargaining, stopping short of raising the minimum wage immediately

Tackle Greece's "humanitarian crisis" with housing guarantees and free medical care for the uninsured unemployed, with no overall public spending increase

Reform public sector wages to avoid further wage cuts, without increasing overall wage bill

Achieve pensions savings by consolidating funds and eliminating incentives for early retirement - not cutting payments

Reduce the number of ministries from 16 to 10, cutting special advisers and fringe benefits for officials

Earlier Eurogroup President Jeroen Dijsselbloem told a news conference the list had been received on time, contrary to news reports of a delay.

He did not give an assessment of the list, but said the Greek government was "very serious" about meeting its reform commitments and had demonstrated an "unequivocal commitment to honour its financial obligations".

The process would not be easy and the list of reforms was just a "first step" towards rebuilding trust between Greece and European creditors, Mr Dijsselbloem said.

Sticking points

Drafts of the list will have been seen by European officials in Brussels as they were being drawn up over the weekend, says the BBC's Mark Lowen in Athens.

But aspects of the plan that require new social spending may well be sticking points with creditors, he adds.

Ending primary home repossessions and providing free medical care and electricity for those who cannot pay may become bones of contention - while the eurozone may insist pension cuts and VAT rises should continue, our correspondent adds.

Analysis: Andrew Walker, BBC World Service economics correspondent

"A valid starting point" - that's how the European Commission described the letter from the Greek Finance Minister Yanis Varoufakis. So even if eurozone finance ministers do accept the proposals, you can be pretty sure that we are in for several months of - at times fractious - negotiations.

The very last sentence of the letter is particularly striking: the government will "ensure that its fight against the humanitarian crisis has no negative fiscal effect".

There you have some key priorities for Greece and its lenders expressed very compactly. It will be very difficult to land any significant blows in that fight without extra spending.

Mr Varoufakis might be able to avoid any negative fiscal effect if he can deliver on all the stuff on improved tax collection. That will take time though, especially the desire he expresses to create a "new culture of tax compliance".

Desirable no doubt, but it's a reminder that in reality the story of Greek economic reform has years to run.

There is little time left to agree an extension to Athens' 240bn-euro (£175bn; $270bn) bailout programme, which is due to expire on Saturday.

Without an extension, Greece could face insolvency and the danger of needing to quit the single currency.

If creditors and finance ministers are happy with the list, it will then be put forward to national governments for agreement before Saturday.

The list will then have to be fleshed out with detailed measures by April.

'Return to dignity'

"Provided Greece avows its obligations and provided there is an agreement in the eurogroup [of finance ministers], the German government would be in favour of the proposed extension," German Finance Minister Wolfgang Schaeuble was quoted as saying.

Greek Finance Minister Yanis Varoufakis told CNN that the list of reforms was "very comprehensive".

"This is a very exciting moment because we are getting to be the co-authors of our fate," Mr Varoufakis said.

"I can assure you that people on the street are elated by this return to dignity of a people, the Greek people, who for five years have been treated as a debt colony."

But the compromises agreed to by leftist leaders of the governing Syriza party in pursuit of a European deal have already estranged key figures among the party's more radical supporters.

They include veteran Greek activist and MEP Manolis Glezos, who apologised to the Greek people for "taking part in this illusion".

Greek economy in numbers

Unemployment is at 25%, with youth unemployment almost 50% (corresponding eurozone averages, external: 11.4% and 23%)

Economy has shrunk by 25% since the start of the eurozone crisis

Country's debt is 175% of GDP

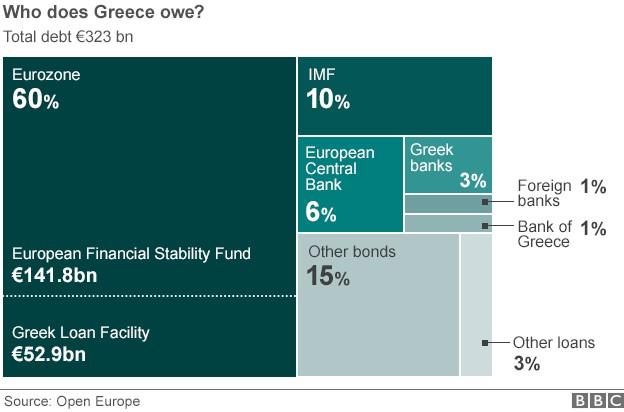

Borrowed €240bn (£188bn) from the EU, the ECB and the IMF