Premier League TV rights: Five of seven live packages sold for £4.464bn

- Published

- comments

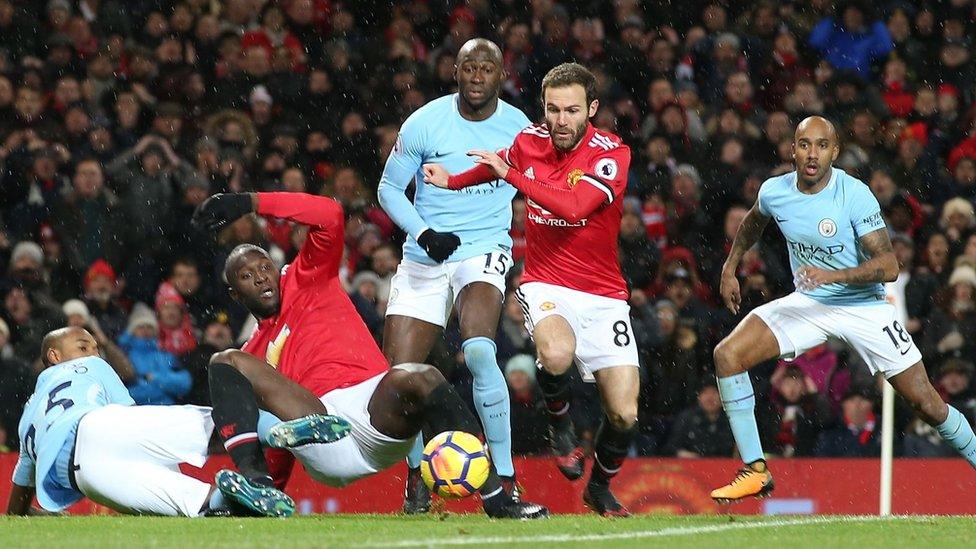

The number of live televised Premier League matches will rise from 168 to 200 from the 2019-2020 season

The rights to show Premier League games from 2019-2022 have been sold for £4.464bn - with two live packages still to be sold.

Sky Sports have won the rights to four tranches - 128 live matches - while BT Sport have one, comprising 32 games.

The Premier League's last deal, agreed in 2015 and running until 2019, was worth £5.14bn.

"To have achieved this investment with two packages remaining to sell is testament to the excellent football competition delivered by the clubs," executive chairman Richard Scudamore said.

Sky will have first choice of every weekend match and will also show Saturday night fixtures (19:45) for the first time.

BT will show Saturday lunchtime fixtures from August 2019 and have said they will pay £295m per season - £9.22m per match, up from £7.6m - across the three years.

That means Sky have committed to £3.579bn - or £9.3m per game, down from £10.8m in the current deal.

In 2015, Sky handed over £4.176bn for 126 fixtures each season - including the first Friday evening games and both Sunday packages - and BT paid a total of £960m for 42 matches.

Who has won what?

The Premier League's bid process this time around comprised 200 live matches a season, an increase from the 168 for which broadcasters bid in 2015.

The broadcasters bid on seven packages of fixtures - five of which contain 32 matches a season and two 20 matches.

What are the packages? | |

|---|---|

Package A - won by BT | 32 matches on Saturdays at 12:30 |

Package B - won by Sky Sports | 32 matches on Saturdays at 17:30 |

Package C - won by Sky Sports | 24 matches on Sundays at 14:00 and eight matches on Saturdays at 19:45 |

Package D - won by Sky Sports | 32 matches on Sundays at 16:30 |

Package E - won by Sky Sports | 24 matches on Mondays at 20:00 or Fridays at 19:30/20:00 and eight matches on Sundays at 14:00 |

Package F - to be decided | 20 matches from one Bank Holiday and one midweek fixture programme |

Package G - to be decided | 20 matches from two midweek fixture programmes |

Other changes for the 2019-2022 deal include eight individual games shown live in a 'prime-time' Saturday night slot, three complete rounds of 10 midweek matches all shown live, and one set of bank holiday games.

The new UK deal, however, does not include revenue for selling rights overseas. That deal is not completed on one set day and is instead finalised region by region, with the revenue from that expected to rise from around the £3bn it delivered last time around.

What about the other two packages?

Scudamore added in a statement, external on Tuesday that the Premier League would continue the sales process "to deliver the best possible outcome for the remaining packages of rights".

BT have said they "will continue to engage" with the Premier League over the final two packages of midweek and bank holiday matches, but there is no indication about Sky's interest.

However, given any broadcaster is limited to a total of 148 matches, they can only win one of the two packages.

There has been speculation that Amazon, Facebook, Netflix or Twitter would bid for the first time and break the Sky-BT duopoly.

Manchester United executive vice-chairman Ed Woodward was among those predicting one of the American tech giants would enter the market.

Amazon was seen as a notable threat as it has already made an impact by purchasing UK rights to the US Open tennis tournament, while also securing ATP Tour tennis rights.

Facebook has also made inroads into sporting markets in broadcasting the ICC's Champions Trophy cricket final in June and working with Fox Sports to stream a number of Uefa Champions League games.

Biggest TV deals | |||

|---|---|---|---|

Competition | Annual cost | Total cost | Duration |

NFL (American football) | $4.95bn (£3.24bn) | $39.6bn (£25.95bn) | 8 years (2014-22) |

NBA (basketball) | $2.6bn (£1.7bn) | $24bn (£15.73bn) | 9 years (2016-25) |

MLB (baseball) | $1.55bn (£1.02bn) | $12.4bn (£8.13bn) | 8 years (2014-21) |

Premier League | £1.7bn | £5.14bn | 3 years (2016-19) |

Analysis

BBC sports editor Dan Roan

For now, the boom years appear to be over when it comes to the Premier League's domestic TV rights.

As predicted, the threat of a tech giant providing competition for the main packages of rights did not materialise, and the recent content-sharing agreement between Sky and BT seems to have effectively ended a fierce rivalry that drove the remarkable 70% increases in the past two deals.

Dominant broadcaster Sky will pay significantly less per game than they did for the current £5.1bn deal. And even though Amazon may still be sniffing around, it seems the two remaining packages are unsold because the reserve prices have not been reached. If so, the overall value of the rights could actually fall.

The blow will be softened by overseas rights, which look set to rise sharply in value and which will continue to drive the richest league in the world's phenomenal commercial success. But it may mean the bigger clubs renew their efforts to claim more of the spoils.

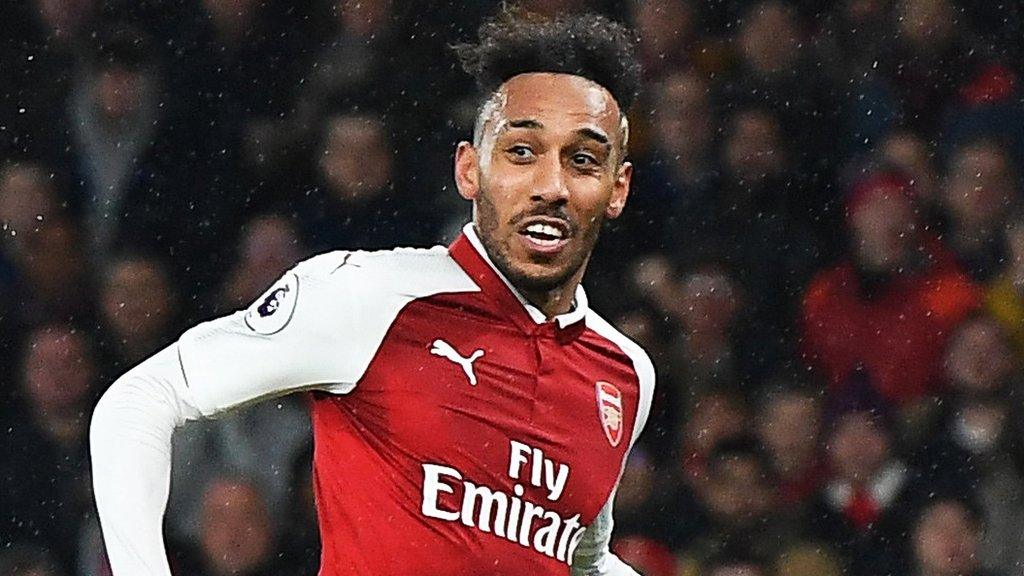

What is certain is that after another record transfer window in which Alexis Sanchez secured a reported £600,000-a-week move to Manchester United, these rights will still renew debate about the influence of TV money, whether enough of it is reaching the grassroots of the game, and whether too much is ending up in the pockets of agents.

Reaction

Roger Bell from financial analysts Vysyble

The only thing that keeps the clubs' enterprise afloat is the lifeboat of increasing TV money every three years. A flat outcome when compared to the previous 70% increases suggests that this time the lifeboat has failed to sail. The Premier League clubs now face a minimum of five years of increasing economic losses and constraints as a result.

We expect to see the 39th game concept to reappear. Add in potential restrictions on international player movement and transfers as a result of Brexit and it looks like the lower clubs will be hugely disadvantaged as a consequence.

- Attribution

- Published9 February 2018

- Published24 October 2017

- Published1 February 2018

- Published5 February 2018

- Published6 February 2018