Isle of Man treasury minister's budget boosts health and education

- Published

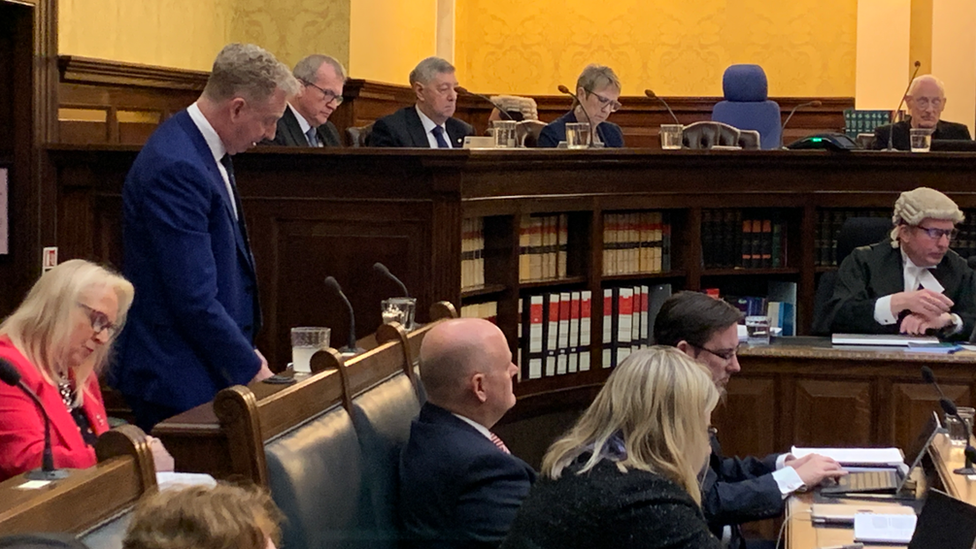

The Isle of Man's financial plan for the next year has been outlined in Tynwald

Boosts to health care services and education have been revealed in the Isle of Man's budget.

Treasury Minister Alex Allinson outlined his financial plan to Tynwald, allocating a total of £1.2bn of government spending.

That equates to £15,243 per person, a rise of £1,199 from the current year.

A raft of social security benefits, including the Manx state pension, are set to increase by about 10%, which will cost the government £26.4m.

To cover the increases in spending the budget draws on a total of £152m of reserves, which Dr Allinson said would "gradually reduce over the following four years".

The Department of Health and Social Care (DHSC) has been given the largest uplift in budget of £20.5m, including £8.5m from the National Insurance reserve fund, while the Department of Education, Sport and Culture follows with a £11.5m rise.

The departmental increases include a 6% rise in the staff pay award budgets for each.

The Healthcare Transformation Fund has also been "topped up" by £3.5m to fund the ongoing implementation of recommendations from the Sir Jonathan Michael report, which led to the creation of the arms-length health care provider Manx Care in 2021.

'Extremely difficult'

Disability living allowance and child benefit are among the benefits set to rise by 9.8%, while the maternity, paternity and adoption allowance will get a 16.8% uplift.

The basic state pension and Manx state pension will rise by 10.1% in a return of the triple-lock principle, and carers' allowance will rise 10.7%.

The treasury said those increases would affect about 19,000 people.

Dr Allinson said the budget for the forthcoming financial year had been "extremely difficult" to compile as forecasting inflation and pay rises had become difficult.

"We're trying to maintain our expenditure in those key public services that people trust and use," he added.

Under the measures unveiled, there is no change to the £14,500 income tax personal allowance, however higher earners will be hit with new measures.

Personal tax allowances will be slashed by £1 for every £2 that a persons' total income is above £100,000.

It means anyone earning more than £129,000 will not benefit from the personal allowance at all.

More broadly £230m has been allocated to capital projects over the next five years, to "deliver central government schemes and progress the aims of the government's Island Plan", Dr Allinson said.

Projects supported in the forthcoming year include:

£3.36m to upgrade the King Edward VIII Pier

£2.3m to deliver the Sexual Assault Referral Centre

£780,000 to replace radiology equipment at Noble's Hospital

£495,000 for mobile classrooms

Dr Allinson said the budget was "a pragmatic way of getting some stability back in terms of government spending, of maintaining public services, maintaining consumer confidence, but also injecting money through the benefit system and also through reform".

Why not follow BBC Isle of Man on Facebook, external and Twitter, external? You can also send story ideas to IsleofMan@bbc.co.uk, external

Related topics

- Published15 February 2022

- Published16 February 2021

- Published16 November 2022

- Published19 July 2022