How the #BlackMonday meltdown happened on Twitter

- Published

Investors are fearful of a Chinese economic collapse

Wall Street is reeling after stock prices plunged, rebounded and then plunged again in a chaotic day of trading dubbed "Black Monday".

Stock markets in Europe and across the world also fell on Monday as investors were unnerved by fears of a Chinese economic slowdown.

All the while, jokes flew on Twitter.

It may sound confusing - and it is. Here is how the bewilderment and subsequent joking played out on Twitter.

The power of Twitter

Some said Twitter really controls the stock market-and offers the best financial advice.

What is worse: One Direction going on hiatus or Black Monday?

The band One Direction announced a hiatus on Monday, and its fans are quite dedicated. The day the band breaks up for good will be pretty "black" indeed. Sorry, stockbrokers.

What it looks like on Wall Street

Some lamented that it was time to pull out stock photos of "exasperated" traders again. Or maybe a cartoon dog with his house burning down is a better fit?

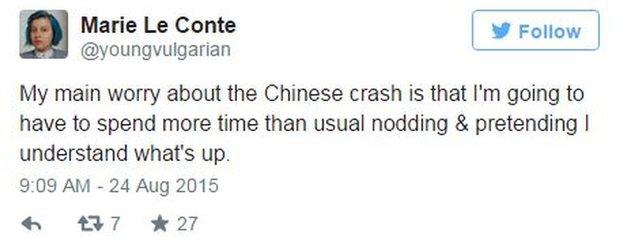

Stocks can be hard to understand

If you are texting mum and dad to see what the crash means for them, you are not alone.

Or maybe you are just nodding along and pretending you understand.

Not another sale, folks

Black Monday may sound like that day people shop after Thanksgiving early in the morning (Black Friday) or that day people order cheap goods on the Internet (Cyber Monday). Not quite.

What is the difference, really?

A shopping day might be a bit more fun for investors and traders than reality.

- Published24 August 2015

- Published24 August 2015