How Help to Buy ISA could work for you

- Published

One of the big announcements in this week's budget was aimed at helping people to buy their first home.

And first-time buyers need all the help they can get, with relatively high property prices and stricter rules on getting a mortgage.

The Help to Buy ISA is an offer from the government to top up your savings for a deposit.

Critics say the move will push house prices further out of people's reach, with a lack of new homes available.

There are also questions over the financing of the policy, with researchers at the Institute for Fiscal Studies claiming the plan is "unfunded".

But if you're interested, here's how it works.

1. The government will add to your savings and there's no minimum monthly deposit

For every £1 you save the government will give you 25p. It'll match that up to a maximum of £200 each month, up to a total of £12,000. So you save £12,000 and you'll actually have £15,000 to play with.

2. There's no time limit and they'll be available from later this year

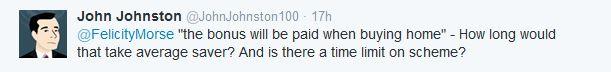

John wants to know about any possible time limits

Help to Buy ISAs should be available from autumn 2015 (ministers still need to finalise the details with industry) and will stay open to first-time buyers for four years. Once you've got one though there's no time limit on how how quickly you have to save and no time limit on when you can use the government's bonus.

3. No buy-to-lets

Help to Buy ISAs are only for people (or groups of people) buying their first home to live in. So wannabe property moguls who want to use them to help with their buy-to-let empire need not apply.

4. There's no limit on how many people can apply

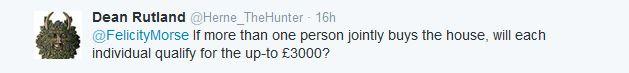

Dean had a question for Newsbeat's social media producer Felicity Morse

If you're buying a home on your own you can use one Help to Buy ISA. If you're buying it with someone else you can both get one. If three of you are buying a house together you can all still get one each and use all three Help to Buy ISAs to help get you started. And so on.

5. You can start with £1,000

The Help to Buy ISAs won't be available until later this year, but you'll be able to open one with (up to) a £1,000 deposit. That way ministers say first-time buyers can start saving now and still won't lose out if they've got £1,000 together by then.

6. No million pound houses

The Help to Buy ISA will only be available on homes worth up to £250,000 (or £450,000 in London). So if you've just won the lottery or come into some inheritance money you can't get this bonus payment from the government for a million pound mansion.

Other help for first-time buyers

Help To Buy ISAs are the latest way the government is hoping to help first-time buyers and boost the construction industry.

Here are some of the other schemes already in place.

Help to buy equity loan

Announced in October 2013, this scheme was aimed at providing nearly £10 billion for almost 200,000 home buyers. For anyone who's got a 5% deposit the government said it would put up 20% in a loan (up to a maximum property value of £600,000, interest free for five years) which can be repaid at any time or when the property is sold.

Shared ownership

Shared ownership schemes are provided through housing associations. People buy a share of their home (25% to 75% of the home's value) and pay rent on the remaining share. There are different rules on who can apply but it's aimed at council tenants, first-time buyers and people with a family income of less than £60,000.

Help to Buy: NewBuy

Another scheme launched in 2013 that lets anyone, not just first-time buyers, buy a new build home with a 5% deposit. This one is run by the housing industry though and people still need a mortgage to pay for the rest of the property's value.

Help to buy: Mortgage guarantee scheme

Under this scheme, the government offers a guarantee to lenders (banks/mortgage providers/building societies) that provide mortgages to people with a deposit of between 5% and 20%. This one isn't available for people wanting to buy a second home or buy-to-let property though.

Follow @BBCNewsbeat, external on Twitter, BBCNewsbeat, external on Instagram and Radio1Newsbeat, external on YouTube