Canada is taking aim at its overheated housing market

- Published

Canada will close a tax loophole used by foreign homebuyers as it struggles to cool red-hot property markets in Vancouver and Toronto.

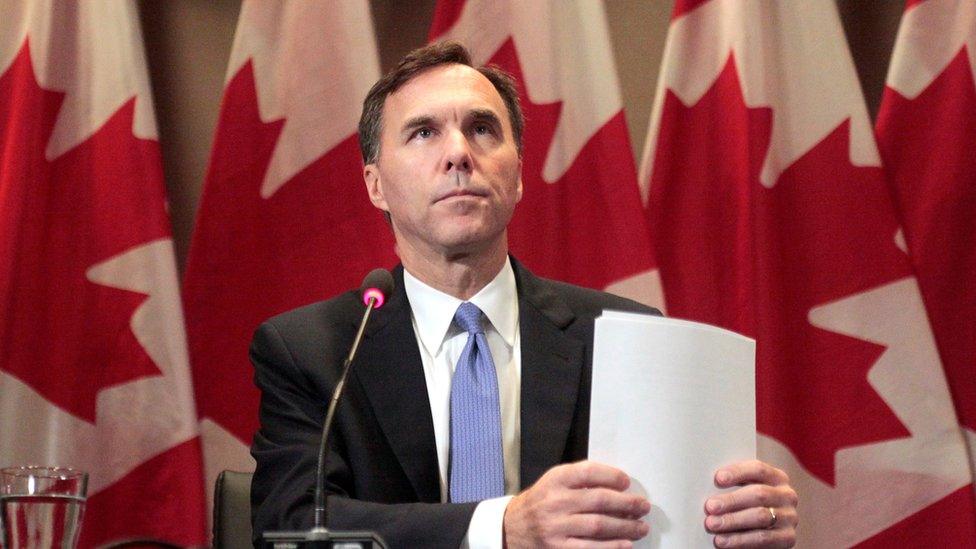

Federal Finance Minister Bill Morneau announced the measure on Monday.

Economists, bankers and politicians have been growing increasingly alarmed at the skyrocketing property markets in the two cities and are warning they may be headed for a correction.

Under Canadian tax law, homeowners selling their principal residence get a tax benefit in the form of an exemption from capital gains taxation.

The new rule will ensure only people living in their home as a principal residence prior to its sale will be able to claim that so-called "principal residence exemption".

"Affordability is an issue that concerns many middle class families, particularly here in Toronto and in BC's lower mainland. It is real, and we do not take it lightly," Mr. Morneau said.

The minister also announced a more robust mortgage stress test on all new insured mortgages.

Affordability is a top concern, Finance Minister Bill Morneau said

The move by Canadian authorities comes shortly after Swiss Bank UBS released a report warning that of all the cities in the world, Vancouver is most at risk of having a housing bubble. The city soared to first place this year from fourth in 2015.

UBS placed Canada's third-largest city ahead of London, Stockholm, Sydney and Munich in the comparison of housing markets of 18 major global cities.

"House prices of the cities within the bubble risk zone have increased by almost 50% on average since 2011. In the other financial centres, prices have only risen by less than 15%," the report said.

The spike in housing prices in those cities have been fuelled by a both a demand from foreign investors and low interest rates.

Mr. Morneau's announcement is not the first step taken by Canadian policy makers in a bid to calm the booming real estate market.

In February, Canada increased the minimum down payment for new insured mortgages from 5% to 10% for homes above CA$500,000 ($381,000 /£296,555) a move that was targeted mostly towards the Vancouver and Toronto markets.

In August, British Columbia's provincial government implemented a controversial 15% tax on foreign home buyers in the metro Vancouver area amid concerns foreign investment is driving up home prices and pushing homeownership out of reach for much of the city's population.

Earlier this year, a "tear-down" property in the city's west side that sold for close to CA$2.5m, external ($1.9m/£1.5m) became a symbol of the city's out-of-control property market.

According to the Real Estate Board of Greater Vancouver, the average price for a single family home in August was CA$1.57m ($1.2m/£931,000).

- Published4 October 2016

- Published2 October 2016

- Published29 September 2016