Was Budget 'the right thing' or 'deeply frustrating'?

The Budget announcements were eagerly followed across the south of England

- Published

An increase in the minimum wage, a three-year freeze on income tax thresholds, tax surcharge on properties worth more than £2m and scrapping the two-child benefit cap were among the main announcements in the Budget.

Chancellor Rachel Reeves insisted she would not "lose control" of public spending with "reckless borrowing".

She told the House of Commons earlier that she would take "fair and necessary choices" for the economy, to bring down NHS waiting lists, the national debt and the cost of living.

Politicians, businesses, employees, pensioners and families in the south of England have been giving their reactions to the announcements.

Sam Sheldon said measures in the budget meant her cafe's prices would continue to rise

In the hospitality sector, many had hoped for a cut in VAT that did not appear.

But Reeves announced a reduction in business rates for retail, hospitality and leisure properties.

Basingstoke pub landlord Darren Head said: "I hoped maybe there would be a shining light that actually the government would do something to support local businesses and pubs, but sadly it looks like its business as usual.

"On the positive side of things, we're not going to be hit worse."

Workers aged between 18-20 will see a minimum wage increase to £10.85 an hour, up from £10, and those aged 21 and over on the living wage will receive £12.71 an hour, up from £12.21.

Teenagers aged 16 or 17 on the minimum wage will be paid £8 an hour - a 45p raise.

Thresholds for National Insurance paid by employers were also frozen until 2031, increasing costs as wages rise over time.

Sam Sheldon, co-owner of the Riptide Espresso & Records café in Poole, said the rise in National Insurance payments would "really affect" her business, which relied on part-time staff.

"The more people we hire, obviously the more national insurance we have to pay," she said.

"We feel like things just go up for us every year - you just expect it now and we just have to put our prices up."

Carol and Judy were among those discussing the budget at the Moordown Community Centre in Bournemouth

The budget was the main topic of conversation at the Moordown Community Centre in Bournemouth.

The chancellor announced National Insurance and income tax thresholds would be frozen for an extra three years beyond 2028, dragging more people into higher bands over time.

Pensioner Jeff, who was playing kurling at the centre, said news that the triple lock on state pensions would be maintained was "very good for me".

The triple lock guarantees that the pension will increase by at least 2.5% and will rise in line with, or faster than, inflation or average wages.

He said: "But the freeze on the income tax threshold will affect me and is not so good.

"In my opinion they give it to us with one hand and take it away with the other."

Another player, Judy, said she found herself in the same position following the pension increase.

"It just puts me into the tax bracket," she said. "I wasn't paying it before and now I am."

Another member, Carol said the minimum wage going up but tax thresholds staying the same would not help her sons and grandsons who own painting and decorating businesses.

"I don't think it's going to help them at all - there were so many taxes etc that keep getting thrown at small businesses," she said.

"They couldn't afford to take anybody on."

Debbie, a singing teacher at the centre, said there was "a lot of positive things" that came out in the budget but it was "disappointing" for the arts.

James Talbot co-founded barbering and hairdressing business HARE in 2013

James Talbot, co-founder of the HARE chain of hairdressing and skincare salons in Oxfordshire, said he was "deeply frustrated by the lack of meaningful support" for businesses.

He said: "Once again, one of the country's most socially important and economically vulnerable sectors has been overlooked and ignored.

"The rise in the minimum wage, while well-intentioned, will hit small legal businesses like ours hard at a time when margins are already razor-thin."

He said that although helpful, the "details remain unclear" about the introduction of lower business rates for retail.

He added that Reeves "failed to address the ongoing issue of VAT reform".

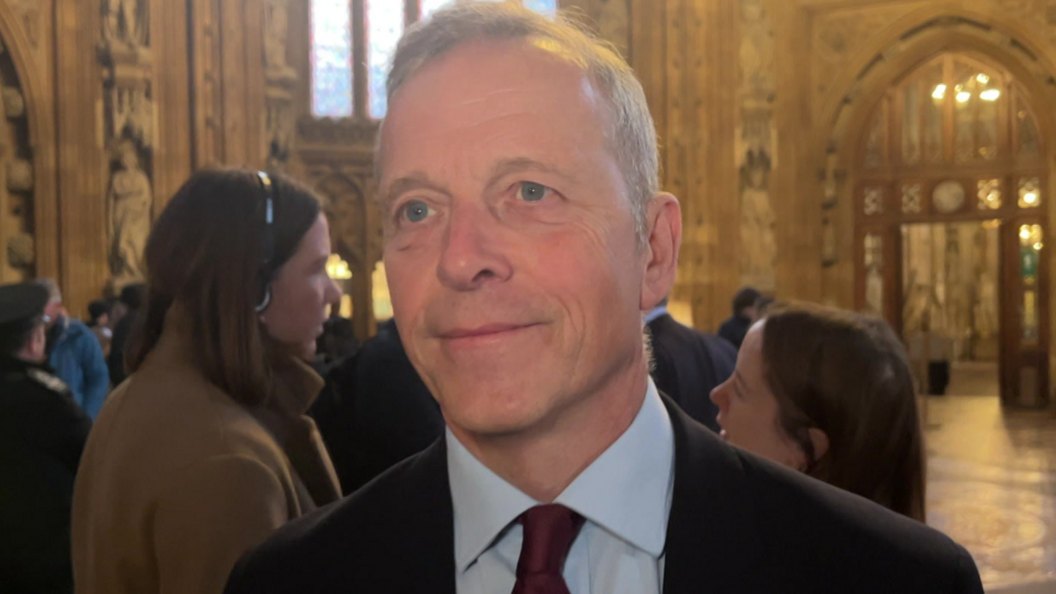

Labour MP for Reading Matt Rodda said it was a "positive budget"

The Budget included a new tax on homes worth more than £2m, which will affect more than 100,000 households in England - many of which are in London and the south and south east of England.

Properties worth more than £2m will be charged £2,500 annually, and properties worth more than £5m will be charged £7,500 on top of council tax.

Regulated rail fares in England were also frozen until March 2027 - the first time they have been left unchanged for 30 years.

Reading Labour MP Matt Rodda said there wer "quite a lot of positives" for his constituents in the Budget.

"The budget will cut the cost of living considerably for many residents in Reading," he said.

"Reducing energy bills, travel costs particularly up to London by train and also the reduction in bus fares - all of that will make a big difference to people.

"It is going to be taxing people fairly, so those who have broader shoulders are paying a little bit more, but it will reduce the cost of living for the vast majority of people."

Amanda Martin, Labour's MP for Portsmouth North, said the chancellor had "absolutely done the right thing" by scrapping the cap limiting households on universal or child tax credit from receiving payments for a third or subsequent child.

"Lifting half a million is exactly what a Labour government should be doing - yes we are asking some people to pay a little bit more, but we need that money to go into our NHS," she said.

"This is a budget for families and working people."

Conservative MP for Isle of Wight East Joe Robertson said: "Forty-three different tax rises - that is going to hit hard-working families, jobs and small businesses, all to pay for a ballooning welfare bill that the government refuses to tackle."

Winchester Liberal Democrat MP Danny Chambers described the freezing of income tax thresholds as a "stealth tax", but welcomed increases to the duty on online casino betting and sports betting.

"It is taxing hard working people when we proposed ways you could raise money from big corporations," he said.

"To give credit, where credit is due, we have been calling for the proper taxes on gambling companies for a very long time."

Get in touch

Do you have a story BBC Berkshire should cover?

You can follow BBC Berkshire on Facebook, external, X (Twitter), external, or Instagram, external.

Related topics

- Published8 hours ago

- Published13 hours ago

- Published9 hours ago