Inflation: Should we trust the Bank of England's forecasts?

- Published

The Bank of England's forecasting, which informs major decisions for the UK economy, is being reviewed and has been criticised.

After the Bank hiked interest rates for a 14th time in a row in an effort to slow price rises on Thursday, officials have predicted inflation to fall from the current rate of 7.9%, to "around 5%" by the end of the year.

So, in light of its estimating techniques being scrutinised, how much faith should we put in "5% by Christmas"?

Why does the Bank of England make forecasts?

The Bank of England's job is to keep inflation - a measure of the rate at which prices rise - at its target rate of 2%.

The UK's central bank is independent of government and it uses interest rates as a tool to try to keep inflation at a steady level.

The Bank raises rates up when they worry that too much spending will send prices spiralling.

Higher interest rates make it more expensive to borrow, with the economic theory being that we will end up spending less, and then prices will not rise as fast. On Thursday, the Bank raised interest rates to 5.25% - the highest level for 15 years.

Every three months, the Bank's officials set out what they think might happen over the next year or two to jobs, the economy overall and to the prices we pay.

Those projections guide their decisions about interest rates. If their forecasts are wrong, then it prompts a question about whether their decisions are wrong.

How good are the Bank of England's forecasts?

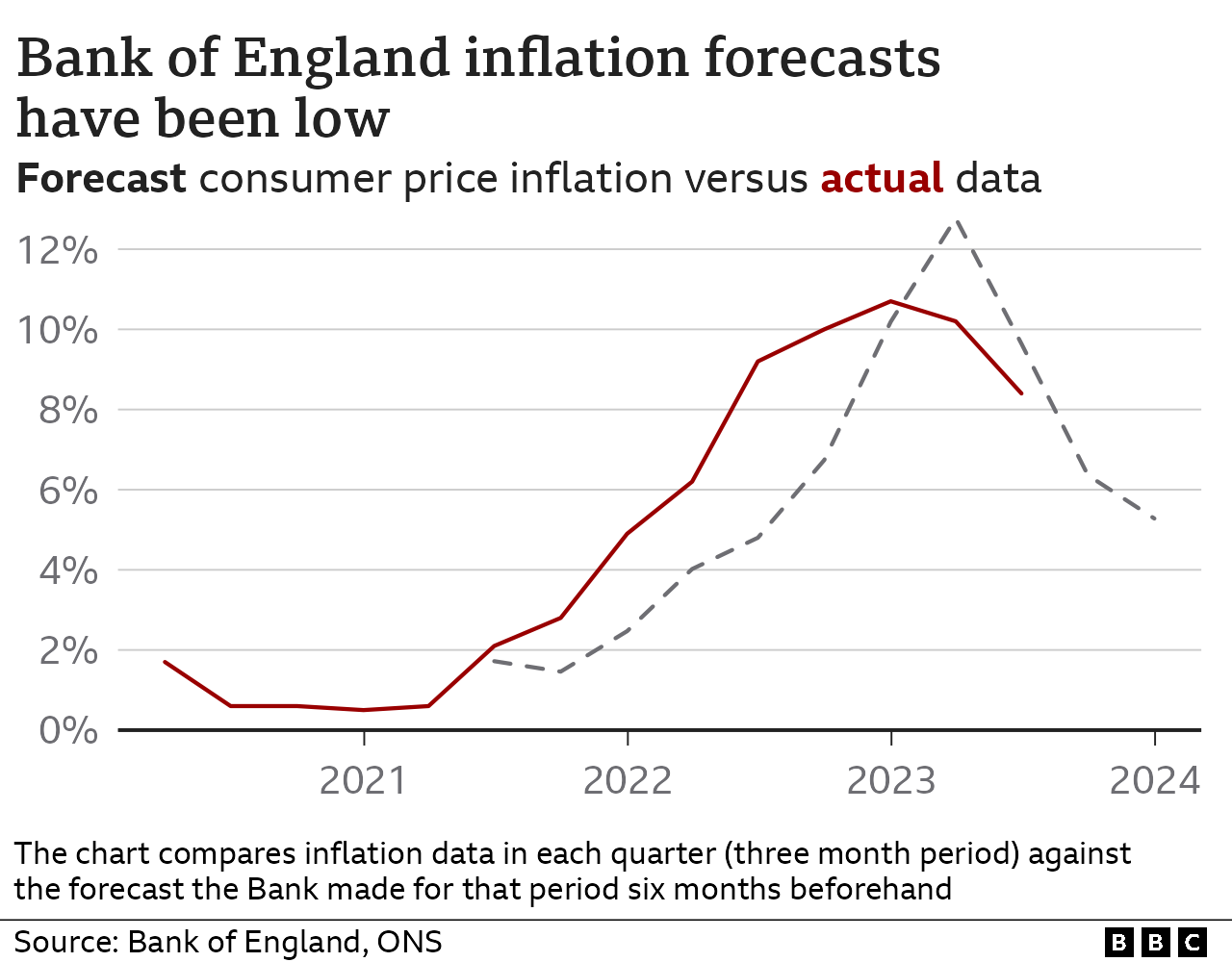

For the last two years, the Bank of England has been underestimating the likely rate of inflation in the short term, say six-to-nine months ahead.

The chart below shows what the Bank has forecast inflation to be and, so far, what inflation has turned out to be.

The red line shows what inflation was each quarter (a three-month period) over the past few years, while the grey line shows what the Bank had predicted for the same periods.As you can see, inflation turned out to be higher than the Bank forecast much more often than not.

MPs have been critical of the Bank's forecast, and its officials have acknowledged, external they have got some judgements wrong in their forecasting.

The Bank has also just announced a review into how it makes forecasts.

But officials point to the huge shocks we've been living through in recent years. Who could have forecast the Covid pandemic or the war in Ukraine?

And some economists also argue that we should focus less on the individual numbers and more on the story they tell about the economy.

How much weight should we put on forecasts?

We can only be precise about some things, argues Paul Donovan, the chief economist at UBS Global Wealth Management.

We can feed the energy price cap into a formula to work out how much inflation will fall when the price cap falls.

But it's much harder to work out exactly how those energy prices will feed through farmers, importers, lorry drivers and supermarket prices, or discounts and your shopping choices.

So as energy prices level off, we know that food prices rise will eventually ease off too, but exactly when and at what level is much harder.

But "media coverage and public debate very often focuses on a single number," says Dr Gemma Tetlow, who is the chief economist at the Institute for Government think tank.

But she always looks for the range of possible outcomes around that number, which the Bank of England also publishes, because the future is "inherently uncertain".

What to do if I can't pay my debts

Talk to someone. You are not alone and there is help available. A trained debt adviser can talk you through the options. Here are some organisations to get in touch with.

Take control. Citizens Advice suggest you work out how much you owe, who to, which debts are the most urgent and how much you need to pay each month.

Ask for a payment plan. Energy suppliers, for example, must give you a chance to clear your debt before taking any action to recover the money

Check you're getting the right money. Use the independent MoneyHelper website, external or benefits calculators run by Policy in Practice, external and charities Entitledto, external and Turn2us, external

Ask for breathing space. If you're receiving debt advice in England and Wales you can apply for a break to shield you from further interest and charges for up to 60 days., external

Tackling It Together: More tips to help you manage debt