Cash-strapped Rangers have four options to survive

- Published

Rangers currently need emergency funding just to survive to the end of January.

After rejecting an offer worth £18m for a controlling stake from US financier Robert Sarver, the Ibrox board are running out of options.

Here BBC Scotland examines the four potential outcomes for the club.

Mike Ashley provides more loans

Mike Ashley could opt to mount a legal challenge to the SFA's ruling that he cannot invest further in Rangers

The Newcastle United owner was declined permission by the Scottish Football Association to raise his shareholding in Rangers above 10%.

Ashley had planned to underwrite a share issue to raise the funds Rangers require to continue operating for the next 12 months - estimated by the board to be at least £8m - but would face sanctions, along with the club, if he increases his 8.92% stake.

Ashley effectively took control of the club through a £3m loan that included clauses entitling him to appoint two directors. Long-time Ashley allies Derek Llambias and Barry Leach have since been appointed as chief executive and finance director respectively.

However, there would be little logic to Ashley providing further loans since they can only be secured against Murray Park - with the board having previously pledged not to use Ibrox as security - and the loans cannot be turned into equity later unless Ashley mounts a legal challenge to the SFA's ruling.

Shareholders provide emergency funding

Rangers shareholder Sandy Easdale is chairman of the football board and holds important proxy votes

While announcing to the Stock Exchange that they were rejecting Sarver's proposal, the board revealed that they are in discussions with "significant stakeholders", which includes the group of Douglas Park, George Letham and George Taylor, who own almost 20% between them.

The group previously made a £6.5m offer for new shares. That cannot now take place, but they have since become major shareholders and would still be willing to provide funding. In the board's statement, they revealed that they are looking at a combination of short-term loans and medium-term equity.

Dave King, who now owns about 15% of the club and previously made a £16m funding offer, could also provide short-term financing and medium-term equity. Both King and the Park group would seek boardroom control in return for their investment.

Of the other shareholders, few participated in the last share issue, and fewer still have the resources to provide Rangers with the level of finance required to begin the rebuilding process, although Sandy Easdale did provide a £500,000 emergency loan for working capital requirements, secured against the transfer fee raised by the sale of Lewis Macleod to Brentford.

Investment from a non-shareholder

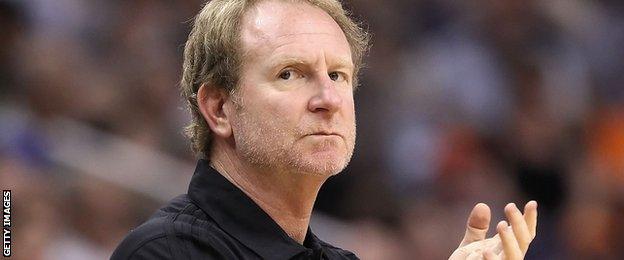

Robert Sarver had hoped for outright control with an initial offer to invest £18m

Sarver is the only other option in town but he, naturally, wants a controlling stake for his £18m investment. That is not possible, because the board needs 75% shareholder approval to be allowed to release that many shares exclusively to a non-shareholder.

The American could offer to buy out existing shareholders, but with more than 50% of the shares likely to be held by Rangers fans in some form or another who do not wish to sell, that also seems unlikely.

Sarver could provide short-term funding, but aligning himself with a board that is deeply unpopular with Rangers fans would reduce his chances of ever being trusted by the supporter base.

He could join forces with King and/or the Park group, but would have to accept being part of a controlling share rather than being the majority stakeholder.

Administration

.jpg)

Attendances at Ibrox have suffered amid the recent financial turmoil

This is the least likely outcome, despite the severity of the cash crisis at Ibrox.

Ashley is the major creditor, but not the major shareholder and so would find it difficult to control the administration event. With his commercial interests to protect - through the joint venture between Sports Direct and Rangers Retail - he would be unlikely to benefit from administration.

The same applies to King and the Park group, both of whom have shown an inclination to provide funding. With those options in place, it is highly unlikely that a judge would grant the directors' permission to put the business into administration. Shareholders would also see the value of their stakes further diminished.

There is still likely to be much drama to pass, but options are limited for the board. Some may not want to cede control, but they have few viable sources of funding apart from those who seek to change the way the club is run.

Ashley remains the wild card, since he could still launch a judicial review of the SFA's ruling, but he has so far been considered to be acting to protect his commercial interests. That could also be served by allowing others to come in and fund the business in return for agreeing to honour the commercial deals.

- Published6 January 2015

- Published6 January 2015

- Published6 January 2015

- Published5 January 2015

- Published5 January 2015

- Published3 January 2015

- Attribution

- Published5 January 2015

- Published20 June 2016

- Published7 June 2019