Recession: What is it? What does it affect? Why does it matter?

- Published

- comments

Experts say the UK could be heading for a recession, but what does that mean?

You might have heard people talking about a recession recently.

The UK isn't in a recession at the moment but experts think there could be a risk of one next year - that's because the economy shrank slightly over the last three months.

A recession is when a country's economy shrinks for two three-month periods - or quarters - in a row.

But, what exactly does that mean and why does it matter? Keep reading to find out more.

What is a recession?

BBC expert Sean Farrington answers YOUR cost of living questions

We buy, make and sell loads of goods and services in the UK. That activity makes up the economy.

The more things and services we sell, the more money the country makes. When that happens the economy grows.

But, sometimes the value of goods and services made or sold falls, which means the economy starts to shrink.

The economy involves making and buying products and services. You may have heard people refer to the economy, which often means a specific country's economy.

A good economy is generally one where there are lots of good-paying jobs, and businesses are selling things and making money.

A bad economy is one where people are losing jobs, can't afford things and businesses are struggling to make money.

Higher prices for goods, things like cars or houses and food, have led to many households cutting back on spending, which has started to affect the economy.

If this happens for a period of two three-month periods - or quarters - in a row, then it is called a recession.

Why are prices going up?

WATCH: Ricky finds out more about the cost of living crisis

The rising cost of things is known as inflation.

That's when, over time, prices rise and how much you can buy with your money falls, so workers want to be paid more in wages, which means it costs companies more to pay people to make things, which then pushes up how much those things cost to make and the prices rise... and so on.

There are lots of different reasons why prices have risen.

It's partly down to an increased demand for fossil fuels like oil and gas, which has meant energy prices have gone up.

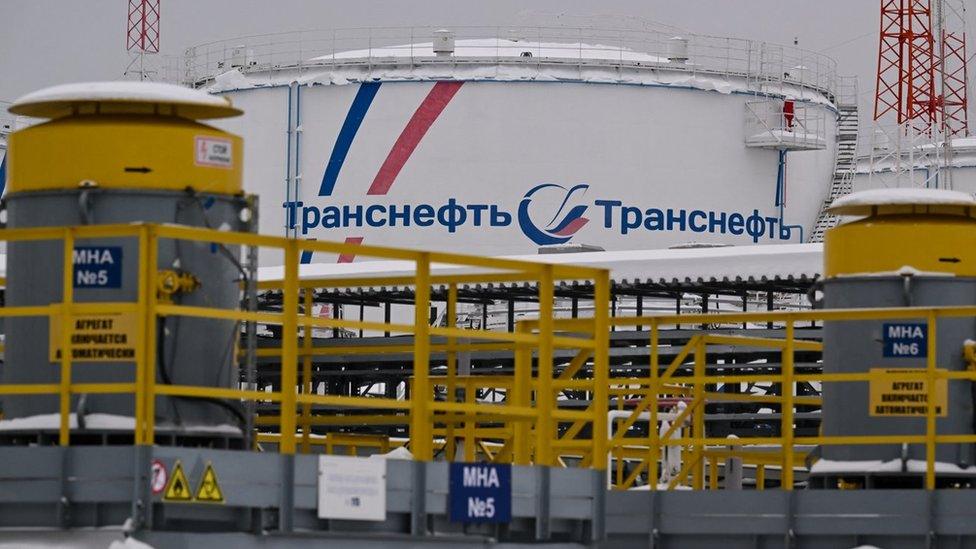

The Russian invasion of Ukraine has caused energy prices to rise because one of the world's big producers of oil and gas, Russia, is now at war.

The UK and the EU have applied sanctions (restrictions) to Russia to try to persuade it not to wage war on Ukraine.

The UK and the EU no longer buys oil and gas from Russia after it invaded Ukraine in February 2022

One of these restrictions is withholding money from Russia by not buying Russian energy, which means those countries have to get their energy from elsewhere, which artificially increases demand and pushes up the price of energy.

We don't just need energy for our homes - businesses also need energy to make their products, heat up offices and transport goods.

The cost of food has also been affected by the war in Ukraine because Ukraine is a big producer of sunflower oil and grain that we use in cooking to make food like bread, pasta or cereals.

There have also been shortages of goods like building materials and computer chips, which has created problems in the supply chain - namely the stages from a product being made until it gets to the shops for people to buy it.

All of this means a bigger cost for businesses, which is often passed on to customers.

What's being done to help the situation?

To try to help, The Bank of England (BoE) - which looks after people's money- put up interest rates. If you borrow money from a bank or building society, the interest rate is the amount of money you are charged to borrow that money.

The BoE hoped that by raising interest rates it would bring inflation down, by encouraging people to spend less and save more. But that caused another problem because it makes paying for big things, like a house or a car, more expensive, so many people have less money to spend on other things, like food and clothes.

Interest rate rises don't just affect people who own their home either.

Landlords, people who rent out their homes, land or buildings for other people to use, also often have loans to afford their property. Rate rises means they have to pay more interest on those loans, which means they are more likely to increase the price of rent to cover their costs.

In 2021 in England and Wales less than a third of people with a home (32%) did not owe any money for it, because they owned it outright, according to the Office of National Statistics (ONS) which gathers data for the UK. That means the majority of people with a home - at least two thirds - do owe money for the place they live, whether that's renting or buying it, and will be affected by interest rate rises, directly or indirectly.

Recently inflation, the rate at which prices rise, seems to be easing slightly. It fell to 3.9% last month from 4.6% in October, meaning that while prices are still rising, they are going up less quickly than before.

Could there be a recession in the UK?

The last time the UK was in recession was in 2020

The latest data from the ONS shows the UK economy shrank in the three months between July and September after seeing zero growth in the three months before between April and June.

There have been concerns about the UK's weak economic growth for some time, but so far the country has managed to avoid a recession (six months of the economy shrinking.)

If the economy shrinks between October and December then the UK will have entered a recession, but the figures won't be released until February.

The last time the UK was in recession was in 2020, during the coronavirus pandemic, and it lasted for six months.

Why does it matter if there is a recession?

Gross domestic product is a measure of the value of all the goods and services produced in a country

For many people, economic growth is a good thing.

It usually means there are more jobs, companies are more successful and can pay employees more money.

People then have more money to spend, which in turn benefits businesses.

A growing economy also means the government receives more money in taxes. So it can decide to cut taxes for individuals, or spend more on benefits, public services and government workers' wages.

When the economy shrinks, all these things go into reverse.

Next year there is likely to be a general election and the Conservative government will want to show voters it has done a good job of managing the economy.

Recessions are generally unpopular with voters and might mean more people vote for other parties.

How could a recession affect people?

Hard Times - a Newsround Special

Some people may lose their jobs, or find it harder to get promotions, or a pay rise.

Graduates and school leavers could find it harder to get a first job.

However, the impact of a recession is typically not felt equally across society, and inequality can increase.

Is a recession happening in other countries?

Other countries around the world have grown their economy more than the UK in the past five years

The latest ONS figures mean the UK has one of the weakest growth rates among other advanced world economies over the past 4 years.

The US, Canada, Italy, Japan and France have performed better than the UK since the Covid pandemic hit, and only Germany, which is likely to be in recession, has had slower growth than the UK out of this group of influential countries known as the G7.

- Published6 October 2021

- Published5 October 2022

- Published26 August 2022