Australian foreign investment real estate probe widens

- Published

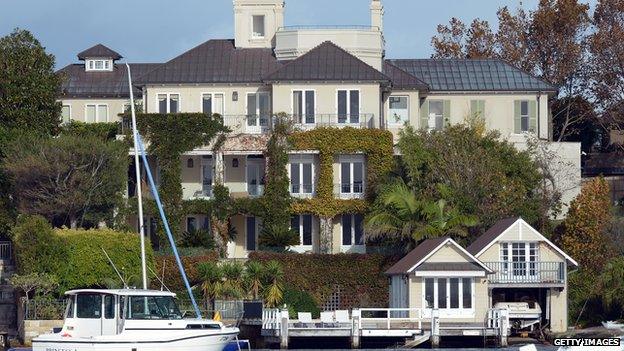

Soaring Sydney prices have prompted the government to look at foreign investors

Australians have reported about 40 foreigners who appear to have breached residential real estate investment laws, says the government.

The rules were tightened earlier this year in the face of soaring property prices, especially in Sydney.

Treasurer Joe Hockey said the government now was investigating 195 residential real estate purchases by overseas investors.

He warned other investors , externalthey should report themselves if necessary.

"Foreign investors who think they may have broken the rules should come to us before we come to them," he said.

Bubble concerns

Foreigners must receive approval before buying established homes but can invest in new housing developments.

Under the new rules, application fees apply for residential purchases by foreigners while tougher criminal penalties apply for people who break the rules.

Mr Hockey said on Tuesday that foreigners who come forward ahead of a 30 November amnesty deadline will be forced to sell their properties but will not be prosecuted.

One of Sydney's most prestigious properties, 'Altona' was sold to a Chinese-born businessman

Of the 195 cases being investigated so far, 24 were foreign investors who had voluntarily come forward, he said.

"Another 40 cases relate to referrals from the community where members of the public suspect foreign investors may have broken the rules by using complex structures and illegal leasing arrangements to hide foreign ownership.

"We want Australia to have more housing stock and foreign investment does help in that regard but not in regard to existing housing," he said at a press conference.

However, the treasurer watered down concern that Sydney is facing a housing bubble that could soon burst, noting that demand for housing still outpaced supply.

"We are a long way from excess supply," he said.

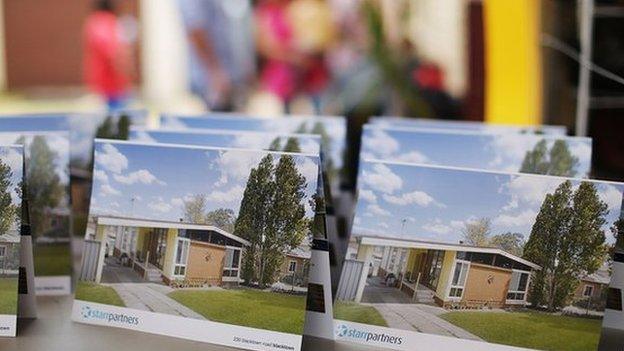

Properties under investigation range from those in Australia's multi-million-dollar prestige property markets to more modest suburban real estate.

Last week, Fairfax Media reported that a Chinese property developer had concealed his identity behind an elderly Melbourne couple to buy one of the country's most famous homes, Altona, at Sydney's Point Piper for A$52m ($40m; £26m).

Forced sales

The Australian Taxation Office received A$37.2m over four years in new funding in last month's federal budget to handle the investigation and its data matching program has already identified one foreign investor who appears to be linked to over 10 properties ranging from a A$300,000 unit to a house worth A$1.4m, according to the government.

Authorities are also talking to a UK investor who voluntarily came forward regarding a property purchased for about A$700,000 in Western Australia.

A shortage of new houses, generous tax breaks, cheap credit and "hot" money from overseas have seen Sydney house price increases eclipse those of other Australian cities.

Chinese buyers are being blamed for driving up property prices

Sydney house values have risen by nearly 60% since 2009, according to property research group, RP Data. Other research shows the median price tag for a detached house in Australia's biggest city is now 13 times the average wage.

More broadly, Australia has the third highest house price-to-income ratio in the world, according to the IMF. Only Belgium and Canada are more expensive.

Despite a complex mix of factors driving prices higher, recently, Chinese investors have been singled out for criticism, with Chinese buyers seeming to dominate auction sales in some parts of the Sydney.

- Published29 March 2015

- Published29 October 2014

- Published25 February 2015