Gas finds in east Mediterranean may change strategic balance

- Published

The Tamar drilling platform sits 25km off the coast of Israel

For decades, it seemed that most countries of the Levant, east of the Mediterranean Sea, had little or no share of the Middle East's abundant energy resources.

Israelis even had a joke about how Moses led his people through the desert for 40 years to reach the one place in the region with no oil.

But in the past few years, there have been offshore discoveries of gas and possibly oil that look set to open up new economic possibilities. In future, they could also redefine strategic relationships.

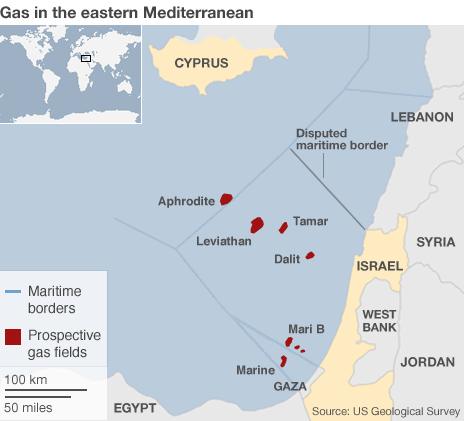

A 2010 US Geological Survey report, external estimated that there were 122 trillion cubic feet (TCF) (equivalent to 3455 billion cubic metres) of gas and 1.7bn barrels of oil off the coasts of Israel, the Gaza Strip, Cyprus, Syria and Lebanon.

In Lebanon, the potential benefits of a domestic supply of gas are immediately clear.

Even the most well-off neighbourhoods of Beirut currently experience daily cuts of state-supplied electricity. Power plants run on expensive imported fuel, mainly diesel.

"You know Lebanon suffers from power cuts and we don't have proper electricity in our houses. It goes off three hours a day in Beirut and it's even worse in other areas," says one consumer, Basil Awada.

"We don't have enough power to supply all the country's demands and so they divide it according to availability into zones, so you've got for example, 12 hours or eight hours, then you get a power cut for eight hours," explains another Beirut resident.

"We have generators and UPS [uninterrupted power supply devices] but we end up paying around four times more for these alternatives than you pay to the government."

Economic turnaround?

In December, a seismological survey in Lebanese waters indicated vast natural gas deposits beneath the seabed, potentially as much as 25 TCF.

Nothing is guaranteed, but already the Lebanese energy minister, Gebran Bassil, is pinning his hopes on hydrocarbon revenues to turn around the country's weak economy, which has one of the highest rates of public debt to gross domestic product (GDP) in the world.

"This will tremendously reduce our oil invoice and the cost of energy production in Lebanon whether related to transportation, to industry," Mr Bassil told the BBC.

"But it also has a much bigger impact. It will create revenues. It will increase our GDP and opportunities for investors. It changes the whole picture and the whole status of the economy here."

Lebanon has just named the international companies that can bid for gas and oil exploration licences. They include giants such as ExxonMobil, Shell, Chevron and Total. It is estimated that drilling will begin in 2015 or 2016.

Yet that timeline still leaves the country lagging behind its neighbours.

Even Cyprus, held up by its recent financial problems, has signed deals with firms overseas to drill in its economic zone.

And last month, Israel started pumping gas from its new $3bn Tamar field, discovered in 2009. It has about 10 TCF of gas and could supply domestic energy needs for decades to come.

It has plans to develop its huge Leviathan reserve, believed to contain 18 TCF of gas and possibly some oil too.

Changing regional relations?

"Leviathan is actually the reservoir that can potentially bring Israel to be totally independent from an energy perspective and also position Israel as an exporter of natural gas rather than importer," says Yossi Abu, chief executive of leading Israeli natural gas company, Delek Drilling.

Delek Drilling and Avner Oil Exploration, also owned by Delek Group, own 31% of Tamar and 45% of Leviathan. Its US partner is Noble Energy.

Lebanon suffers from acute energy shortages and powercuts

Mr Abu sees enormous geopolitical opportunities in the finds as well as commercial ones.

"Israel can use the new natural gas discoveries as a bridge to have a better relationship with our neighbours," Mr Abu says. "It's a win-win for everyone in the area."

"We had discussions with the Palestinian Authority regarding supplying gas from the Israeli discoveries to a power plant in Palestine. We are also exploring potential opportunities to supply gas to Jordan."

In future, exports could also reach Turkey, after it restored diplomatic ties with Israel last month, and Egypt.

Up to now Israel and Jordan imported Egyptian gas via a pipeline in the Sinai.

However this has been attacked repeatedly in the past two years, disrupting supplies, as the Sinai has become increasingly lawless. Egyptian energy demands have also been growing.

Obstacles to overcome

While generally, the new Levant Basin gas finds guarantee their owners energy security, there are many complications.

Israel and Lebanon remain technically at war and there is a dispute over their un-demarcated maritime border.

A Turkish 'powership' docked off Beirut burns heavy fuel to try to meet Lebanon's heavy energy demand

"Investors in the oil and gas sector are used to taking risk and companies take a long-term perspective," says energy economist, Carole Nakhle from the UK's Surrey Energy Economics Centre (SEEC).

"But if I look only at the maritime borders this can be a disincentive for investors in Lebanon. We heard that the southern part of the country could hold better potential of gas, however most companies would be cautious in terms of bidding for blocks within the disputed area."

Political uncertainty in Lebanon means it is also unable to make key decisions, notably on the delineation of offshore blocks, which must be approved by a new cabinet.

There is currently only a caretaker government after the prime minister stepped down last month.

The civil war in Syria not only stops it from exploiting its own offshore energy, it could also disrupt development of Lebanon's resources as violence spills over the border and increases political division.

In Israel, domestic politics also plays a role. The second largest party in the governing coalition has questioned the level of private investment in the exploitation of a natural resource and the planned level of exports.

Experts also point out that energy markets are changing with the US boom in shale gas, which has brought down prices, and this makes commercial decisions tougher.

Syria and Gaza

For now though it is the Palestinians and the Syrians who are least able to take advantage of the offshore gas that lies under their waters.

In Syria, the ongoing civil war currently makes further energy exploration impossible.

Until recently, the country - which is a minor oil producer - was unable to export oil from its existing fields in the north and east of the country because of a Western embargo.

However the European Union lifted its sanctions last month to provide more economic support to the rebels fighting against President Bashar al-Assad's forces.

Further south down the coastline of the Levant Basin, the Gaza Marine field, 30km off the coast of the Palestinian territory, has long been known about. In 1999, the Palestinian Authority awarded the exploration licence to British Gas.

However the conflict between Israel and the Palestinians has prevented further development of the field. The situation became more complicated when the Islamist group, Hamas, took over by force in 2007, ousting its rivals from the Fatah faction. Israel then tightened its border and naval blockade of Gaza.

Last year, talks resumed between the PA and Israel to try to work out their differences over the gas.

"There are some technical problems but the problems are mainly political - because of the Israeli occupation and the internal Palestinian problems - the need for reconciliation," says Mohammed Shtayyah, head of the Palestinian Economic Council for Development and Reconstruction.

"Overall it is extremely frustrating for us as Palestinians. You have that natural resource there that should be a real wealth for the nation and you're not using it."

Interviews in Lebanon by Ghadi Sary.

- Published10 July 2012

- Published23 April 2012

- Published30 September 2011

- Published11 July 2011