Guernsey faces 'unprecedented' public service demand

- Published

Guernsey's 2020 budget has recommended an additional £15.5m for public services

Guernsey is experiencing an "unprecedented" demand on public services, according to its latest report.

The island's 2020 budget states that increasing pressure on the services are a "major challenge".

An additional £15.5m of funding has been recommended to underpin the growing demands.

The policy and resources committee has called for a major review to manage long-term costs.

According to the States of Guernsey, pressure to address the sustainability of the Long Term Care Scheme - which helps some residents with the cost of living in a private care home - will increase public services costs.

Demands for more access to medical treatments and the introduction of the Secondary Pension Scheme, which aims to encourage workers to save for their retirement, were also named as major factors in the growing costs.

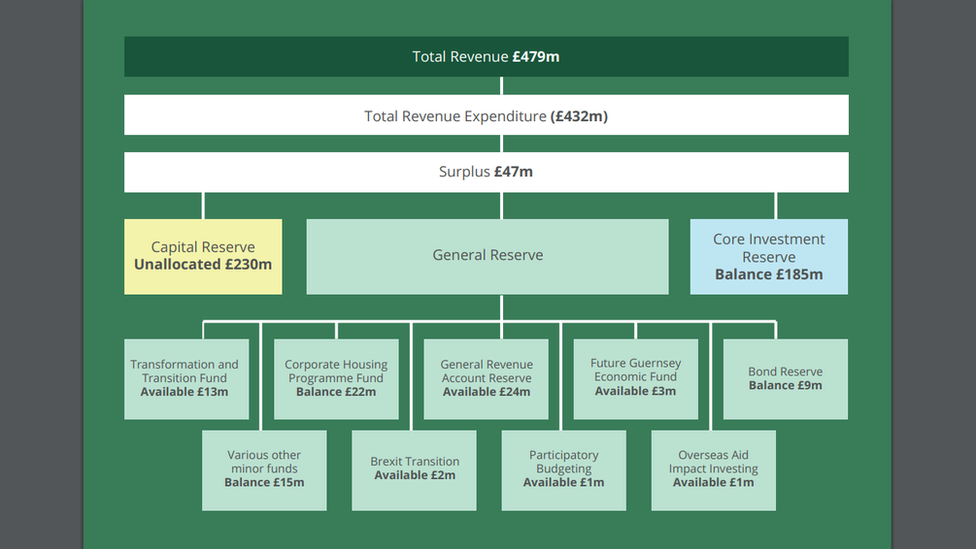

These budgetary demands have so far been met by moving money from the island's capital reserve, used for long-term investments.

Extra funding for public services is being taken from the capital reserve

In light of increasing expenditure, committee members have also sought to create "a more progressive tax system" for the island.

Deputy Gavin St. Pier, president of the policy and resources committee, said: "We have increased the contributions from companies... and ask those most able to contribute to take on a bigger burden in public funding services."

The 2020 budget also details an increase in taxes on alcohol, tobacco and fuel.

The price of alcohol will see an extra 2p on a pint of beer and 10p on a bottle of wine, with tobacco rising by 37p on a packet of cigarettes.

Duty on motor fuel is currently up by 1.1p per litre, and a further 1.1p will be added from 1 January 2020.

There are also proposed increases in tax for commercial and domestic properties and a 5.2% increase in personal tax allowances to £11,575.

- Published8 October 2019

- Published7 September 2019

- Published20 September 2019