No farm inheritance tax U-turn - Welsh secretary

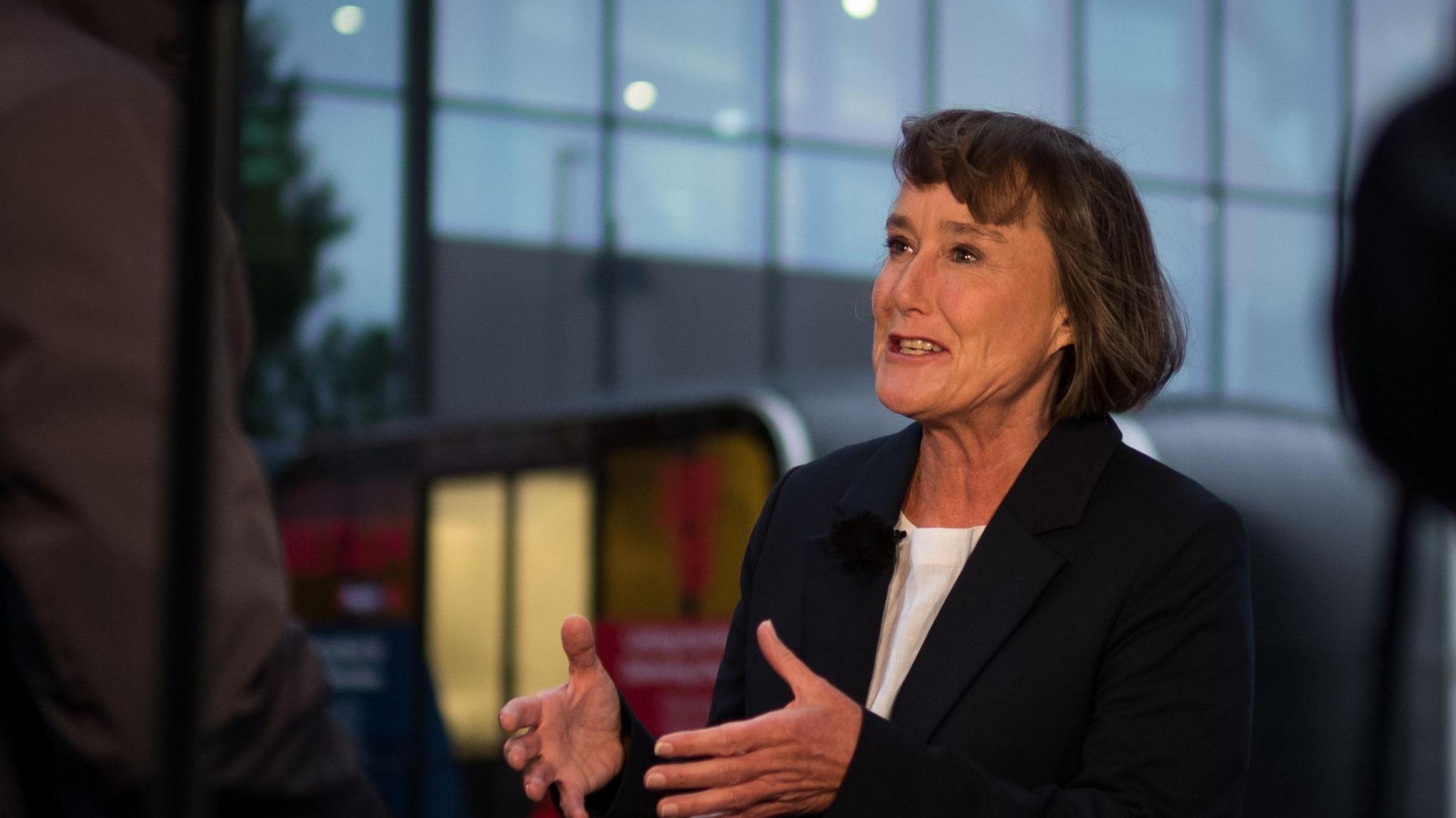

Jo Stevens says most people do not have "anywhere near" £1m in assets when they die

- Published

Plans to scrap an inheritance tax exemption for farms worth more the £1m will not be reversed, even though "some farmers in Wales won't be happy", the Welsh secretary said.

Jo Stevens defended the new tax on combined business and agricultural assets at an effective rate of 20% from April 2026.

Some Welsh farmers said the new rules would hurt farming families, while the leader of Welsh Conservatives in the Senedd called the changes "devastating".

"Lots of people don't have anywhere near a million pounds when they die," Stevens said.

Extra £1.7bn for Welsh government in UK Budget

- Published30 October 2024

Five things to watch out for in the Budget for Wales

- Published30 October 2024

Farmers 'betrayed' by £1m inheritance tax relief cap

- Published30 October 2024

"Three quarters of farmers will be unaffected," she told BBC Politics Wales.

"This will impact only on the wealthiest farmers in the United Kingdom and we know the vast majority of our farmers in Wales are small farms.

"We don't expect that there will be a significant impact on farmers in Wales."

The Farmers' Union of Wales (FUW) previously expressed "grave concerns" about capping relief on business and agriculture assets at £1m.

Exemptions for houses and married couples passing assets on to direct descendants mean it could be a combined £2m of exemptions before any tax is due.

But anything above the threshold would be taxed at 20%, payable over 10 years.

Another farming union, NFU Cymru, said the changes will not only cause "lasting damage to Welsh farming and the break-up of family farms, but will also leave farmers with neither the means, confidence nor the incentive to invest in the future of their business".

Farmer Liam Price, from Swansea, says the new tax means he has to to choose between staying in farming or having children

The UK government said 75% of farms will not be liable for inheritance tax.

But farming unions said the changes "will bring the majority of Wales’ family farms into the scope of this tax".

The Treasury did not have an estimate of the impact on Welsh farms.

Across the UK it said it expected 2,000 estates to be affected from 2026-27, with around 500 of those claiming agricultural property relief.

Liz Saville Roberts, Plaid Cymru's party leader in Westminster and MP for Dwyfor Meirionnydd, said she was concerned the change would lead to farms being broken up and sold off.

"One factor that hasn't been considered... is the effect this is likely to have on tenant farmers.

"If you've got large estates being hit by death duties, they will then sell up.

"Tenant farmers, they could then have their land sold out from underneath them," she told BBC Radio Wales' Sunday Supplement.

Andrew RT Davies, the Conservative's leader in the Senedd, said UK Labour had given assurances last year that there would not be any such changes, allowing "family farms to continue to be passed through the generations".

"This is a devastating change, a brutal betrayal and they should hang their heads in shame," he said.

Stevens said: "This was a Budget where we had to fix the foundations.

"We have had to ask the people with the broadest shoulders to pay a little bit more so that we have got that money to bring down waiting lists, to invest in our schools and to make our streets safer."

Asked if criticism from farmers would make the UK government reconsider, Stevens said "it was announced in the Budget this week, and that's what will happen".