Jersey and Guernsey say tax regulation should be global

- Published

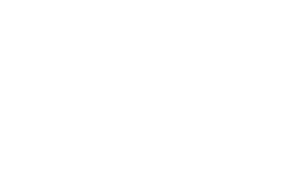

Deputy Peter Harwood and Senator Ian Gorst said FATCA could put the islands at a disadvantage

Jersey and Guernsey do not want to sign up to a tax exchange agreement with the UK unless it is a global regulation.

Officials have met members of the UK government to talk about the Foreign Account Tax Compliance Act (FATCA).

Jersey and Guernsey both have tax information exchange agreements which means they agree to share information on a case-by-case basis.

But the UK wants to adopt the new FATCA regulation, used in the US, which would make this automatic for the islands.

The FATCA rules will force US taxpayers to declare financial assets held overseas and overseas financial institutions to report on assets owned by US taxpayers.

'Common commitment'

The Chief Ministers of Jersey and Guernsey said the islands would be put at competitive disadvantage and are asking for more information.

In a joint statement they said: "We share a common commitment with the UK to combat tax evasion and to participate in international efforts to combat financial and fiscal crime.

"We have long made it clear that neither island has any wish to accommodate those engaged in tax evasion."

The agreement between the UK and the US, signed in September, allows the principles of FATCA to be applied to its relationship with the Crown Dependencies.

But the agreement still needs to be ratified separately by each of the islands' parliaments.

Last week the Isle of Man agreed to sign the agreement with the UK.

Jersey's Chief Minister, Senator Ian Gorst, said: "Jersey considers it is important that in doing so the UK government mirrors the approach of the US FATCA in being global in its application, ensuring a non-discriminatory approach for all jurisdictions."

- Published7 December 2012

- Published1 December 2012

- Published9 October 2012

- Published6 October 2012

- Published25 September 2012