Student loans: Biden opens applications for debt forgiveness

- Published

The scheme applies to those earning less than $125,000 a year. or households earning less than $250,000

US President Joe Biden has formally launched his student loan forgiveness scheme, which could see billions of dollars of federal loans cancelled.

The plan, which applies to tens of millions of graduates, means up to $20,000 (£17,600) of debt could be written off per borrower.

Those who meet the eligibility criteria are able to apply online here, external.

"This is a game changer for millions of Americans," Mr Biden said at a news conference.

The plan has been challenged in court by a group of six Republican-led states who are seeking to block it from taking effect. They have argued the scheme - which independent analysts estimate will cost $400bn - is too expensive and places an unfair burden on some taxpayers.

On Monday, as the legal challenges continued in court and risked the scheme being put on hold, Mr Biden launched a defence of his plan.

"Republican members of Congress and Republican governors are trying to do everything they can to deny this relief," he said. "I will never apologise for helping working Americans and middle class people as they recover from the pandemic."

He earlier said "no high-income individual or high-income household" would benefit from the plan.

Who can apply for student debt relief?

The scheme applies to those earning less than $125,000 a year - or households earning less than $250,000 - and most applicants will have $10,000 of debt cancelled.

But $20,000 will be written off for those who have been awarded federal Pell Grants, which are designed for students in the greatest financial need.

Mr Biden said the online form would take less than five minutes to complete. An early testing version was released on Friday, and the president said some eight million people had already applied using that version by Monday.

The form requires the borrower's name, contact information, date of birth and Social Security number. Users are then asked to tick a box confirming that they meet the income requirements.

This information is then checked against existing Department of Education records, and those applicants likely to exceed the income limits will be asked for further information.

Applications will be accepted until the end of 2023.

The White House projected that around 30 million Americans would apply for relief using the form, while an additional eight million borrowers who already have their information on file with the Department of Education will have their debt cancelled automatically.

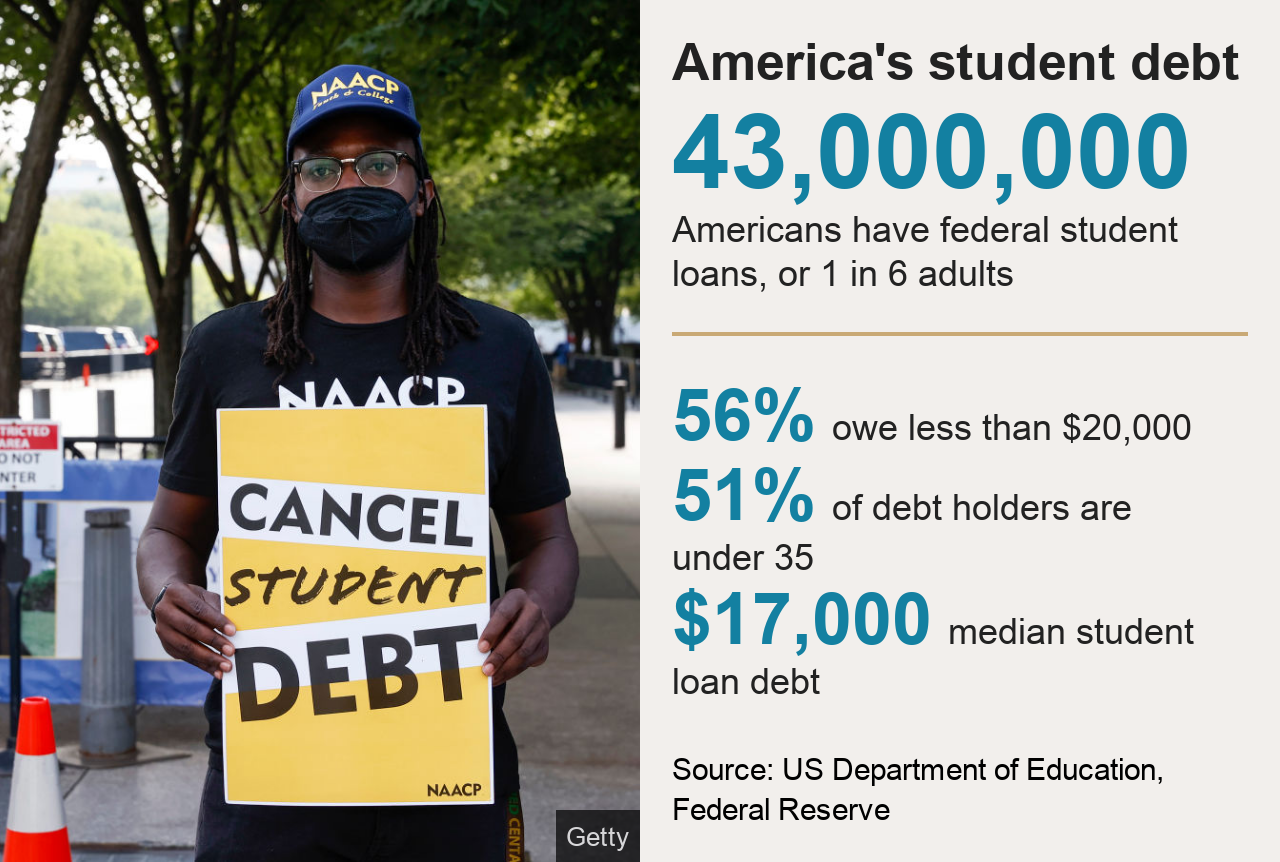

An estimated 43 million Americans owe a combined total of $1.6tn in federal student debt. That means that about one in six American adults, or about a third of Americans with at least some post-secondary education, has some student debt.

The median student loan debt is just over $17,000, according to the Federal Reserve. About 17% owe less than $10,000 in federal student loans, while on the other end of the spectrum, 7% owe more than $100,000.

- Published27 February 2023

- Published24 August 2022

- Published14 April 2021

- Published3 December 2019