The bottlenecks on alternative routes to export Ukrainian grain

- Published

Ukrainian farmers load barley grain during a harvest in Odesa

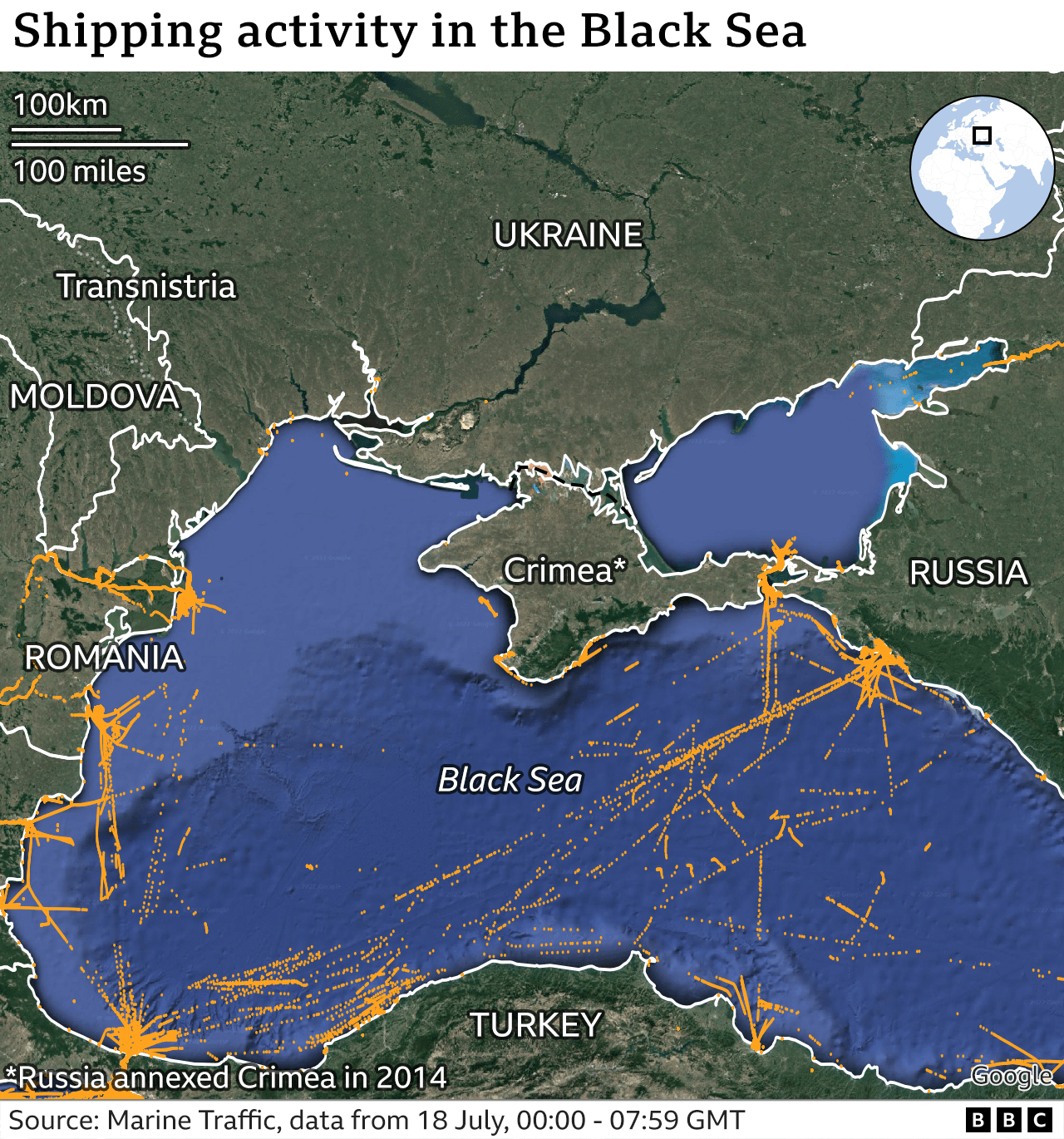

Russia's invasion has forced Ukraine to reroute its grain exports, as its six major Black Sea ports remain under a blockade. The standoff has left millions at increased risk of starvation. A deal is being discussed to allow the resumption of exports but it may take months until the ports re-open. The BBC's Nick Thorpe has seen the bottlenecks in Hungary and Romania.

"You have to understand this as a logistical chain, and there are so many weak links," says Capt Botond Szalma. In his office in Budapest, a chart of the Black Sea, the Danube river, and the whole eastern flank of Europe, from Poland to Turkey, is spread out on the table.

He is a third-generation ship's captain; his grandfather and father both moved grain on the Danube. "We're trying to catch up on 30 years of disastrous neglect of the rail infrastructure in the whole region, including Hungary," says Capt Szalma, who is also executive vice-president of the Federation of National Associations of Ship Brokers and Agents (Fonasba).

These problems, from lack of storage to inadequate transport, are now being felt as the Russian blockade continues.

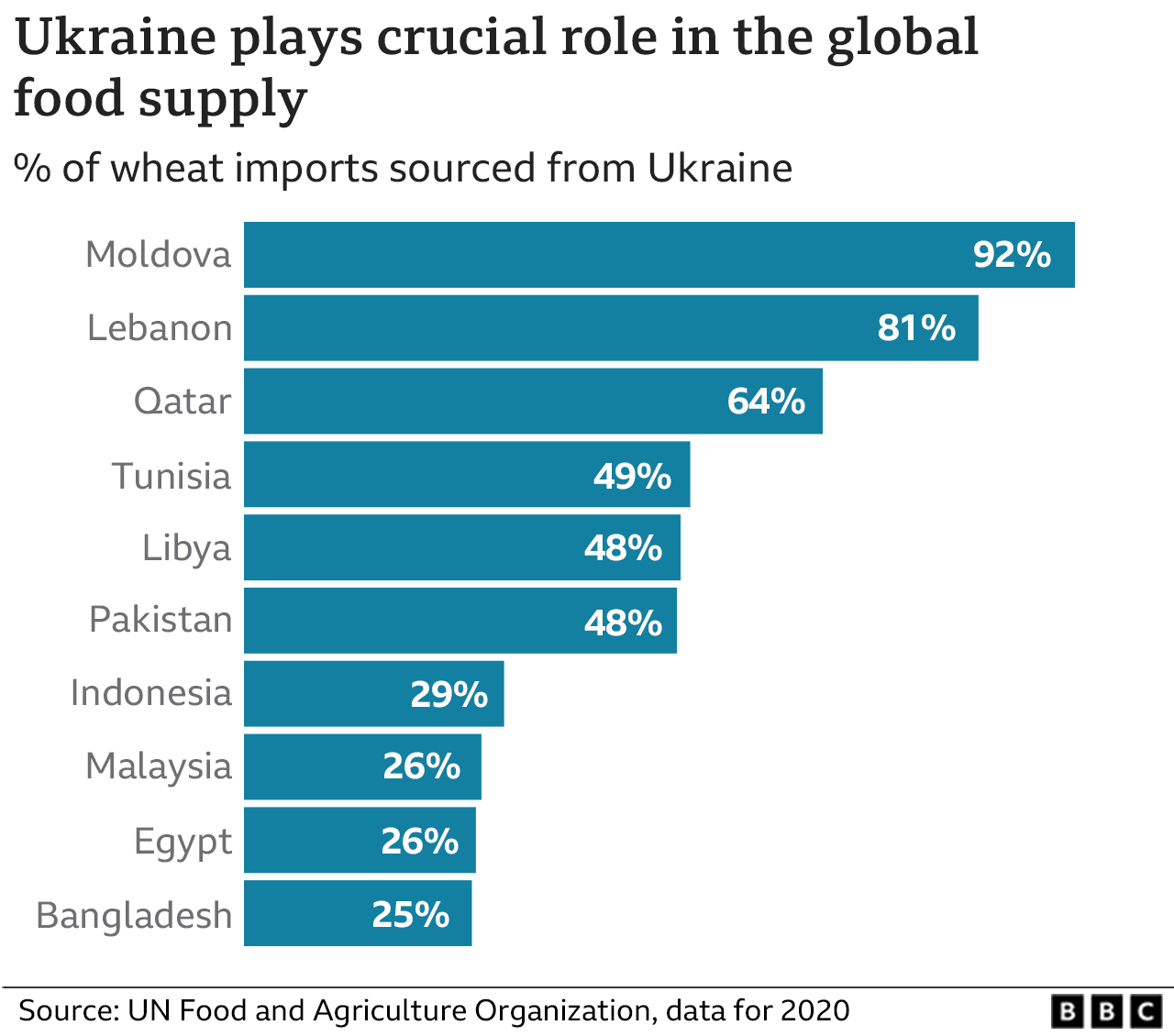

Ukraine is one of the world's largest grain producers. Since Russia invaded the country in February, new ways had to be found for Ukraine to export 20m tonnes of wheat left from the 2021 harvest, and the expected 60m tonnes of this year's harvest.

"We're trying to catch up on 30 years of disastrous neglect of the rail infrastructure," Botond Szalma says

There are 12 rail crossings for goods trains between Ukraine and its five western neighbours - Poland, Slovakia, Hungary, Romania and Moldova. The first logistical nightmare is shifting wagons or their loads from broad gauge tracks - 1,524mm wide, in use in the former Soviet Union - to narrower European gauge - 1,432mm wide.

Dilapidated tracks, and a shortage of wagons, cranes, conveyor belts, and trained personnel make up the picture.

The many resulting trickles now add up to a flow, but experts say it will only be enough to export one third, at best, of Ukrainian food to the world, something that has threatened to push millions of people into food insecurity.

A cloud of corn dust envelops the wagons, workers, and a lone sunflower by the track in a fine film of white powder at Eperjeske, close to Zahony on the Hungary-Ukrainian border. A 30 wagon block train from Ukraine edges forward. Each wagon contains 70 tonnes of Ukrainian corn, bound for farmers in Italy, to feed their cows.

After quality inspection, the wagons jettison their loads, one by one, into a cavity under the track. It is then taken up by conveyor belt, to pour into Hungarian wagons on a parallel track. The whole process takes several hours. There is only capacity here for four trains a day, to cross the railway bridge and return for more.

Yet the quantity being moved is already ten times more than the pre-war period.

"We have 3,500 clients who have a lot of grain for export," says Denys Mararenko of the Ukrainian Agrosem trading company, overseeing the trans-shipment. "There are a lot of bottlenecks during loading… we're trying to set up one big supply chain. We have no other option." He thanks the Hungarians, for getting this much out.

Competing at Constanta

At the Comvex terminal of the big deep-sea port at Constanta in Romania, barley from Serbia and Romania funnels down into the bowels of the Pretty Sight, a 30,000 tonne ship registered in the Marshall Islands.

In 24 hours, 17,000 tonnes, about half the ships' capacity, will be loaded, bound for Tunisia. Chaff from the grain blows everywhere, like a summer snowstorm. The docks here work round the clock, channelling grain, not just from Ukraine, but from all over Central Europe.

Constanta is the biggest port on the whole Black Sea, shipping 65m tonnes a year, double the volume even of Odesa. The problem here is that the port was developed for the past decade as the main outlet for Romanian, Bulgarian, Serbian, Hungarian and Slovak grain, to world markets. They are now competing for space in the dock area, even as Romanian and EU money tries to increase capacity.

"Speed is everything," says Viorel Panait, Comvex director and president of the Constanta Port Business Association. Since the start of the war, his company has invested €4m (£3.1m; $4m), he says, mainly in new conveyors, and doubled its turnover to 70,000 tonnes in, and 70,000 tonnes out per day.

Of the 12m tonnes of grain shipped from Constanta this year, only 1.2 million tonnes were Ukrainian.

But it is not just about grain. Ukraine also needs to export its minerals, Panait says. "We're expecting iron ore as well. If we fail, the cost of the fridges in people's kitchens will double next year."

About 40% of the goods arriving in Constanta come by barge along the River Danube. The rest is brought by rail and road. But the Ukrainian river ports, at Reni and Ismail, are overloaded. They were built for local river transport, and a long queue of trucks leads back from the river, deep into Ukraine.

Viorel Panait, president of the Constanta Port Business Association, says "speed is everything"

It takes 36 hours for the barges to travel 250km (155 miles) up the Danube to Cernavoda, then down the canal to Constanta. When the water is high, a barge can transport 1,800 tonnes. But low water in the river, blamed on climate change, means they cannot fill each to over 1,300 tonnes.

What if the war ends, or Turkey brokers an agreement between Russia and Ukraine, to re-open Odesa and other ports? How long would it take to resume full transport from Ukraine, across the mine-strewn Black Sea, and restore the transport corridors?

Six months is the most optimistic estimate, I hear. Others suggest a year or more.

Watch: Ros Atkins on why the war in Ukraine is pushing up food prices - and the likely impact on poorer countries

Related topics

- Published27 June 2022