'House fire insurance battle destroyed my life'

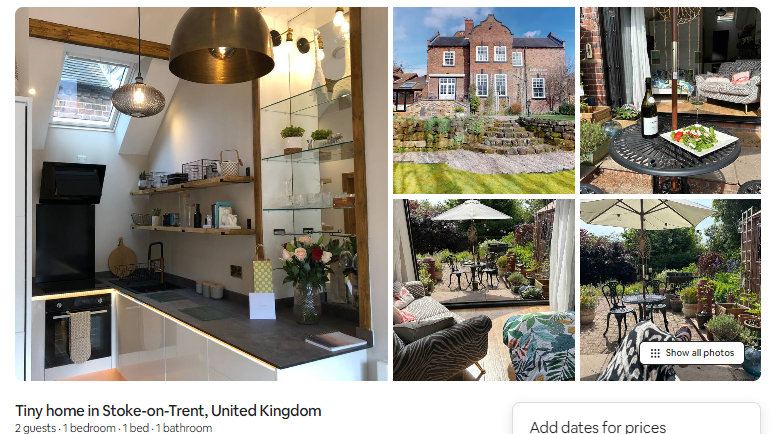

Claire Massey has been unable to live in her home since it was damaged in a fire

- Published

A mum who went through a 17-month battle with an insurance company following a devastating fire at her home, has said the fight "destroyed her life".

Claire Massey said she had been through “absolute hell” since a dehumidifier caught fire in her restored Victorian vicarage in Stoke-on-Trent in February 2023.

Insurers first stopped paying for alternative accommodation a month after the blaze.

She complained to the Financial Ombudsman Service (FOS) which has found in her favour.

Trinity Claims, which handled the claim on behalf of Policy Expert and the underwriter, Accredited Insurance (Europe) Ltd, said it accepted the decision.

Ms Massey, 43, said mortgage, rent and council tax payments for her uninhabitable house and temporary home had been costing her more than £5,000 a month.

She was also forced to live apart from her children for months when payments for their rental home were first suspended.

“I had savings – I had money to do my house up and it’s all gone," she said.

"I just feel like they’ve intentionally tried to wear me down, to make me give up and go away and just take whatever they were offering me.”

Fire crews said the residents managed to get out the house just in time

A friend who was staying at their home raised the alarm over the fire to Ms Massey and her daughter, then 12, and the three managed to escape.

Policy Expert paid for her and her two children to stay in temporary accommodation, and the claim was passed on to Trinity Claims Management which sent in a team of cleaners to the fire-damaged home.

When Ms Massey complained about the standard of the work, she was accused of delay tactics when a new date for cleaning to start could not be agreed on and the rental payments for their temporary home were halted.

The children went to live with her ex-partner in Stoke-on-Trent to continue schooling while Ms Massey moved in with her parents in Worcestershire, resulting in a three-hour round trip to see them.

Claire Massey had been restoring her period property before the fire

Ms Massey complained to the FOS in May 2023, which upheld it and ordered insurers to pay compensation, rental accomodation and resolve the cleaning.

But five months later, insurers asked why, when she took out the policy, she answered "no" to a question about using her home as a rental business when there were listings on Airbnb and other platforms for available rooms as well as a self-contained annex.

Ms Massey said she had used price comparison website Compare the Market and was never asked specific questions about whether she used the house as a rental business or guest house.

Just before Christmas, Policy Expert cancelled her policy stating she had not disclosed the business use of her home.

“I just felt helpless - I became very ill during that period and actually I still am very ill with high blood pressure," she said.

"It’s just been the whole uncertainty around my future and my children’s future and this theme hasn’t gone away.”

A dehumidifier caught fire in the house and the blaze caused severe damage to the home

Ms Massey complained to the FOS again which concluded although she had made a "misrepresentation", the questions asked on the comparison site did "not appear to be the same questions [her insurer] want[ed] answers to".

It told insurers to reinstate the policy - but they stood firm and challenged the FOS decision.

The final ruling came on 8 July and the FOS said although "it's more likely than not that the annex was used for business purposes" after the policy was bought, Ms Massey had had the annex insured separately with a different company.

The FOS ruled her insurers were not entitled to cancel her policy.

Ms Massey had a separate policy for rental accommodation, the Ombudsman ruled

Trinity Claims said it accepted the decision and had reinstated Ms Massey's policy.

"We will address the balance of Ms Massey's claim in accordance with the Ombudsman's recommendations and in line with our claims process," it added.

Trinity said it would work with the 43-year-old to "bring this matter to a close".

The plaster had to be stripped from the walls throughout the house to get rid of soot and smoke

Ms Massey said she felt vindicated and had set up a support group on Facebook to hear from others in a similar situation.

Her then MP, Jo Gideon, previously raised her case at Prime Minister's Questions in April saying she had been the "victim of bullying by aggressive claims handlers".

'Severe financial distress and debt'

“It’s such a traumatic thing to go through to have a fire, especially when you almost lose your lives and then to be constantly fighting an insurance company to do the right thing to help you and support you through the worst moments of your life," Ms Massey said.

She said the complaints process took far too long and "puts ordinary families like myself into severe financial distress and debt, even when they've done nothing wrong".

"Things have to change," she added.

Related topics

More like this story

- Published28 September 2023

- Published3 January 2024

- Published18 March 2024

- Published7 February 2024