Jersey law change 'to close dirty money loophole' urged

- Published

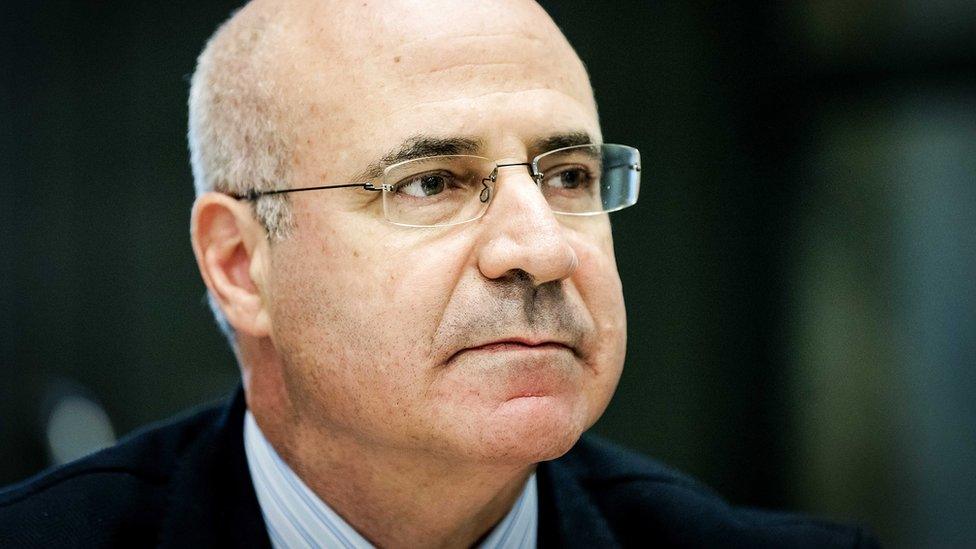

Bill Browder believes increasing powers to sanction Russian officials in offshore jurisdictions will have a "significant" impact

A high-profile critic of Russian President Vladimir Putin has welcomed a possible law change to prevent "dirty" money flowing into Jersey.

Financier Bill Browder urged island politicians to approve a "Magnitsky act" when they meet in December.

A number of countries have passed similar laws, named after Mr Browder's former lawyer Sergei Magnitsky.

Promotional body Jersey Finance said there was "no evidence" of assets being hidden in the island.

Mr Browder, a US-born financier, said Jersey needed to adopt a version of the law and accompanying sanctions, which target those who commit human rights violations.

If the law is approved by politicians, external, the island could become the eighth place in the world to adopt the measures, joining the US, Canada, Gibraltar and a number of Baltic countries.

"In a certain way Jersey adopting the Magnitsky law is more significant than many other places," he said.

"Interestingly Russian oligarchs and corrupt Russian officials use offshore jurisdictions to hold the majority of their wealth."

Mr Browder believes "huge swathes" of offshore money is unreported to Jersey authorities, going through layers of companies, trusts and other financial schemes designed to hide ownership.

Jersey's regulator maintains a register of business owners but, unlike in the UK, this information is available only to law enforcement and not the public.

Under Jersey's current laws, the island's government can implement UN and EU sanctions but adopting elements of UK law would further extend those powers.

Jersey's offshore finance sector

Most Jersey companies pay 0% tax on their profits with some paying 10% or 20%, depending on their type of business

Income tax is payable at a flat rate of 20% but wealthy immigrants can minimise their tax bills further

There is no capital gains, VAT, withholding or wealth taxes

About a quarter of Jersey's 60,000 workforce is employed in financial services

Banking, funds, and trust administration make up the bulk of the finance sector

Jersey is not a part of the UK and is not represented in the British Houses of Parliament but has its own elected parliament of 49 politicians

"Ironically because Jersey is one of the more well-regulated and safer jurisdictions, it's a more attractive place than some of the dodgier ones for Russians to keep their money," Mr Browder said.

"For Jersey to exist as an offshore financial centre it cannot be seen in any way as a place that attracts dirty money," he added.

- Published30 May 2018

- Published29 December 2017

- Published20 May 2017

- Published21 November 2017

- Published11 June 2014

- Published24 May 2016

- Published11 July 2013