Mortgages yet to drop despite interest rate fall

Most Guernsey banks have kept rates the same despite a drop in interest rates, unlike the UK

- Published

Despite interest rates falling in August, Guernsey is still waiting for mortgage rates to follow suit.

Lloyds Bank and Skipton have dropped their rates locally, but other providers were yet to follow suit.

This contrasts to the UK where most banks and lenders have dropped rates following the Bank of England's decision to lower interest rates to 5% from 5.25% last month - the first cut since the start of the pandemic in March 2020.

Pierre Blampied, managing director of mortgage broker SPF Private Clients, said: "Banks are here to make a profit so they're going to take their time."

Mortgage broker Pierre Blampied said it was "understandable" the island's mortgage rates have not dropped yet

Interest rates influence the cost of borrowing which affects high street banks and money lenders' rates for mortgages, he said.

Mr Blampied said he was "not expecting to see a big reduction in fixed rates imminently".

He said it was "a supply and demand market", adding "we don't have increased competition".

Mr Blampied said: "In the UK a lender wants to be the first to reduce their rates - they'll get an avalanche of business.

"Whereas here if they take their time to reduce the rates, it's not really going to make a massive difference.

"We are relatively the equivalent of a small town in the UK, combining both Channel Islands, so they don't have to move as quickly onshore."

'Battle is half won'

Nick Paluch, director of Savills Guernsey, said he had "confidence that rates will drop," and the island was "heading in the right direction."

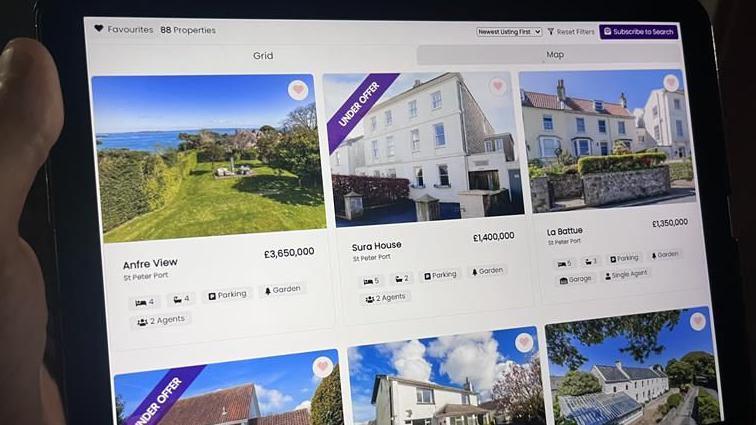

But he said the island "still needs mortgage rates to drop" to help boost property sales for first time buyers and starters.

Mr Paluch said they had seen more activity in the middle and upper end of the property market since interest rates dropped last month.

"The fact the market is now stable means the battle is half won."

Different market to UK

A spokesperson for the Association of Guernsey Banks said setting mortgage rates was a "commercial decision for each bank", but the "Channel Islands mortgage market is different to the UK".

He said average house prices were "much higher" as was the ratio of property prices to average household incomes.

He said: "It is also a much smaller market and Guernsey banks generally face higher operating costs and a different regulatory environment that affects funding models and overall cost of borrowing.

"Local mortgages also involve more complex local conveyance requirements than the UK."

Follow BBC Guernsey on X (formerly Twitter), external and Facebook, external. Follow BBC Jersey on X (formerly Twitter), external and Facebook, external. Send your story ideas to channel.islands@bbc.co.uk, external.

Related topics

- Published2 August 2024

- Published29 June 2023

- Published24 July 2024