Scrapping income tax and other Republican 2016 plans

- Published

Republican presidential hopeful Rand Paul poses with thousands of pages of tax documents

If there's one issue that every Republican presidential hopeful can agree on, it's that taxes are too high and the resulting system and rules governing their collection is too complex.

Coming up with a plan to pare back the federal revenue-collection system can be a tricky task, however. Putting forward a realistic proposal requires making some uncomfortable, possibly politically damaging choices that opponents can try to exploit.

It's not surprising, then, that only four of the 15 current candidates have advanced anything more than a basic outline of how they'd reform the tax code. And even those four plans leave a lot to the imagination.

Here's a closer look at what the candidates are selling.

Jeb Bush

One of the former Florida governor's favourite lines on the campaign trail is that he'll be the president whose tax reform boosts annual US economic growth to 4%, from its current sub-2% levels. (We're still waiting for a savvy competitor do him one better and tout a 5% plan.)

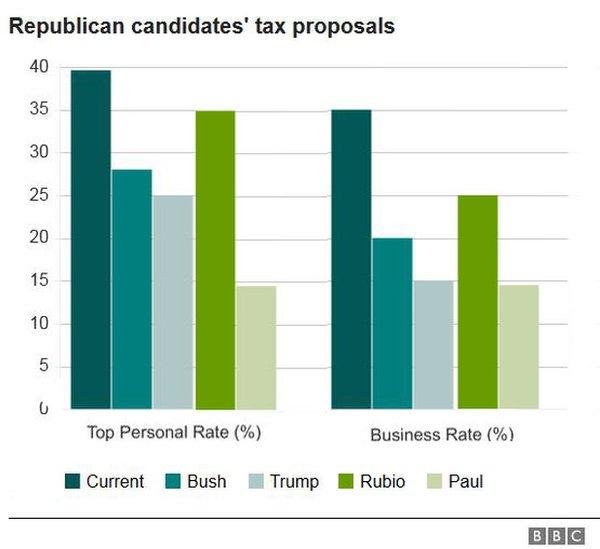

Mr Bush wants to reduce the number of tax brackets from seven to three, with a top rate dropping from 39.6% to 28%. He'd eliminate the estate tax and double the standard deduction (used by those who don't itemise their tax deductions), which would effectively increase the number of Americans in lower incomes paying no federal income taxes whatsoever.

Several popular deductions, for home mortgage interest and medical expenses, would be capped, and filers would no longer be able to deduct state and local taxes. The "carried interest" deduction, much loved by billionaire hedge-fund managers, would be eliminated.

The alternate minimum tax, which applies to wealthier earners who take sizeable deductions, would be out. Older workers who reach full retirement age would not be required to pay Social Security payroll taxes.

US corporations would also get in on the fun, with their tax rate dropping from 35% to 20%. Overseas earnings wouldn't be taxed, but Mr Bush would exact a one-time levy of up to 8.75% on existing deferred foreign income.

What's the catch? Getting rid of the state and local tax write-off will hurt residents of high-tax places like New York and California, but Mr Bush seems to have little sympathy for the plight of those in big-government states.

Donald Trump

Despite a lot of talk about unveiling a groundbreaking new tax plan, the unconventional candidate's proposal is quite traditional by Republican standards.

The New York billionaire would reduce the number of tax brackets from seven to four, with a top rate of 25%. Individual filers earning under $25,000 [£16,000] would pay no income taxes - although, in a bit of Trumpian dramatic flair, they'd have to file a piece of paper that tells the IRS, "I win".

The corporate tax rate would drop from 35% to 15%, and capital gains would move from 23.8% to 20% (or lower based on income levels). Some loopholes would be closed, including the "carried interest" break. The end result, however, is that the extremely wealthy would likely end up paying less.

The $2.1 trillion [£1.39 trillion] in overseas cash reserves of US companies would be subject a one-time 10% tax, at which point they could bring the money back into the US. Foreign earnings would continue to be taxed, and Mr Trump would end the ability to defer those tax payments.

Trump also would do away with the estate tax and the alternate minimum tax.

If all of this looks a bit familiar, that's because it's basically a more aggressive version of Mr Bush's tax plan.

"It almost looks as if Trump simply looked at Bush's plan, then slashed all the rates a little further - or, you know, classed it up a bit," quips, external Slate's Jordan Weissmann.

What's the catch? Increasing the number of Americans who pay no income taxes - "takers" not "makers", as former Republican vice-presidential nominee Paul Ryan once said, external - may rub some conservatives the wrong way.

Marco Rubio

If Mr Trump's tax plan is well within the bounds of Republican orthodoxy, the Florida senator's proposal - which he devised in 2014 along with Utah Senator Mike Lee - actually is a bit of an outlier.

Mr Rubio's top tax rate drops only to 35% for individual income over $75,000 - which could actually increase the marginal tax rate for some middle-class filers. Income below that would be taxed at 15%. The per-child tax credit would be raised from $1,000 to $2,500, with the existing phase-out for high earners ended.

Taxpayers would no longer choose between taking a standard deduction or itemising their taxes - they'd receive a $2,000 personal credit, and every filer would be allowed to take deductions for home mortgage interest and charitable contributions. All other itemised deductions would be eliminated, as would the alternate minimum tax.

The Florida senator would cut the corporate tax rate to 25% and, like Mr Bush, he'd end the tax on overseas earnings after exacting a 6% repatriation tax. He'd also cut the tax on capital gains to zero - which neither Mr Trump nor Mr Bush suggests.

What's the catch? If Mr Rubio keeps rising in the polls, those attack adverts targeting his 35% top rate will practically write themselves.

Rand Paul

"Hey, I'm Rand Paul, and I'm trying to kill the tax code."

Thus begins the memorable YouTube video, external in which the Kentucky senator sets about destroying 70,000 pages of tax rules, regulations and related legal opinions with fire, a woodchipper and finally a chainsaw - all set to Jimmy Hendrix's electric guitar rendition of the US national anthem.

Mr Paul was trying to draw attention to his plan to replace the existing tax structure with a 14.5% flat tax on all personal income and 14.5% value-added tax.

He'd do away with other corporate, personal, payroll, excise and estate taxes entirely and exempt the first $50,000 of all earned income.

The senator would keep a few of those prized loopholes for middle-class Americans, however, such as deductions for home mortgage interest and charitable donations, earned-income and child credits, and tax-exemption for work-provided health plan premium payments.

"I'm telling you, this is erotic, it is so good," said, external conservative gadfly Glenn Beck.

According to the conservative Tax Foundation policy organisation, roughly $3 trillion in taxes would be cut over 10 years, which Mr Paul says he will balance out through spending cuts and increased revenue from the economic growth his plan would generate.

What's the catch? Critics will argue that a flat tax with plenty of choice loopholes isn't much of a flat tax at all.

The rest of the pack

What about the other eleventy-billion candidates running for the Republican nomination, you ask. Don't they have plans, too?

Sure. Kind of.

New Jersey Governor Chris Christie spelled out his tax plan in a Wall Street Journal opinion piece, external. He'd cut the corporate tax rate to 25%, set a top personal rate of 28%, reduce the number of brackets to three and do away with all itemised deductions except mortgage interest and charitable donations.

Retired neurosurgeon Ben Carson has repeatedly asserted that a progressive income tax structure - which, by the way, the US has used for over 100 years - is socialism. He recommends a 10% flat tax he says is drawn from the biblical concept, external of tithing.

Former Arkansas Governor Mike Huckabee has endorsed the FairTax, external plan, which replaces all income and corporate taxes with a 23% federal sales tax. Every taxpayer would receive a monthly "prebate" cheque covering the taxes assessed on basic necessities.

Senator Ted Cruz wants to "abolish the IRS" by implementing what he calls a simple flat tax, although the details of such a plan still solely reside in the Texan's head.

What's the catch? Plans that are unrealistic, unworkable or totally off-the-wall can often look good when they're reduced to one or two-sentence soundbites.

Candidates in (and out of) the Republican presidential field