Inflation blamed for raft of Isle of Man local authority rate hikes

- Published

Rates are a tax based on property value which are levied to pay for local services

Local authorities on the Isle of Man are blaming hikes in rates on high inflation and spiralling costs.

Ratepayers in Castletown are facing a 14% increase from April, the steepest rise announced so far this year.

Castletown Commissioner Jamie Horton said financial challenges in 2022 had been "underestimated", leading to the "significant rise".

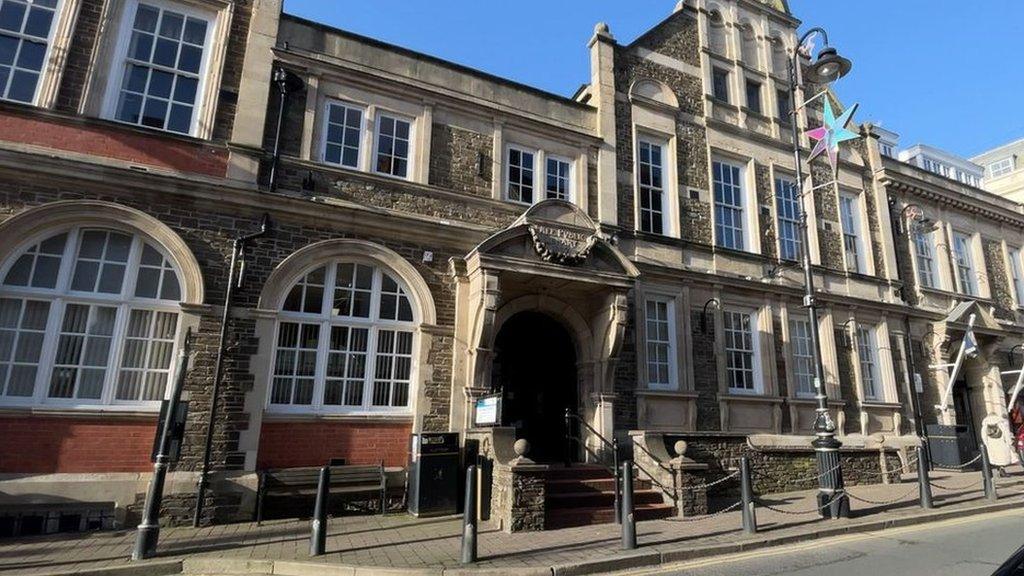

Elsewhere, council rates in Douglas were upped by 8%, which leader Claire Wells said was "unavoidable".

The tax is based on the rental value of a property and is raised by the island's twenty-one local authorities to fund services like street lighting, bin collections and leisure facilities.

'Difficult decisions'

Inflation stood at 7.4% on the island as of December after it hit a 14-year record high of 10.8% in July.

Mr Horton said Castletown Commissioners had to take "difficult decisions" after significant inflation had a knock-on impact on borrowing, waste disposal and employee costs.

The 14% increase will see an average home in the town pay an extra £100 a year.

The board "absolutely recognised" residents were under the same financial pressure, but he said the uplift was needed to address a deficit and to manage future costs.

Rates in Braddan are set to increase by 11.7%, a decision the parish commissioners' chairman Andrew Jessop said was "the most difficult rate setting exercises in a decade".

"In common with other local authorities, there are many external costs outside our control which have seen significant increases over the last 12 months", he added.

Mr Jessop said disposal fees at the island's Energy From Waste Plant had been increased 7.2% by central government.

Rate bills are also set to climb by 9% in Port Erin and Port St Mary, where both local authorities have blamed inflation for squeezing budgets.

Why not follow BBC Isle of Man on Facebook, external and Twitter, external? You can also send story ideas to IsleofMan@bbc.co.uk, external

Related topics

- Published31 January 2023

- Published27 January 2022

- Published3 October 2019

- Published1 March 2019

- Published17 March 2015