Flat owners' misery over soaring service charges

Joe has to pay £2,800 a year in service charges on his one-bedroom flat

- Published

“I wish I'd never bought it," sighed Joe.

In 2018, he used inheritance to buy a one-bedroom flat in Lincoln's new waterfront luxury development One The Brayford.

At first, he was excited: "I was left some money by my late mum and wanted to invest in a property that I loved. I fell in love with the area, fell in love with water at the front."

As part of his leasehold agreement, Joe had to pay an annual service charge of £1,100 a year to property management company RMG to cover costs such as building insurance, repairs and maintenance.

It didn't put him off: "I still went ahead with the purchase on the understanding that we were going to be given a five-star restaurant at the bottom and my investment would go up in value because of this. That never happened."

One The Brayford is next to Brayford Pool in Lincoln and includes 89 apartments

Since then, the annual service charge has increased and now stands at £2,800 for his one-bedroom flat.

Joe thinks this is excessive and believes leaseholders are paying over the odds for things like building insurance, night-time security, and building manager wages.

Then there are the unexpected extras.

"The toilets in reception area for the staff were blocked. I think they came up to about £800 and it was charged to our invoices without consultation," Joe said.

"It just seems like a conveyor belt of costs that aren't investigated, aren’t discussed with each owner, and owners aren’t replied to. It’s really affected my finances dramatically.”

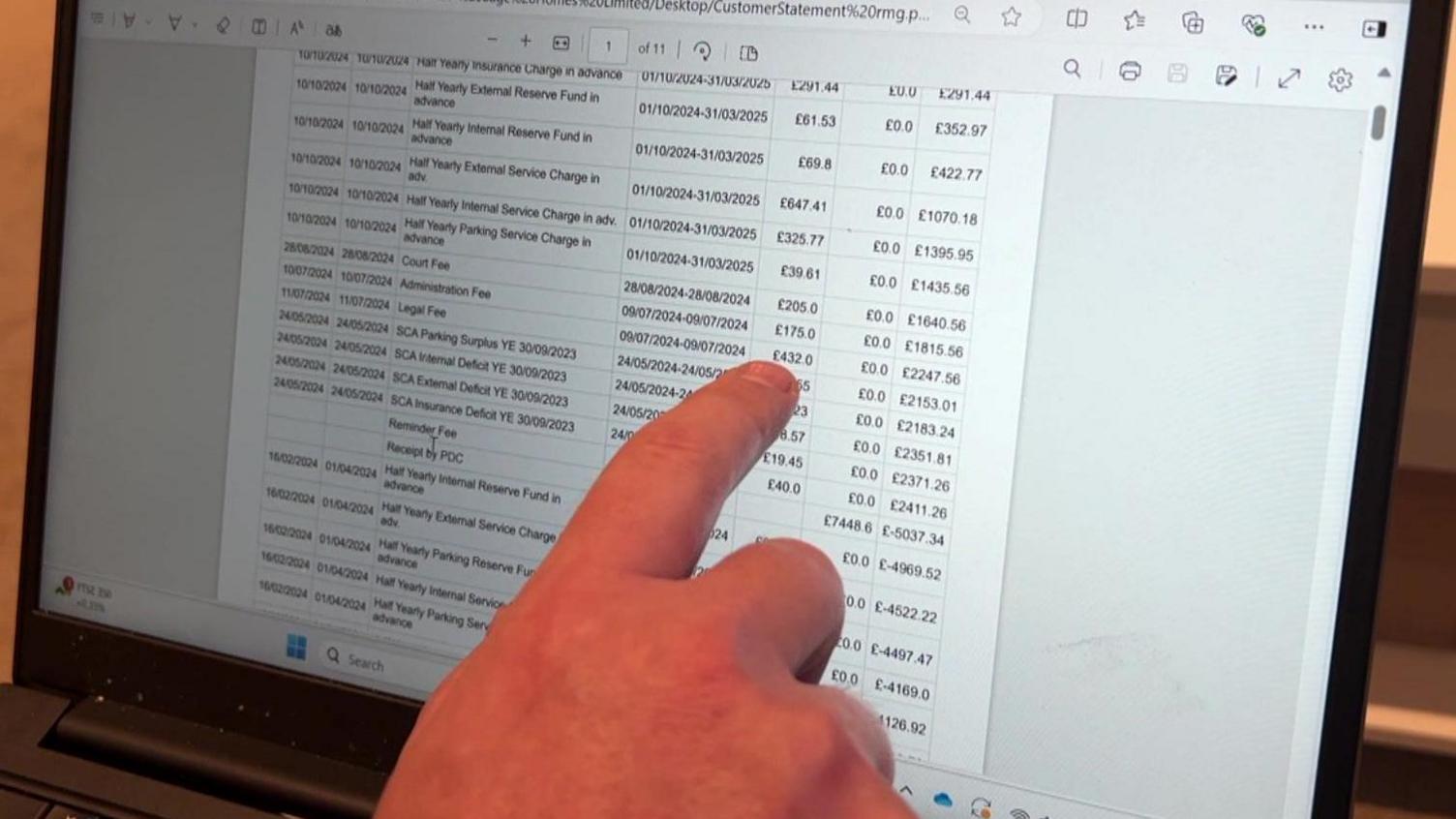

Joe has faced extra court, administration and legal fees for withholding payments

Joe admits withholding payments while challenging costs with RMG, but that has made things worse.

Legal, court and admin fees have been passed on to Joe: "For a one-bedroom apartment in Lincoln, I've paid about £25,000 in the past five years to RMG.

“You end up feeling that you are trapped in the building. They won't communicate with you. You can't make formal complaints because they're not responded to.

“It’s had a huge impact on my income and a huge impact on my mental health."

Joe spent inheritance from his late mother to buy a flat in Lincoln city centre

An RMG spokesperson said: "Service charges rise alongside inflation, including rising energy costs, and are also impacted when unforeseeable, but crucial, maintenance works must be completed.

"Costs have also been significantly impacted by heightened insurance premiums due to the building’s external wall which, whilst deemed safe, contains materials considered to be more susceptible to fire than traditional brick which is an issue completely out of our control.

“We completely understand the impact rising costs can have and always offer a full breakdown of service charges to customers and they are always given a reasonable time to pay and are asked to call us to discuss any concerns.

"We work proactively with all residents to prevent late payments and we will only need to pursue legal action as a very last resort."

A new bill to improve the transparency of service charges and give leaseholders more rights was fast-tracked through parliament before the election but campaign groups and some politicians believe the leasehold system should be abolished altogether.

The Residential Freehold Association said inflation and extensive material cost increases following Covid-19 were to blame for increasing service charges, adding: "Leasehold is a well-established, evolved and flexible tenure system for communal living.

"There are a raft of existing protections for leaseholders including the ability to challenge unfair or unreasonable service charges before an independent tribunal."

'Our service charge tripled in 18 months'

In Hull, Monika Schoenleber-Lewis and her husband, Colin Lewis, were looking for a flat when they came across City Exchange.

They were impressed by the Grade II listed building and bought the leasehold for a two-bedroom apartment, even though they thought the £220 monthly service charge was rather expensive.

But they were soon in for a shock.

Just 18 months after they moved in, they were informed by Pure Block Management that their service charge would be increasing to £654 a month.

Monika Schoenleber-Lewis and Colin Lewis were shocked when their service charge tripled in 18 months

Mrs Schoenleber-Lewis said it didn't go down well: "Everyone was up in arms. We were shocked and we were talking about what we were going to do.

"They notify you via email but they don't have to meet you at all and they would not meet with us."

"We still love Hull and the building is amazing. We love old buildings but would we buy it again? I don't think so, because it is way too much."

Mr Lewis fears the service charge will make the flat undesirable to future buyers: "If we did choose to sell it, we would struggle and we would be left with quite a large amount of money to pay out on a regular basis for something we couldn't enjoy."

The Grade II listed City Exchange building contains 42 apartments

The director of Pure Block Management, Liam Parker, said: "At times, with historic buildings such as this, unavoidable works can be of significant cost.

He said a total overhaul of the roof was now needed, which would cost £700,000.

"We appreciate the impact of the cost of this work on both the residential and commercial leaseholders, and therefore works have been planned to be completed in two phases, spreading the cost over three years," Mr Parker said.

"In order to make sure we have funds in place to begin this process and for works to start next summer, the annual service charge for all leaseholders did increase significantly in 2024.

"We expect the service charge to return to a much lower level once the roof works are completed."

Listen to highlights from Lincolnshire on BBC Sounds, watch the latest episode of Look North or tell us about a story you think we should be covering here, external.

Related topics

- Published25 May 2024

- Published26 February 2024