Donald Trump's proposed tax plan could benefit Trump

- Published

"I'm doing the right thing, and it's not good for me, believe me." - Donald Trump on his tax plan in Indianapolis on Wednesday.

Unpacking Donald Trump's latest tax proposal, external is a bit of a challenge, but it's fairly safe to say that it would, in fact, be quite good for him.

In quite a few places, the plan - estimated to cost at least $3tn (£2.23tn) over 10 years - is short on details.

There's no information, for instance, on what income levels would fall into newly adjusted tax brackets.

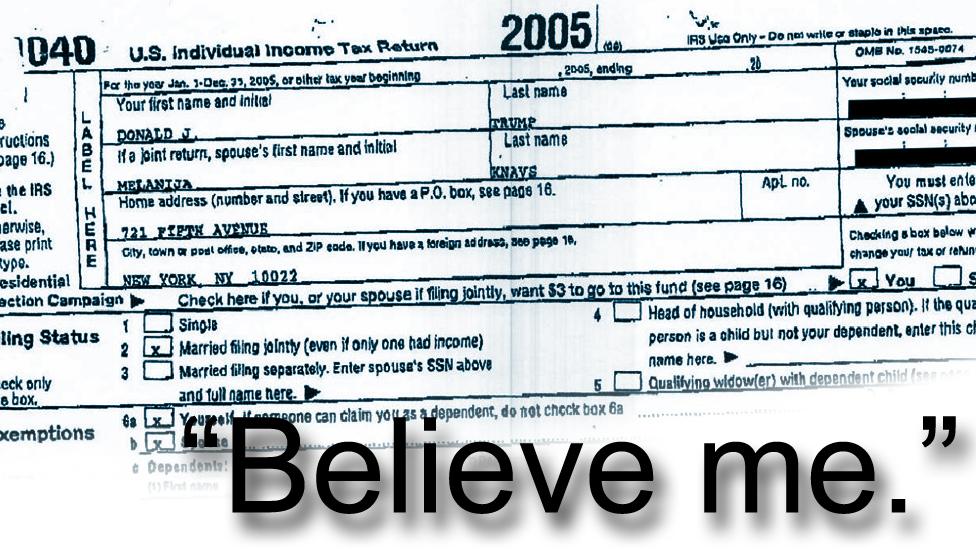

As for Mr Trump's personal finances, that picture is even muddier, given that he is the first president in more than 40 years not to publicly release his tax returns when running for office. During a White House briefing about the president's tax plan on Thursday, economic advisor Gary Cohn repeatedly declined to discuss how the administration's plan might alter the president's tax obligations.

Given what we do know about his situation - including from the leak of his 2005 tax returns in March - certain conclusions can be drawn about how his proposed changes could affect Mr Trump and his family personally.

While some Americans could see their taxes go up if the president's proposal becomes a reality, Mr Trump has a very good chance of ending up on the winning side of the ledger.

Here are three ways he's likely to benefit (and one way he could be hurt).

The Alternative Minimum Tax

The Alternative Minimum Tax (AMT) will be abolished entirely if Mr Trump has his way. The levy was first instituted in 1982 as a means of ensuring that the wealthiest taxpayers can't entirely avoid paying income taxes by taking significant deductions for expenses like state taxes, interest on home mortgages, charitable donations and medical bills.

The AMT is a separate way of calculating tax obligation that, if it results in higher amount owed, replaces the standard tax system with a starting rate of 26% (subject to a personal exemption) that increases to 28% on income over $179,500.

In his 2005 tax returns, external, the AMT hit Mr Trump hard. With it, he paid an additional $31m in taxes, setting his tax rate at roughly 24%. Under the standard tax computations, Mr Trump's effective rate would have been 4%.

The Estate Tax

The estate tax is also facing the axe in Mr Trump's proposal. The "death tax", as it's called by its detractors, currently exacts a 40% levy on inherited assets in excess of $5.49m (twice that for married couples). It affects only a small number of American estates every year - 5,500 out of roughly 3 million in 2017.

Donald Trump has given control, but not ownership, of his business empire to his children while he's president

Given the lack of concrete information on the disposition of Mr Trump's far-flung business empire, it's difficult to calculate exactly how much his heirs would receive at the time of his death - and how much would be subject to the tax.

It's safe to assume, however, that the president's assets are in excess of the amount exempted. He has said in the past that his net worth is $10bn, which would create a $4bn tax burden in the unlikely event that none of those assets are sheltered.

Corporate taxes

The Trump plan cuts corporate taxes from 35% to 20%. That will be welcome news for many US businesses - at least, the ones that haven't already found a way, thanks to various loopholes, to make their effective tax rate significantly lower.

That doesn't directly affect Mr Trump, since he operates his sprawling empire not as a corporation but as a family-run business. Where the president will benefit, however, is a change to how "pass-through" businesses are taxed.

Currently, personal income derived from closely held partnerships, limited liability corporations and sole owner proprietorships - which is how the president's more than 500 businesses are structured - are taxed as personal, not corporate, income. High earners like Mr Trump (who chose not to relinquish ownership of his business entities while president) could be paying as much as 39.6% on some of their income.

The president's proposal would cap pass-through profits at 25% - a significant reduction, even if Congress decides to follow the president's advice and reduce the top personal tax rate by a few points.

State and local tax deductions

One area where the president might suffer a new tax hit is from his proposed elimination of the federal income tax deduction for money paid in state and local taxes.

In states with high-income tax rates, like California, New Jersey and the president's home of New York, this deduction can be quite substantive. If the president does away with the alternative minimum tax, not being able to deduct what is probably a substantive New York state obligation will drive up his total tax bill.

Given the other places the president appears poised to profit if his plan becomes a reality, however, this would seem a small price to pay.

What cuts are in the Republican tax plan?

For businesses:

Reduce corporate rate from 35% to 20%

Change tax on overseas profits, with details unclear

A top 25% rate for firms organised as "pass-through entities", such as limited liability corporations

Surrounded by fellow Republicans, Speaker of the House Paul Ryan speaks about the Republican tax plan

For families:

Nearly double the amount individuals and families can deduct to $12,000 and $24,000

Increase tax credit for children

Introduce a new tax credit for non-child dependents

Eliminate a tax on inheritances

- Published28 September 2017

- Published30 August 2017