Chinese-led deal to buy Australia's biggest farming estate

- Published

Grass fattened cattle in Kidman's Naryilco property in Queensland

A joint Chinese-Australian group has reached an agreement to buy Kidman & Co, Australia's biggest farming estate.

The deal, which values the firm at A$370.7m (£201m; $289m), still needs approval from Australian and Chinese regulatory bodies.

A takeover had previously been blocked by Australia's Foreign Investment Review Board (FIRB).

It was concerned that part of the property was inside a military weapons testing range in South Australia.

Kidman has since taken the Anna Creek farm out of the sale.

Dakang Australia is to acquire 80% of the farm, while local partner Australian Rural Capital (ARC) will take the remaining 20%.

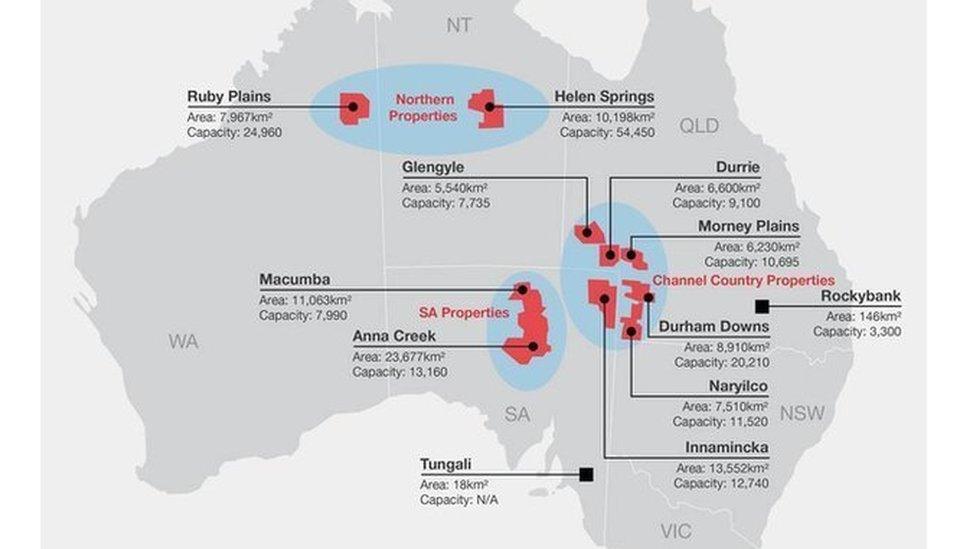

The sale comprises of areas covering 77,300sq/km - equal to 1% of Australia or an area bigger than Ireland.

The Anna Creek farm has been taken out of the sale

Chinese market focus

Kidman chairman John Crosby said that the deal complied "with all the requests that have been made by the FIRB and we believe the sale will secure the long-term future of the Kidman enterprise."

He also recommended shareholders to accept the consortium's offer.

Gary Romano of Dakang Australia and James Jackson of ARC said they "intend to continue investing where it is required to improve productivity and performance, apply our insights into the rapidly growing Chinese market, and bring proven know-how in the development of integrated supply chains and marketing models."

Dakang Australia's Chinese parent company is Hunan Dakang Pasture Farming, a private Chinese company which also has major stakes in New Zealand's dairy industry.

Its majority shareholder is Shanghai Pengxin which had already been among the previous bidders for the Kidman territory.

- Published19 November 2015

- Published20 November 2015

- Published9 June 2015