Devils in the details of Republican tax plans

- Published

- comments

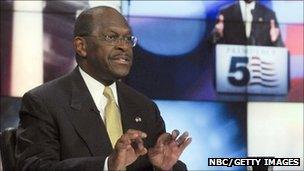

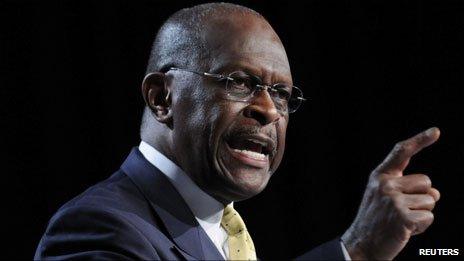

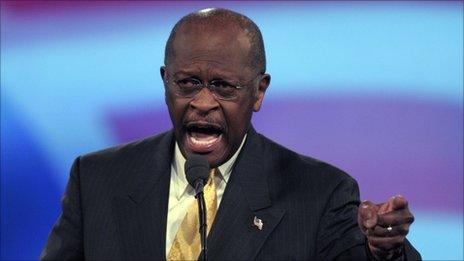

Herman Cain's "9-9-9" plan has come under closer scrutiny as his poll numbers rise

President Obama is out on the stump again, pushing his American Jobs Act in North Carolina and Virginia.

The Republicans have put out a detailed document, external arguing he is trying to resell a policy that has failed once already.

At the moment there is a curious feel to the political debate. Indeed it isn't a debate at all. The two sides are sounding off rather independently of each other. It is two visions in a vacuum.

Congress has rejected the Obama plan as a whole, so now will vote on it bit by bit.

The president's aim is obvious: to paint Republicans in Congress as the enemies of job creation. It is a simple strategy, but a curious one.

After all, next year he'll be running not against Congress, but against one of the Republican candidates. In 2012 the main argument of the campaign is likely to be about how you create jobs.

Whatever the differences between the Republican candidates, they pretty much agree on their prescription for the economy.

President Obama's stimulus has failed, they say, and the government can't create jobs. Lower taxes, less red tape and more US oil production will boost employment.

But some are more specific than others.

Herman Cain's 9-9-9 plan has helped him punch through. His proposal - a 9% business flat tax, a 9% individual flat tax, and a 9% national sales tax - is pretty easy to understand.

The trouble about details is that it gives critics something to attack. Conservatives aren't keen on Mr Cain's plan for a new federal tax, a value-added tax for the US.

Economists largely agree that 9-9-9 would mean a tax rise for those on lower incomes and a tax cut for the better off, but there is disagreement, external whether it would mean an increase for the average family.

Keeping it vague

There are similar concerns for each of the other candidates.

Newt Gingrich would get rid of capital gains tax and the death tax, reduce corporate tax to 12.5% , and offer an optional 15% flat rate tax.

Ron Paul would abolish not only income, capital gains and the death tax but the Internal Revenue Service itself, external. He argues income taxes ''not only diminish liberty, they retard economic growth by discouraging work and production".

Michele Bachmann's website talks about getting rid of the death tax and tax on overseas earnings and simplifying the tax code. But when she offered more details, suggesting she would follow the Reagan tax model, some mocked, claiming that would in fact mean big tax rises.

So you can see why some keep it vague. Rick Perry has written about getting rid of income tax but his website merely promises, external "low taxes".

Rick Santorum's web site is similarly lacking, external in detail, promising he's about "reducing the tax burden" although he has said he would get rid of corporation tax for manufactures.

Mitt Romney gets the prize, external for the most facts, figures and numbers with a 160-page document on the economy. It includes cutting corporation tax to 25%, getting rid of the death tax and capital gains tax, as well as taxes on dividends and income.

Jon Huntsman's plan is strikingly similar in these details, but has caught nobody's eye.

Arguments over taxation will be central for whoever wins the Republican nomination.

The age-old debate role of tax cuts in job creation is a core philosophical difference between the left and right.

But in an election the Republican candidate will have to convince Americans such cuts will not only put more money in their pockets but create jobs for the whole of the country.

- Published14 October 2011

- Published25 September 2011

- Published23 September 2011