Interest rate cut hopes raised as wage growth slows

- Published

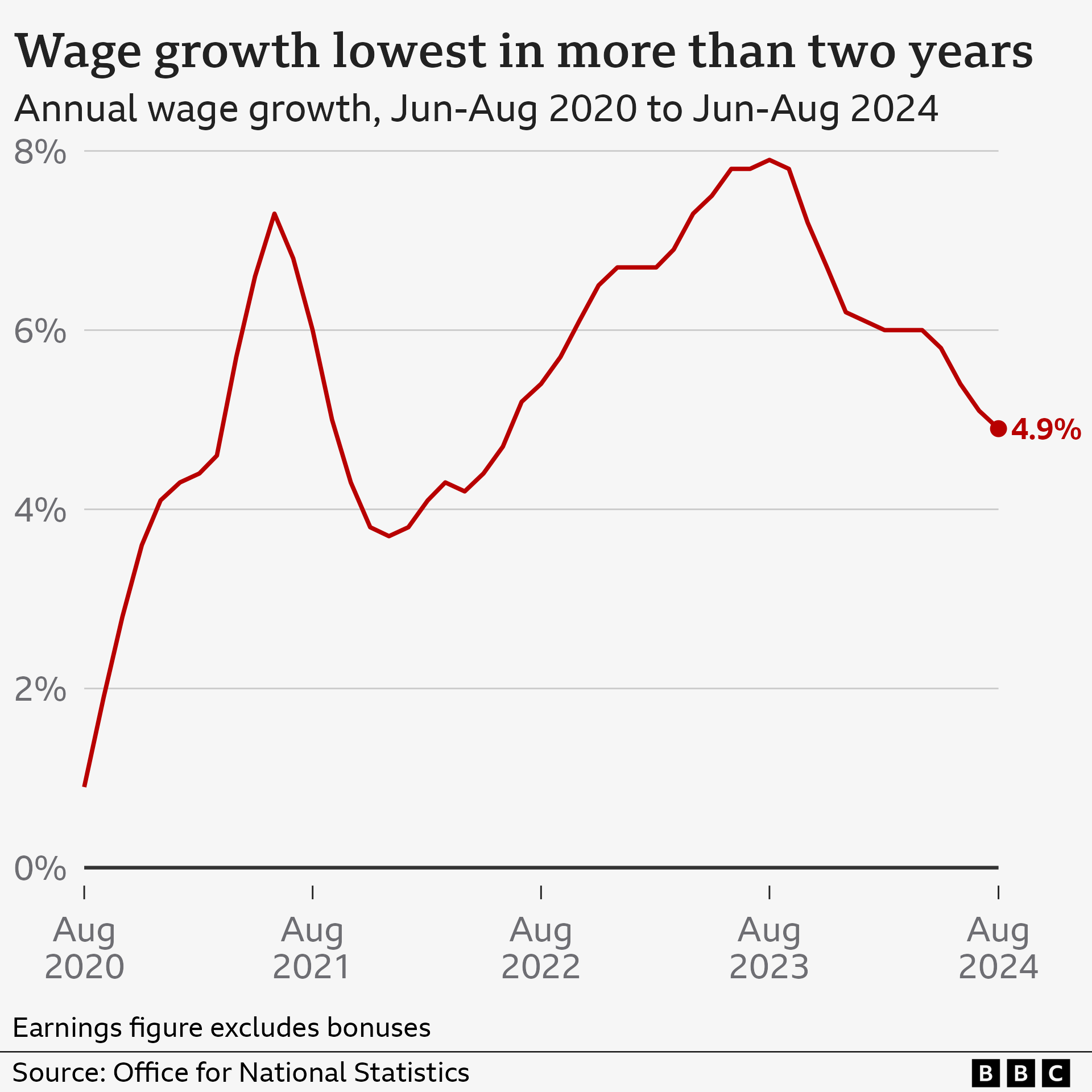

Expectations that UK interest rates will be cut in November have risen after wage growth slowed to its lowest pace for more than two years.

Pay grew at 4.9% between June and August, official statistics show, down from 5.1% previously.

The figures have added to widespread expectations that UK interest rates could be cut to 4.75% when the Bank of England meets next month.

Pay is still rising faster than inflation - which measures the rate of price increases - but analysts do not expect that to delay any rate cut plans by the Bank.

The Bank of England watches wage growth closely. If pay rises too quickly it increases costs for firms who might then raise the price of their goods to cover this.

Yael Selfin, chief economist at KPMG UK, said the "encouraging" figures on wages plus slowing economic growth meant she expected the Bank of England to reduce borrowing costs from 5%.

In the last set of jobs numbers before the Budget, the Office for National Statistics (ONS) said, external the unemployment rate fell to 4%.

However, Ashley Webb, UK economist at Capital Economics, said this "isn't a sign that employment is booming".

The ONS has urged caution with its unemployment figures due to problems with the survey data it collects. It said that an alternative measure shows a flattening off of the number of employees on payrolls in recent months.

The number of job vacancies decreased again, falling to 841,000 in the July to September period, although the total remains above pre-pandemic levels.

Recruitment firms have been reporting a slowdown in the jobs market, which has been drawn out by a combination of sluggish economic growth and higher interest rates over the past two years.

James Reed, boss of consultancy Reed, told the BBC the jobs market was experiencing “a slow-motion car crash” as companies continue to lack the confidence to hire new workers.

Recruiters also said firms are holding off hiring as they consider the costs of Labour’s plans for enhanced workers' rights and wait to see what Chancellor Rachel Reeves might announce in the Budget.

There is increasing speculation that the government will increase the amount of money companies pay in National Insurance - something the prime minister declined to rule this out in an interview with the BBC on Tuesday.

The ONS said the rate of people considered "economically inactive" - defined as those aged between 16 to 64 years old not in work or looking for a job - edged lower to 21.8%.

Concerns have been raised over worker shortages affecting the UK economy, and the inactivity rate among adults has remained at a persistently high level in recent years since it first surged during the pandemic.

'Ask for help'

The ONS data indicates that unemployment among those aged 18-24 has been edging up over the past couple of years.

The estimated jobless rate for this age group was 12.8% between June and August, higher than pre-pandemic levels.

Rocky Minhaaj Uddin, 21, joined Nando's in June last year and has already been promoted to being a supervisor.

Before that he had been out of work for eight months. He was helped back into employment through a programme run by the charity, Resurgo.

“They helped me with my confidence, they helped me with my interviewing skills and they helped me literally with my literature, how I speak to people, " he says.

His advice for someone struggling to find work is "ask for help".

"Without help I wouldn’t be the person I am today. Just be true to your character and believe in yourself."

Pensions

Data released on Tuesday also showed that the wage figure published last month has been revised upwards slightly, which could affect how much is paid in the state pension next April.

It now implies:

The full, new flat-rate state pension (for those who reached state pension age after April 2016) is expected to increase to £230.30 a week. That will take it to £11,975 a year, a rise of £473 compared with now.

The full, old basic state pension (for those who reached state pension age before April 2016) is expected to go up to £176.45 a week. That will take it to £9,175 a year, a rise of £361 compared with now.

"A slightly higher rate of increase is welcome for pensioners, though will be an unwelcome £100m extra cost for the chancellor as she prepares her Budget," said Sir Steve Webb, former pensions minister and partner at advisers LCP.

Tips for getting a pay rise

Choose the right time - Scheduling a talk in advance will allow you and your boss time to prepare, and means you're more likely to have a productive conversation

Bring evidence - have a list of what you've achieved at work and how you've developed yourself

Be confident - Know your worth and don't be shy about speaking up

Have a figure in mind - look at job adverts online to see the salaries for comparable jobs

Don't give up - keep talking to your employer if it doesn't work this time and if you can't get what you want be prepared to look elsewhere