Gold and tech purchases drive strong retail sales

There was strong demand for gold jewellery among shoppers over the summer

- Published

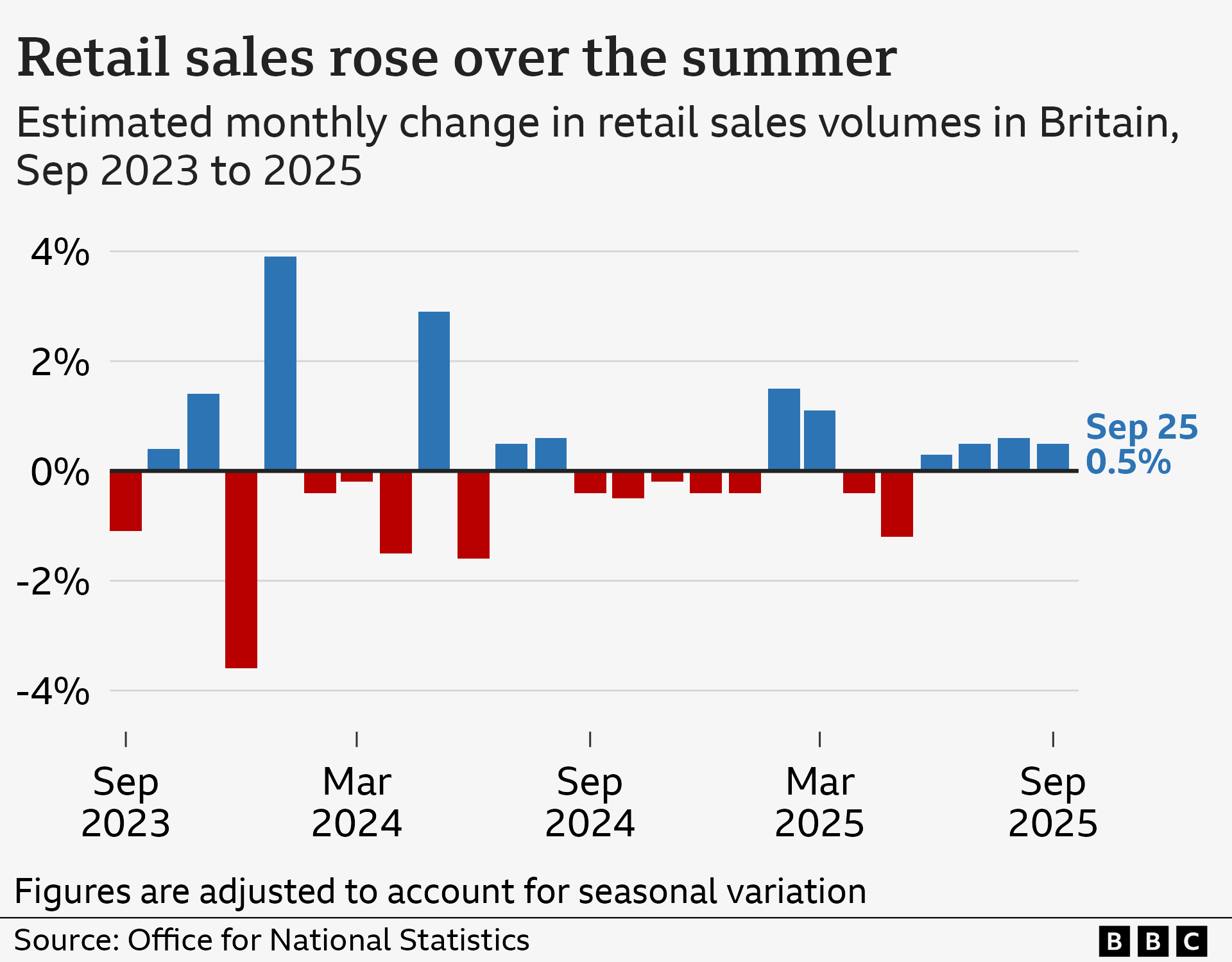

Retail sales volumes have risen for the fourth month in a row, driven by consumers buying gold online and new tech gadgets.

Monthly sales rose by 0.5% in September 2025, new figures from the Office for National Statistics (ONS) show, defying an expected decrease of -0.2%.

"Although food stores saw very little growth, good weather in July and August boosted sales of clothing, while online retailing also did well," said ONS senior statistician Hannah Finselbach.

Tech sales were boosted over the summer by the launch of Nintendo's long-awaited Switch 2 gaming console and Apple's iPhone 17.

Within non-store retailing, online jewellers reported strong demand for gold.

Between July and September, retail sales were 0.9% higher than the previous three months.

The amount spent online between July and September was 3.5% higher than the previous quarter and 5% higher than the same period last year.

Retail sales volume are a measure of the quantity of goods sold during a certain period.

The figures are a positive sign amid ongoing concerns that the British economy is slowing down.

Danni Hewson, AJ Bell head of financial analysis, said consumers were starting to feel a bit more confident about spending.

"Interest rate cuts and above inflation pay increases have meant many workers have had a bit more cash to play with, even if pressures on household budgets have remained high."

Alex Kerr, UK economist at Capital Economics, said the month on month rise in retail sales volumes was better than expected.

"But against a backdrop of weak employment, high inflation and with tax rises on the horizon, we doubt the retail sector will be able to sustain this strength," he said.

Mr Kerr said that a strong demand for gold jewellery from online retailers could be a result of surging gold prices.

Despite this, recent results from the UK's longest-running consumer confidence survey, conducted by GfK, indicate that shoppers are holding back on spending before Black Friday.

Retail analyst Catherine Shuttleworth said that in addition to this, the "constant background of running commentary on the upcoming budget" was likely discouraging consumers from discretionary spending.

The ONS gathers its figures from all of Great Britain's large retailers and a representative sample of smaller ones.

Monthly figures for retail sales are generally more volatile than quarterly.

ONS statistics are used in deciding government policy, which affects millions, and are also used by the Bank of England to make key financial decisions, such as setting interest rates.

But a recent review of the ONS was highly critical of the agency, calling into question the quality of the economic data it produces.

The ONS has struggled, as have many statistical bodies, with tight budgets and with the problem of getting people to fill in the questionnaires needed for their data.

Get in touch

Have you made changes to your spending habits?

Related topics

- Published19 August