Air fares and food prices push up inflation to 3.8% in July

- Published

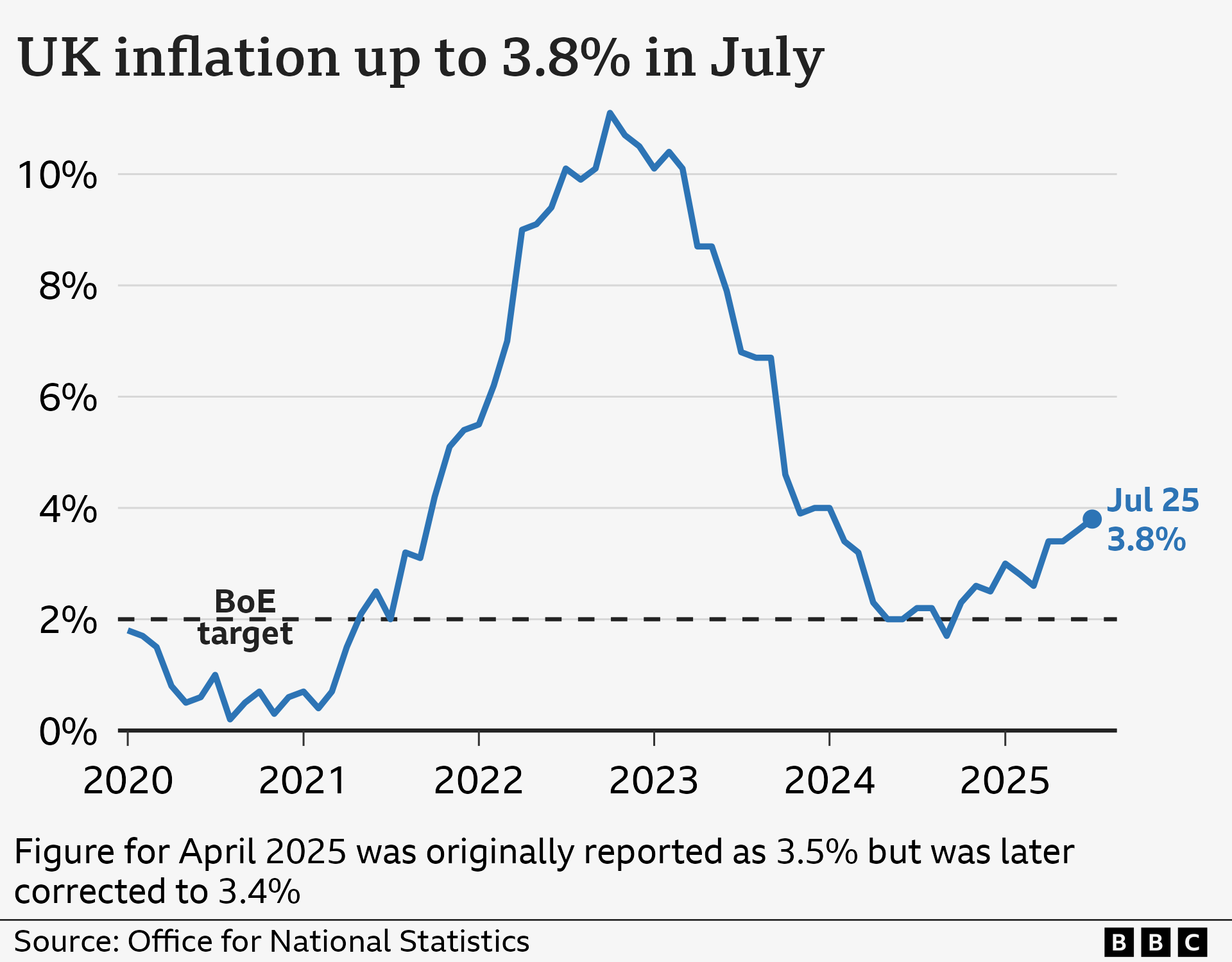

Prices in the UK rose by 3.8% in the year to July, driven mainly by a jump in the price of air fares and food.

That means inflation is at its highest level since January 2024 and still far above the Bank of England's target of 2%, according to the Office for National Statistics (ONS) data.

While the timing of school holidays likely caused the jump in air fares, higher food prices were driven by increases to the cost of beef, chocolate and confectionery, instant coffee, and fresh orange juice.

The slightly higher-than-expected increase to inflation strengthens economists' expectations that the Bank of England will slow the pace of interest rate cuts.

July's rise in the Consumer Prices Index (CPI) measure of inflation compares with a rise of 3.6% in the year to June.

The Bank's latest forecast expects inflation to peak at 4% in September.

ONS chief economist Grant Fitzner said the "hefty" increase of 30.2% in air fares between June and July was the biggest jump for that period since the collection of monthly data began in 2001.

He said it was "likely due to the timing of this year's school holidays".

This year, the collection day for the ONS data overlapped with the start of the school holidays in a way they didn't last year.

The price of petrol and diesel had also increased, compared with a drop this time last year, he added.

The cost of food and non-alcoholic beverages rose 4.9% in the year to July, up from 4.5% in the year to June. It was the fourth month in a row in which food and drink inflation had risen, bringing prices to their highest since February 2024.

'Cost of my weekly shop has gone up so much'

Michelle Birkenhead says the speed at which food prices have been rising is "ridiculous"

Rising food and fuel prices are "stretching" Michelle Birkenhead's finances.

"It's so expensive," says Michelle. "It's gone up so much, it's ridiculous. What used to cost us, two years ago, a weekly shop of £100, you're looking at £150."

Another measure of inflation, the Retail Prices Index (RPI) rose to 4.8% in the year to July, up from 4.4% in June. RPI differs from CPI in that it includes things like mortgage interest payments and buildings insurance.

It is also used to determine upcoming hikes in train fares in England.

This year's rise in the price of rail fares of 4.6% was one percentage point above RPI in July 2024, meaning that if the same pattern was adopted, fares in 2026 would rise by 5.8%.

However, the Department for Transport has said that no decisions have been made yet on next year's fares.

Why are food prices still going up?

- Published20 August

Why is UK inflation still rising?

- Published19 November

What are interest rates and will they fall further?

- Published19 November

'Close call' on rate cut

Policy makers at the Bank of England take into account inflation and other economic data when deciding what to do about interest rates. When inflation is high they can use higher interest rates as a tool to bear down on prices. When the economy is slow then they can cut interest rates to boost growth.

Earlier this month, they narrowly voted to cut rates to 4%, down from 4.25%, taking rates to their lowest for more than two years.

Monica George Michail, associate economist at the National Institute of Economic and Social Research (Niesr), said that some of the recent drivers of inflation have been one-off policy changes. Those changes include the April increase in employers' National Insurance Contributions and the National Living Wage rise.

"The Bank faces a difficult balancing act between lowering inflation and boosting a sluggish economy," she said.

While Niesr expects one more rate cut this year, Ms Michail added the Bank will have to "remain cautious" if food prices remain high.

Ruth Gregory, deputy chief economist at Capital Economics, said while she also expects a rate cut, in November, that decision "will be a close call and will depend on the data released over the next few months".

Bank of England governor Andrew Bailey told the BBC earlier this month that interest rates were "still on a downward path," but added that "any future rate cuts will need to be made gradually and carefully."

Reacting to the latest figures, Chancellor Rachel Reeves said the government had "taken the decisions needed to stabilise the public finances, and we're a long way from the double-digit inflation we saw under the previous government".

But she added: "There's more to do to ease the cost of living."

Shadow chancellor Mel Stride said the news on inflation was "deeply worrying for families".

"Labour's choices to tax jobs and ramp up borrowing are pushing up costs and stoking inflation - making everyday essentials more expensive."

Liberal Democrat treasury spokesperson Daisy Cooper said rising inflation was "grim news for families, pensioners and businesses still struggling with the cost-of-living crisis".

She said the chancellor needed to take "far bolder action, starting with the Liberal Democrat plan to halve energy bills by 2035".

Get in touch

How are you managing with the rising cost of living as a consumer or as a business owner? Share your experience.