Greece debt crisis: Tsipras faces eurozone deal battle

- Published

Greek banks are verging on collapse, more than two weeks after they shut their doors to customers

Greek Prime Minister Alexis Tsipras is battling to convince MPs within his government to back a third bailout offered by eurozone leaders.

Four pieces of legislation have been submitted to parliament, including pension and VAT reforms. They must be passed by the end of Wednesday

But Defence Minister Panos Kammenos, a junior coalition partner, has said he will provide only limited backing.

If the agreement fails, Greece could be forced to leave the euro.

Eurozone leaders agreed a conditional deal on Monday, external to provide up to €86bn (£61bn) of financing for Greece over three years.

It included an offer to reschedule Greek debt repayments "if necessary", but there was no provision for the reduction in Greek debt - or so-called "haircut" - that the Greek government had sought.

Parliaments in several eurozone states also have to approve any new bailout.

Europe's media stress drama of Greek deal, external

The International Monetary Fund (IMF) announced early on Tuesday that Greece had gone further into arrears by missing a debt repayment for the second consecutive month.

It had been due to pay €456m (£323m; $500m) on Monday and now owed €2bn, the Washington-based fund said.

Defence Minister Panos Kammenos likened the situation to a "coup" by foreign leaders

Greece is also faced with a short-term cash crisis. Banks - which could face collapse without a deal - have been shut since 29 June.

The European Commission is to propose providing emergency financial support for Greece under the EU-wide European Financial Stability Mechanism, but Britain and the Czech Republic, who are both out of the euro, have opposed the move.

Cracks open up - by Mark Lowen, BBC News, Athens

Mark Lobel examines the steps ahead if Greece is to secure a fresh bailout

With the deal done, Greece is now racing to meet its first deadline: to pass four pieces of legislation by the end of Wednesday.

But the cracks are emerging in Alexis Tsipras' coalition.

Away from parliament, Mr Tsipras will also struggle to sell this deal to his own voters, with strike action already called.

But only if he pushes on will the Greek banks get an urgent injection of cash and will the vital bailout funds start flowing once again.

Profile: German Finance Minister Wolfgang Schaeuble

Cabinet reshuffle expected

Mr Tsipras will have a difficult task selling the terms of the third bailout to many of his own supporters.

Many Greeks have expressed their widespread anger online using the hashtag #ThisIsACoup. Civil servants have called for a 24-hour strike on Wednesday.

Mr Kammenos, whose Independent Greeks party underpins Mr Tsipras' coalition government, said he and his colleagues would back plans agreed by Greek parties before the weekend but "no other measures that are imposed".

Greek reforms - in 60 seconds

Some 30 Syriza MPs, led by left-wing Energy Minister Panagiotis Lafazanis, could defy the prime minister, but the urgent reforms would go through with the help of opposition party support.

Mr Tsipras was meeting Syriza MPs on Tuesday morning amid predictions of a reshuffle that could lead to leading anti-bailout figures such as parliament speaker Zoe Constantinopoulou being replaced.

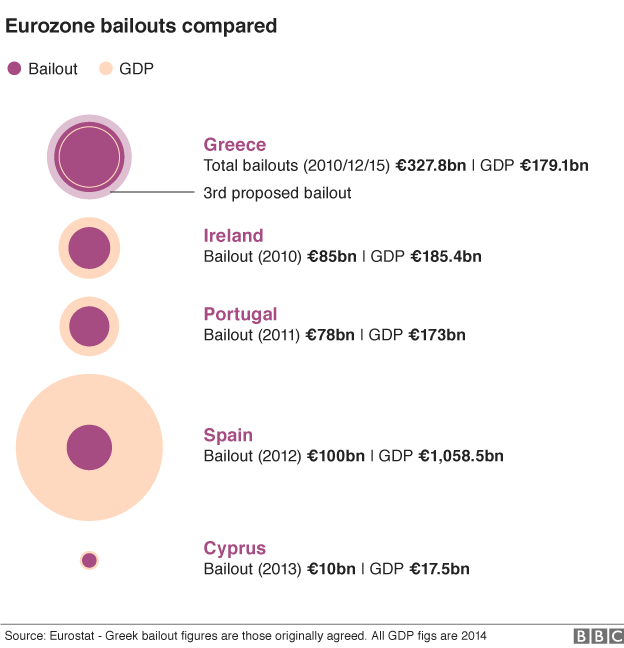

He came to power after his left-wing Syriza party won elections in January on a promise to end austerity. Greece has already received two bailouts totalling €240bn since 2010.

Greek laws to be passed by Wednesday

Ratifying eurozone summit statement, external

VAT changes: Top rate of 23% to extend to processed food, restaurants etc; 13% to cover fresh food, energy bills, water and hotel stays, 6% for medicines and books

VAT discount of 30% to be abolished on islands, but remotest islands to keep discount until next year

Corporation tax raised from 26-29% for small companies

Luxury tax for big cars, boats and swimming pools up from 10-13%; farmers' tax up from 13-26%

Early retirement to end (phased in by 2022); retirement age raised to 67

Greek statistics authority Elstat to have full legal independence

Germans split - by Jenny Hill, BBC News, Berlin

German Chancellor Angela Merkel and Finance Minister Wolfgang Schaeuble returned from Brussels to face a tough crowd at home.

Some disapproved of their negotiating tactics. The German threat of a temporary "Grexit" was, said one Social Democrat, a "breach of trust".

Others believe they didn't go far enough. One senior conservative told me nothing would persuade him to approve a third bailout deal for Greece. It was tantamount to throwing away "our children and grandchildren's money", he said.

An opinion poll suggests 52% of Germans think it's right to give Greece more financial help, but 78% don't trust the Greek government to implement promised reforms.

As the government in Athens struggles to stay afloat, Germany's hardline Finance Minister Wolfgang Schaeuble has reportedly suggested Greece should start issuing IOUs to pay domestic bills such as public sector salaries.

Mr Schaeuble had earlier backed Greece's exit from the euro, and his latest intervention would be seen by many as a first step towards a parallel currency, the Handelsblatt daily reports, external.

#ThisIsACoup trended worldwide - it started with a movement of left-wing activists in Spain

Greek deadlines

15 July: Greek parliament to pass urgent tax, pension and labour law reforms demanded by creditors

16-17 July: Possible votes in eurozone member state parliaments on bailout

20 July: Greece due to make €3.5bn payment to ECB