Irish budget: Michael Noonan says Ireland is on new path

- Published

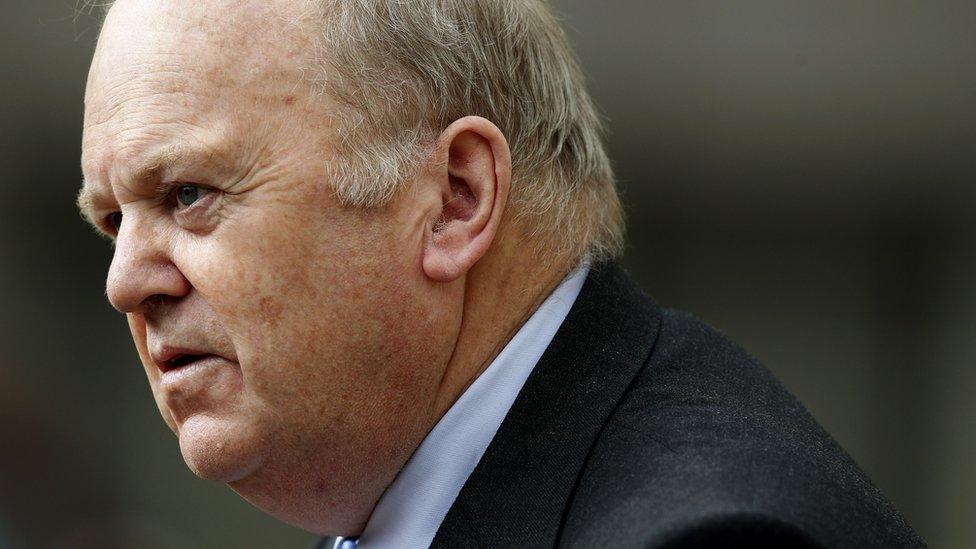

Brendan Howlin and Michael Noonan prepare to deliver the Irish budget

Ireland is "on a new path" and the top priority is to keep recovery growing, the Irish finance minister has said.

Michael Noonan announced a series of tax cuts and spending increases in Ireland's last budget before an election.

The country exited its international bailout programme in 2013 and is now Europe's fastest growing economy.

He told the Dáil on Tuesday that the government was on track to recover all of the jobs lost in the "bust" years.

There would be no more booms and no busts, he told politicians.

About 1,100 jobs are being created every week, Mr Noonan said in his budget speech.

"Our people are in a much stronger and certain position than 2011," he said.

"We are on track to recover all of the jobs lost and have more people working by the end of this decade than ever before."

The governing coalition had indicated that there would be a modest giveaway of about 1.5bn euro (£1.1bn).

Finance Minister Michael Noonan said the days of "boom and bust" were over

Mr Noonan said he would cut the unpopular Universal Social Charge (USC) which is sometimes called "the bailout tax".

The threshold at which people pay USC is to rise to 13,000 euros (£9,646), he said.

The cuts in personal taxation would mean an extra week's wage at every point of income, he told politicians.

The changes would mean a one-income family with two children earning 35,000 euros (£26,182) will see their take home pay increase by 57 euros (£42) a month due to this budget, he said.

He has also reduced capital gains tax and raised the threshold at which inheritance tax is paid.

The minister said the pension fund levy had "done its job" and would end this year.

Mr Noonan said the 9% VAT rate for the tourism sector would not change despite the fact that the need for it is diminishing each year.

He announced plans to make it easier to transfer farm ownership.

New homes

He also said that road tax for large goods vehicles was too high compared to that in Northern Ireland and the rest of the UK. Rates would be simplified and reduced to five new rates, he said.

Mr Noonan also announced more details of a "knowledge box" corporation tax rate. That will allow profits related to patents and software copyrights to be taxed at a rate of 6.25%. The UK "patent box" system is set at a rate of 10%.

Mr Noonan said the country's "bad bank" Nama has been tasked to deliver 20,000 new homes before the end of 2020. That is to help tackle an acute housing shortage in Dublin which has seen rents rising sharply.

The finance minister said this budget would "give certainty to the Irish people of a better future".

Brendan Howlin, the minister for public expenditure and reform said the Irish minimum wage would increase by 50 cents to nine euros 15 (£6.72) per hour.

He announced that children under 12 would get free GP care. He plans to invest 14.2bn euros (£10.6m) in the health service.

The minister increased child benefit to 140 euros (£104.50) per child and said he would invest 3m euros (£2.2m) to develop after school services.

Pensions are also to increase by three euros (£2.24) per week.

Funds would be made available for 600 new police officers, he said.

The allocation for social housing is to be increased by 69m euros (£51.4m) to 414m euros (£308m). This will aim to help local authorities secure accommodation for an additional 14,000 households.

He also increased fuel allowances.

Mr Howlin said there would be an "orderly unwinding of financial emergency legislation" concerning public sector pay.

The only tax increase imposed in this budget was 50 cent (37p) on 20 cigarettes.

- Published14 October 2014

- Published14 October 2014

- Published15 October 2013

- Published30 September 2014

- Published30 September 2014

- Published13 December 2013

- Published13 December 2022