$1tn student debt crisis crushes home-buying dream

- Published

'I'll be paying my student loans until my son's in college," says Michael Nealis of the $64,000 debt he built up at university

Student debt has risen dramatically in recent years, leaving many college graduates unable to buy their first homes. That has analysts worried about the future of the US economy.

There are plenty of "For Sale" signs in the Philadelphia suburb where Michael Nealis lives with his wife, Jessica. They dream of owning a home and on learning they were expecting their first child, they approached a mortgage adviser.

"We were told immediately that no mortgage company would touch me with the amount of student loan debt that I have," Mr Nealis says.

He studied for an undergraduate degree for four years and owes $64,000 (£38,138) in student loans. He is now a science teacher and Jessica works as a special needs assistant in a school.

'Beyond frustrating'

But with stricter rules for mortgage lenders now in place following the sub-prime debt crisis, their debt-to-income ratio disqualifies them from a loan.

Student debt repayments account for around 45% of Mr Nealis' monthly take-home pay, making it impossible, he says, to save for a deposit.

"It's beyond frustrating," he says. "We're left in a situation where we can't qualify for anything. I make a decent living but I don't make enough to pay $1,200 a month in student loans."

Housing market experts say that many young people are in the same situation, which is dampening demand for homes. First-time buyers have historically been the bedrock of the US housing market, accounting for around 40% of total sales.

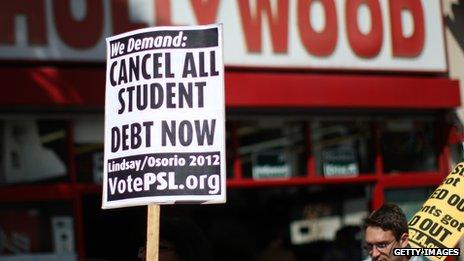

Campaigns against high college costs, including this one in California in 2012, have been waged over the years, yet the price of a degree remains high

The latest figures from the National Association of Realtors (NAR) show that in February 2014 they only accounted for 28%.

NAR President Steve Brown said that in a recent consumer survey, 56% of younger buyers who took longer to save for a down payment identified student debt as the biggest obstacle.

"It's clear there are other people who would like to buy a home that are not in the market because of debt issues, so we can expect a lingering impact of delayed home buying," he said.

Levels of student debt have risen substantially in recent years. According to the Federal Reserve Bank of New York, aggregate student loans nationwide have almost quadrupled in the past ten years, from $253bn at the end of 2003 to $1.08tn at the end of 2013.

It is now the second-highest form of consumer debt after mortgages, overtaking credit card borrowing and car loans. One of the main reasons is that the price of higher education is rising.

Between 2000-12 the average cost of four-year college tuition increased 44%. The rise was highest at public universities, which have traditionally provided a cheaper alternative to for-profit and private institutions.

Call for forgiveness

The income level of the average family has not kept pace, and so students are taking out more loans. The CEO of the Mortgage Bankers Association, David Stevens, is worried by the trend.

"If the average college graduate has more student debt than we have ever seen the likes of before in this country, that has an extraordinarily dampening effect on their ability to buy a home," he says.

"With housing making up a fifth of the gross domestic product of this country, that could have an adverse impact on the pace of the economic recovery."

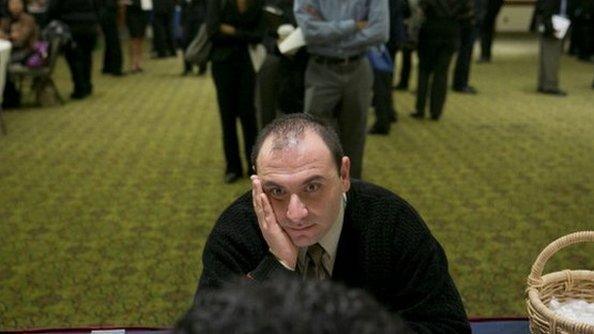

Many students are paying for college - and cannot afford to buy a house

He says that policymakers are starting to take note that student debt may be starting to drag down the economy.

"Some are calling for some form of debt forgiveness programme," he says. "Some are discussing providing subsidies for young people to buy their first homes."

Worth it?

There are also proposals in Congress to reset student loan interest rates and make debt refinancing easier, amid concerns that increasing numbers of graduates are unable to repay their loans back in time.

In 2003, 6.2% of borrowers were at least 90 days late making a payment. By 2013 that number had risen to 11.5%.

Research shows that having a university education does pay off in the long term; graduates have lower rates of unemployment and higher salaries. But Aaron Smith, who founded Young Invincibles, external to represent the interests of 18-34-year-olds, says people he speaks to are increasingly worried about the cost.

"There's a lot of scepticism out there among young people about whether it's worth going to college anymore," he says. "They see their older brothers and sisters in huge amounts of debt and question whether they want to be in that position."

He said that this could hinder social mobility in the US.

"One of the ways people from different spheres of our economic system moved up was by getting an education then being able to buy a house, which opened up a path to the middle class for millions of Americans," he says. "That is becoming more of a distant reality for a lot of young people."

Homeownership certainly seems a very distant dream for Mr Nealis.

"I thought I did everything right," he says. "I had a blue-collar father, a work-from-home mother and I was trying to do better. But it seems that having got an education, I'm now in a situation worse than they were."

- Published7 April 2014

- Published10 April 2014

- Published26 March 2014

- Published12 March 2014