Jersey approves first regulated Bitcoin fund

- Published

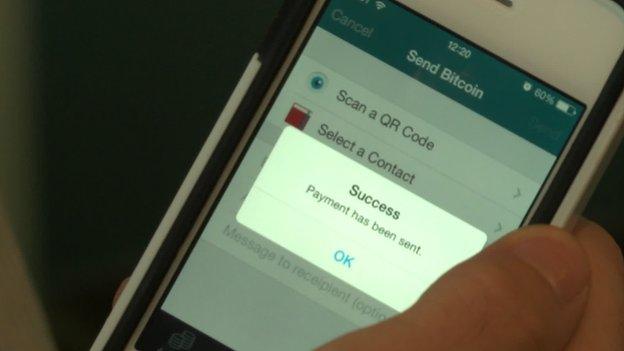

There are a number of businesses in the island that accept Bitcoin as payment

A regulated Bitcoin investment fund overcomes anonymity concerns about the virtual currency, says its director.

The Global Advisors Bitcoin Investment Fund (GABI) has been certified by the Jersey Financial Services Commission to run from 1 August.

Daniel Masters said Jersey's regulatory system meant major investors, such as pension and insurance companies, could invest in Bitcoin for the first time.

The fund will not be open to investments from the general public.

Global Advisors is a Jersey-based hedge fund company which usually specialises in commodities such as metals and oil.

Mr Masters said investors would have to conform to the same security checks as those undertaken with mainstream financial products.

"For institutions there are no options right now," he said.

"This is institutional strength and it's an absolute world first."

'Money laundering'

Island leaders want Jersey to become a global centre for digital currencies and Bitcoin payments are already accepted by some local businesses.

There have been issues around the digital currency, including a lack of regulation and concerns over potential for money laundering and other illegal activity.

In October 2013 the FBI shut down online marketplace Silk Road, which traded in drugs and other illegal goods and took payments using "crypto-currencies".

"There is an anonymity associated with Bitcoin... but any cash or any Bitcoin coming into or out of our fund has to be fully identified under KYC (Know Your Customer) procedures, so there will be no dictators or criminals sending us money," said Mr Masters.

Bitcoin payments work by sending money from one wallet directly to another

- Published23 June 2014

- Published19 June 2014

- Published3 June 2014

- Published29 May 2014

- Published7 May 2014

- Published29 April 2014

- Published25 February 2014

- Published10 February 2014