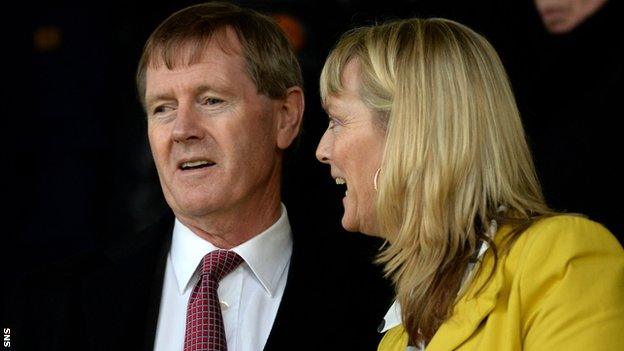

Rangers: Dave King company buys 15% of Glasgow club

- Published

Dave King is a former Rangers director and failed in a previous takeover bid

Dave King has bought a near 15% stake in Rangers International Football Club by purchasing the shares held by Artemis and Miton.

The South African-based businessman made the purchase after his funding offer was rejected by the board.

King had previously wanted his funds to go directly to the club.

But the former Rangers director had to alter his strategy following the board's decision to take a loan from Newcastle United's Mike Ashley instead.

The shares were purchased from the institutional investors by New Oasis Investments Ltd, a company wholly owned by King's family trust.

Rangers fans' response |

|---|

Rangers fan groups have welcomed King's purchase following the transaction by Park, Letham and Taylor. They have urged fans, though, to also purchase shares. A spokesman for the Rangers Supporters Trust said: "We're delighted that Dave King has bought shares, but the shareholder dynamic still hangs in the balance to some extent. "We would encourage people to join BuyRangers and support George Letham and the rest of the investors. George is already a member of the RST board." Rangers First, the other vehicle created to try to encourage fans to become shareholders in the club, has experienced a rise in membership following this week's events. "This has coincided with a number of well-known Rangers fans also stepping up with multi-million pound purchases, all of which are a welcome sign of fans 'stepping up and playing'," a spokesman said. |

Its transaction was completed two days after a group of three businessmen - George Letham, Douglas Park and George Taylor - purchased the 16% of shares held by Laxey Partners, which was the single largest shareholder.

However, BBC Scotland has learned that the move has prompted one large shareholder to lodge complaints with the takeover panel and the Financial Conduct Authority.

Those bodies have yet to respond, but the shareholder believes King is working in concert with the Park consortium in a bid to seize control.

Takeover panel rules dictate that, if a consortium crosses the 29.9% threshold, it must make an offer to buy the rest of the company.

Both parties together hold more than 34%, but King and Park are adamant they are separate groups.

Rangers Football Club chairman Sandy Easdale holds a little over 5% and has proxies for a further 21%, while Newcastle and Sports Direct owner Ashley has 8.92%.

When RIFC needed funding in October, the board accepted a £3m loan from Ashley - providing him with two board placements - which is to be paid back by April, despite a £16m offer of funding from a consortium including King and a £3m loan offer from Sale Sharks owner Brian Kennedy.

King said: "I would like to specifically record my disappointment that, if I hadn't been blocked by the present board in favour of a lesser and commercially disadvantageous offer by Mr Ashley, the money could have gone into the club and not into the pockets of exiting shareholders."

Rangers were unable to afford a pay-off for Ally McCoist and have sold Lewis Macleod (right)

The former Rangers director had no further comment to make on the transaction, which was announced by the RIFC board in a release to the Stock Exchange.

Since Rangers accepted Ashley's loan, his long-time associate, Derek Llambias, has become Rangers' chief executive, while Sports Direct executive Barry Leach has been widely tipped for a role as finance director.

Letham, Park and Taylor, who recently offered to invest £6.5m into the club, bought 13 million shares at 20p each from Laxey, which revealed it made the £2.7m deal in a bid to stop Ashley taking control.

The Englishman had his plan to increase his stake to just under 30% rejected by the Scottish Football Association because of his dual interest in the two football clubs.

Rangers recently revealed they need £8m of new funding to stay afloat in 2015.

They have sold prize asset Lewis Macleod this week, with cash from the sale of the midfielder being used as immediate funding.

Meanwhile, manager Ally McCoist was put on gardening leave with the club unable to afford a pay-off after he tendered his resignation.

- Published2 January 2015

- Published2 January 2015

- Published31 December 2014

- Published24 December 2014

- Published20 June 2016

- Published7 June 2019