Trump Organization: Criminal tax fraud trial begins in New York

- Published

A jury of four women and eight men was chosen on Friday

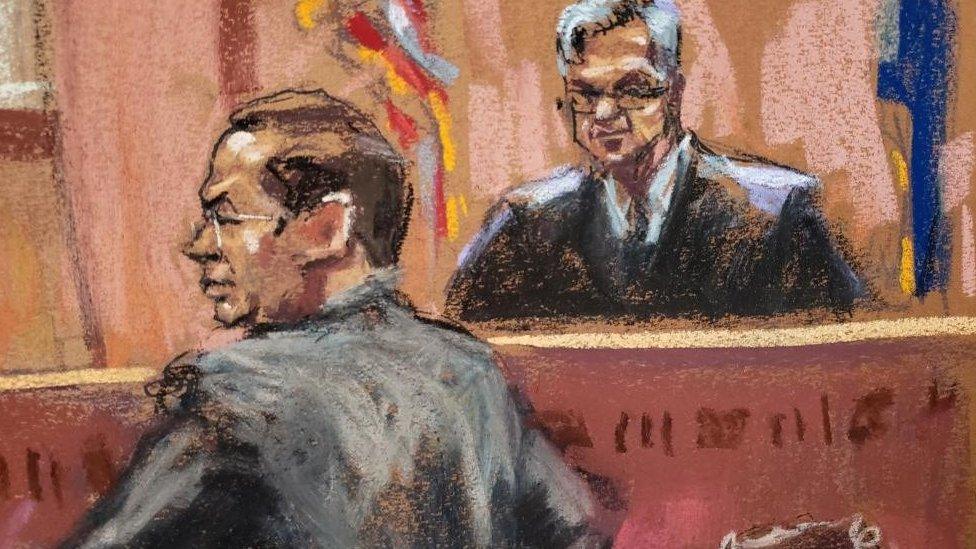

A criminal trial against the Trump Organization, which is accused of paying untaxed perks to its executives for 15 years, has begun in New York.

The real estate business run by the former president's family is synonymous with Donald Trump, but neither he nor his family members are on trial.

A former executive who worked for Mr Trump for decades and pleaded guilty in August is expected to testify.

It is one of three legal cases that Mr Trump and his company face in New York.

New York City prosecutors accuse the company of running a scheme to pay executives off books and by offering them untaxed perks.

An indictment accuses it of conspiracy, scheming to defraud, criminal tax fraud and falsifying business records. If convicted, the company could face fines amounting to more than $1m (£870,000) and may face difficulty in securing loans and financing.

Allen Weisselberg, a long-serving chief financial officer for the Trump Organization, pleaded guilty to financial crimes in August as part of the case and is co-operating with prosecutors in exchange for a more lenient sentence.

He is expected to testify next week in the Manhattan courtroom, and will face sentencing after he speaks. He could be sentenced to 5 to 15 years if he refuses to co-operate at trial.

In a plea agreement, the 75-year-old admitted his involvement in the scheme and to receiving private school tuition for his grandchildren, BMW cars and a home in Manhattan in exchange for his work.

But on Monday, lawyers for the Trump Organization accused him of lying and acting without the company's knowledge, saying he was motivated by "individual personal greed".

"Donald Trump didn't know that Allen Weisselberg was cheating on Allen Weisselberg's personal tax returns," Trump Organization lawyer Susan Necheles said in her opening argument.

Prosecutors said that the "case is about greed and cheating" and accused the company's executives of conspiring with Weisselberg to avoid paying taxes.

"Everybody wins here," said Manhattan prosecutor Susan Hoffinger. "Of course, everybody but the tax authorities. The problem with doing it this way is that it's not legal."

Jury selection concluded on Friday after four women and eight men were chosen, as well as six alternatives in case a juror is dismissed for any reason. Defence lawyers for the Trump Organization say it has been difficult to find neutral jurors, and have called on lawyers to "keep politics out" of the courtroom.

The Trump Organization, through two corporate entities - the Trump Corporation and Trump Payroll Corporation - has pleaded not guilty and denies any wrongdoing.

Financial statements and cheques signed by Mr Trump are expected to be introduced as evidence during trial.

Mr Trump has slammed the criminal case, which has taken three years to bring to trial - as a "witch hunt".

He is not expected to testify or attend the trial, but the judge overseeing the case last week warned that Mr Trump and his three eldest children could be called to testify.

Mr Trump and his children are also facing a civil case brought by the New York state attorney general, accusing them of overstating the value of real estate properties, such as golf courses and hotels, in order to get more favourable loans and better tax rates.

Mr Trump, a Republican, is also being sued in New York by a group of protesters who say they were violently attacked by Mr Trump's security team while protesting outside Trump Tower in 2015.

Jury selection in that case begins in the Bronx on Monday.

Related topics

- Published18 August 2022

- Published28 August 2024

- Published11 August 2022

- Published2 July 2021

- Published10 August 2022