California unveils plan to plug $15.7bn budget gap

- Published

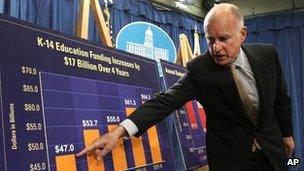

Governor Jerry Brown is hoping that California voters will pass tax rises in November

California's governor has unveiled a proposal to tackle the cash-strapped US state's $15.7bn (£9.7bn) budget gap.

Gov Jerry Brown proposes to raise $16.7bn, about half from cuts and half from tax rises and other measures.

The budget hinges on voters passing two tax rises in November. The plan also envisages cutting 5% of payments to state employees, with a four-day week.

California also hopes for $1.5bn in revenue over the next year after this week's Facebook stock flotation.

In outlining the proposal, the Democratic governor said on Monday the state could not overcome its deficit by cuts alone.

"It's taken more than a decade to get into this mess. We're not going to get out of it in a year," he told reporters. "But we're making real progress."

California residents will vote in November on an increase in the sales tax as well as an income tax rise on those making more than $250,000 yearly. Both measures would be temporary and would also increase education spending.

Gov Brown expects those tax rises to make up about $6bn of the shortfall. Polling suggests support for the measures but their passage is far from assured.

If the ballot measure fails, Gov Brown proposes $5.5bn to be cut automatically from education in the state.

California - which would be the world's ninth-largest economy if it were a nation - must pass a fiscal plan by 15 June. Democratic legislators balked at Mr Brown's previous plan to address the deficit.

Gov Jerry Brown said on Saturday that the deficit had grown from a projected $9.2bn in January because of a slackening economy and legal challenges to planned cuts.

The $8.3bn in planned cuts also envisages delaying courthouse construction projects and trimming $500m from the court system.

Previously planned cuts to welfare and childcare are maintained in the new proposal as well as increased cuts to Medi-Cal, a government healthcare assistance programme.

Gov Brown also plans to send low-level offenders in state prison to county jails, with an anticipated $1bn in savings to the state.

- Published12 February 2011

- Published11 January 2011

- Published9 October 2011

- Published18 April 2012