Cost of living measures included in Guernsey's 2023 budget

- Published

Higher rates for empty properties and encouraging downsizing are among moves to deal with the housing crisis

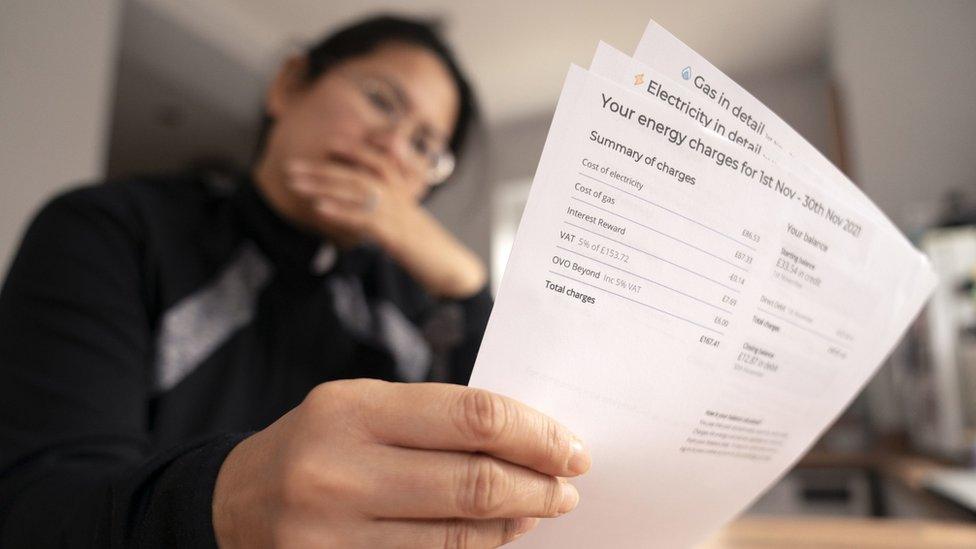

The rising costs of providing services, the cost of living and the ongoing housing crisis are the main themes of Guernsey's 2023 budget.

An increased £48m spending in services, especially health, have been set out.

The budget has a predicted surplus of £33m, but when capital spending is included it suggests a deficit of £43m.

The Policy and Resources Committee, which complies the budget, said there was currently no agreed solution to this structural deficit.

The committee said currently the plan was for reserves to be used to maintain balance but "actions have to be agreed in the very near future in order to maintain a sustainable financial position".

Proposals are due to be put forward in the Tax Review, which will be debated in January.

"This budget paints a stark picture of how fast the cost of providing our existing services is rising," Deputy Peter Ferbrache said.

"These are services people rely on, and we need to face the very serious problem of how we fund them in the future."

The president of the Policy and Resources Committee continued: "If we're not prepared to do that, we must make the even more difficult decision of which ones we will stop."

Deputy Mark Helyar, Treasury lead for the Policy & Resources Committee, said: "Many people are going through increasingly difficult times, even if Guernsey is that bit more insulated from the full impact of the international economic instability compared to other places.

"But this budget also underlines the deficit we are already running, which is worsening each year. We face a growing structural deficit and if it is not addressed, next year's budget could see some very big cuts to budgets."

Proposed cost of living and housing measures:

Personal Income Tax Allowances increase by 7%, so an individual's allowance rises by £850 to £13,025

No increase in domestic TRP tariffs for properties with a TRP rating under 200

One-year pause in the phasing out of mortgage interest relief

Proposed offsets are through TRP, excise duties, income tax and first registration duty

Phasing out of interest relief on Domestic Let properties

Time-limited reduction in document duty to encourage downsizing

Bring in higher rates of document duty for residential property purchases that are not for the owner's principal residence

Plans for new penal rates, through the TRP system, to encourage development and the use of empty properties

Follow BBC Guernsey on Twitter, external and Facebook, external. Send your story ideas to channel.islands@bbc.co.uk, external.

- Published29 September 2022

- Published31 August 2022

- Published28 March 2022

- Published19 January 2022