In Canada, complex fraud schemes are targeting homeowners

- Published

Fraudsters appear to be targeting lucrative real estate markets in Canada, primarily Toronto, where the average home costs over $1.2m

A Canadian couple recently learned that their home was sold by fraudsters without their consent while they were out of town. Experts say theft of this nature is rare, but there has been a notable rise of similar cases in the country's most populous city.

Early this year, Toronto police said they wanted the public's help in catching two people who were involved in a complex fraud scheme.

The individuals, police said, had used fake identities to pose as owners of a home in the city. They then successfully sold the home, handing over the keys to the unsuspecting new owners.

The real owners of the home, meanwhile, had been out of the country for work since January 2022.

The out-of-town couple only learned that their home had been sold without their knowledge months later, after noticing that their mortgage payments had disappeared from their bank accounts.

The incident captured the fascination of many in Canada, particularly in the Greater Toronto Area and Vancouver, where real estate is categorised as a national obsession because of its high cost - the average home costs over C$1m ($749,000; £620,000) - and housing scarcity.

Similar stories from other property owners in Toronto have since emerged, external, and investigators say these once-rare cases of property title fraud appear to be on the rise.

For industry veterans, these types of cases are "definitely unique to this point in time," said Trevor Koot, the CEO of the British Columbia Real Estate Association, who has been in the business for nearly 20 years.

"I would say I've never seen anything like it," he said, especially when it comes to the level of sophistication used to carry out these crimes.

What is title fraud? And how much has it risen in Canada?

Schemes related to home or property ownership can typically occur in two ways: mortgage fraud and title fraud.

Mortgage fraud is typically more common, explained Brian King of King Advisory International Group, a Toronto-based firm that investigates white-collar crime.

Why it takes 30 years to buy a house in Canada

It's carried out when a fraudster uses fake identification documents to place a second mortgage on a house they don't own, usually when the first mortgage has been nearly or fully paid off.

Title fraud, on the other hand, involves tenants of a vacant home posing as the owner and selling that home to earnest buyers. This results in a total title transfer of the property.

In most cases, the real owner and the buyer of the house are able to get most of their money back if there is title insurance on the home. The insurance helps re-establish ownership and covers legal fees incurred during the process.

Mr King said he has observed both mortgage and title fraud increasing in frequency since 2020.

His firm has seen a "rash" of title fraud in the last few years, he said. In almost all cases, the home owners had been living away when fraudsters took over their property, in places like the US and China.

One of his clients, Mr King said, was a couple who moved for work to the UK from Toronto in 2018. Their home in Canada was then sold from underneath them in 2022.

It was sold for C$1.7m and it had been entirely renovated by the time they found out that it had been stolen last June. As of February, the couple is still working through having their title on the home restored.

John Rider, a vice-president at Chicago Title Insurance Company, said the firm's Canada branch had only seen two cases of fraud - mortgage and title - between the 1960s and 2019.

Now they are dealing with dozens, including at least five title fraud cases, all in the Greater Toronto Area, which includes the city and surrounding municipalities.

Similar cases of title fraud have emerged in the province of British Columbia as well - home to the city of Vancouver, where the average home costs C$1.1m - though with less frequency.

The BC Land Title and Survey Authority (LTSA) said it is aware of two title fraud attempts since 2020, only one of which was successful. The public corporation added it only knows of one prior case in 2019, and two in 2008 and 2009.

It maintains that these types of fraud cases remain exceptionally rare - the LTSA processes up to one million land title applications each year.

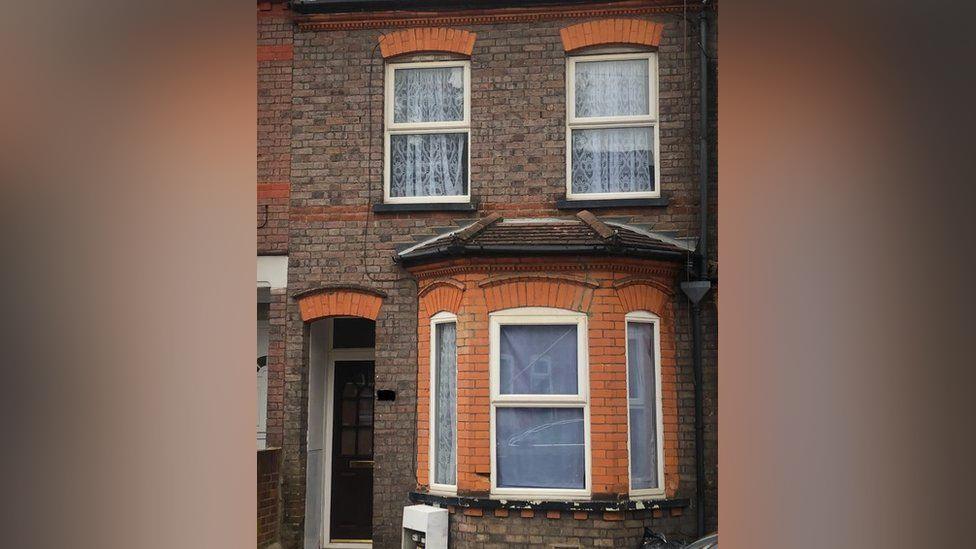

A similar case made headlines in the UK in 2021, when a man in Luton returned to his house only to find that the home and all its furnishing were sold without his knowledge.

Property fraud cases in the UK, however, appear to be steady. Data provided to the BBC by the UK Land Registry shows an average of 41 reported cases of both mortgage and title fraud in the past four years. Cases hit a peak of 50 in 2016-2017.

Why are reports of title fraud on the rise?

Experts are puzzled as to why there has been a surge of reported cases, particularly in Toronto.

Mr King said it's possible that virtual real estate deals during the pandemic could have made it more difficult to detect fake identification documents. The pandemic, he added, has also forced some people away from their property for longer periods due to travel restrictions.

Others have pointed to the growing sophistication of the perpetrators - some of whom have been linked to organised crime - who seemingly have a good grasp of the Canadian real estate system.

Mr Rider added that the fraudulent IDs used in these transactions often look authentic, and perpetrators will hire skilled actors to pose as homeowners and carry out the scheme.

"IDs are so easily faked now that it can't be relied on as the sole way of closing a C$3m transaction," Mr Rider said.

There is also the profitable nature of these crimes. Real estate in Toronto has significantly risen in value in the last few decades - the average home in 1996 cost C$198,150. Last year, it was C$1.18m.

"It does make sense there is a big focus on where real estate is really valuable," said Ron Usher, a general counsel with the Society of Notaries Public in British Columbia.

But Mr Usher cautioned little is known about these reported cases of title fraud, which are often complex in nature.

"These crimes are not easy to do, and they often get caught and are often stopped."

He and others have called for a national investigation to determine the root causes and if more can be done to protect homeowners in Canada.

Related topics

- Published18 September 2021

- Published1 November 2021